While 2020 has been an eventful year for the crypto-market, it holds special significance for the world’s second-largest cryptocurrency – Ethereum. The year marks not only Ethereum’s 5-year anniversary but also one of the biggest changes in its ecosystem – the transition to Proof-of-Stake consensus protocol slated for this year, despite the delays.

During a recent episode of the Unchained podcast, Vitalik Buterin, Co-founder of Ethereum, discussed issues pertaining to ETH’s high transaction fees and what it means for Ethereum. A few days ago, Ethereum was on a steady uptrend, one that could have been responsible for more users entering the ecosystem. In recent times, however, transaction fees have skyrocketed on the Ethereum network. Buterin noted,

“So ultimately high gas prices are just a function of high demand, right? Lots of people want to send Ethereum transactions on the blockchain and there’s not enough space for them. And so people just keep outbidding each other.”

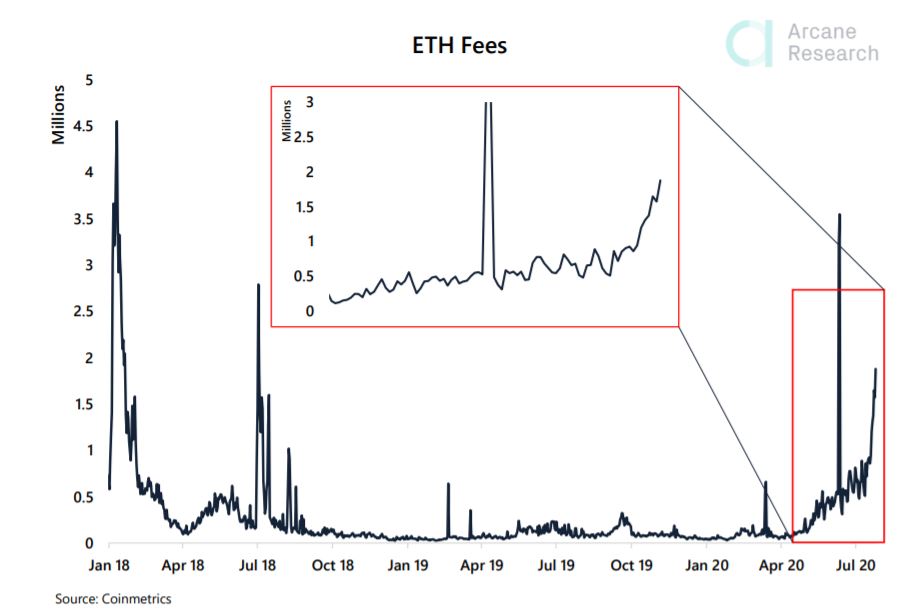

In fact, the latest Arcane report collated data from CoinMetrics and highlighted how ETH’s transaction fees saw a 2-year high on 25 July as the daily transaction fees hit $1.8 million with a median transaction fee of $0.72. Buterin argued that in order to improve efficiency, the long-term viable solution remains increasing scalability. He said,

“Scalability is the thing that we’ve been talking about for more than five years, every major Ethereum presentation – I probably mentioned scalability…the difference now is that instead of just being this kind of far away thing, it’s a very short-term necessary reality that we have to find a way to work around.”

Interestingly, according to network data provided by Glassnode, 2020 saw Ethereum addresses with non-zero balances surge. Presently, there are over 42 million addresses, when compared to 34 million at the start of the year. As more users enter the ETH ecosystem, implementing solutions to boost scalability and keep transaction fees competitive may be extremely crucial for Ethereum. Buterin went on to note,

“There is a lot of room for application and to increase their efficiency it sometimes even involves moving things off-chain and the applications team are working hard on that.”

The post appeared first on AMBCrypto