[Featured Content]

The DeFi space continues to boom. In fact, the total value locked in decentralized lending protocols is currently over $3.5 billion, according to data from DeFiPulse.

This has created a tremendous demand for various solutions, including cross-chain swap protocols.

Introducing Anyswap

To fulfill this demand, Anyswap, a fully decentralized cross-chain swap protocol, was launched earlier this month.

In the five short days since its inception, Anyswap got over $4.5 million in its pool. The protocol distributed over $53,070 worth of ANY for the last 24H in liquidity pool rewards with an impressive 548% APY.

It’s powered by the DCRM technology of Fusion and comes with automated pricing and liquidity system. The protocol enables swaps between various coins on any blockchain that uses the ECDSA or the EdDSA as its signature algorithm, including FSN, XRP, LTC, BTC, ETH, USDT, and so forth.

Initially, Anyswap will support Ledger and Metamask wallets. However, later on, there will be more hardware wallets added. Anyswap’s protocol can be integrated into any wallet thanks to the provided API.

In addition, the protocol will also introduce a governance token, ticked ANY. It would be issued on Fusion Chian and can be used to:

- Vote for changing governance rules proposals.

- Vote for electing Anyswap working node.

- Vote for adding supported chains.

The total supply of the token is set to 100 million, and there will be no fundraising or pre-sale.

In addition, the protocol will support the following features:

- Programmed pricing and liquidity. This means that liquidity providers will be able to add and withdraw liquidity into the swap pair. The programmed pricing system is thoroughly based on the liquidity that’s provided.

- Cross Chain Swaps. Users will be able to swap one coin to another immediately.

- Decentralized Cross-Chain Bridge.

In terms of fees, Anyswap charges 0.4% for every swap transaction where 0.1% goes to the company, and 0.3% goes to the liquidity providers.

Explaining Fusion’s DCRM Technology

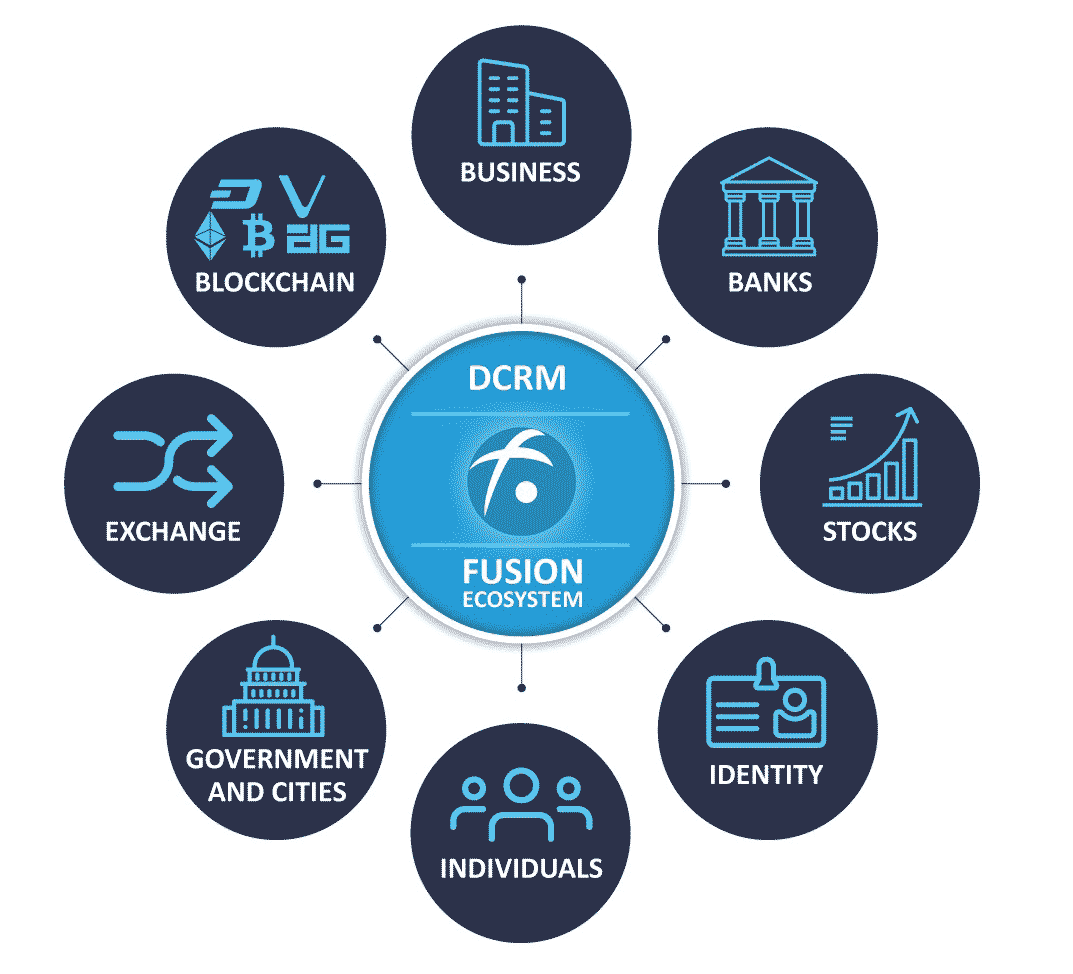

DCRM stands for Decentralized Control Rights Management. It represents a truly interoperable solution that’s more powerful than atomic swaps and presumably more secure than sharded key storage schemes.

It offers distributed key generation, which means that the private keys controlling the assets are never revealed – from the point that they are generated to the point they are actually stored. This is a substantial leap forward in terms of security, and it’s stronger than other secret sharing schemes.

At the same time, it also features a distributed transaction signature. This means that the transactions are executed with the agreement of the nodes and can be tailored to a set of minimum signatures required.

DCRM and Its Applications

The inherent qualities of the technology make it appropriate and preferred for a range of different applications, which include the following.

- Cross-Chain and Cross-System

Taking advantage of the decentralized custodian models that will hold and transfer assets on behalf of the actual users across different chains allows for possibilities that widely expand the functionalities of different systems.

- Hot Wallet Liquidity and Cold Wallet Security

The distributed key management scheme mentioned above is capable of being employed as a non-custodial solution for different DeFi use cases or as a hot wallet solution for centralized enterprises such as exchanges, wallet providers, or custodians.

These solutions can be enhanced with key recovery and compliance checks – compelling features of DCRM.

- The Key Recovery System

By providing users with 2-of-3 key shards where the provider keeps one and requires 2-of-3 shards to sign a transaction, users are provided with an economically viable multi-sig solution and a key recovery solution.

They can use one shard with that of the provider and keep their one extra shard as a backup to restore or even to create new keys.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited – first 200 sign-ups & exclusive to CryptoPotato).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato