The cryptocurrency market went through a Sunday morning roller-coster with some intense moves charted. Bitcoin marked a new yearly high of above $12,000 before tanking in a matter of minutes to $10,490 (on Binance). Similar developments followed most altcoins, but the market appears to have calmed now.

Bitcoin’s New 2020 Top And Drop

August doesn’t look anything like July for the primary cryptocurrency so far. While July began with slow and dull price movements, Bitcoin has taken August for a wild ride in the first two days. As reported yesterday, BTC registered a new yearly high of over $11,700.

The bullish trend continued, and just a few hours ago, Bitcoin reached yet a fresh 2020 high when the asset topped at about $12,100 on most exchanges. However, what followed was a massive rejection, and BTC nosedived to approximately $10,500 in a matter of minutes. The latter is the prior high from mid-February.

As of writing these lines, Bitcoin is trading around $11,300, after a quick recovery move.

On its way up, Bitcoin shot through the major trend-line resistance at $11,600, but the psychological level of $12,000 didn’t allow the asset to reach its August 2019 high of $12,300. Corrections are part of the game, and that correction was expected following the parabolic surge.

Altcoins Fluctuate As Well: XRP and ETH Bullishness

As it typically happens, most alternative coins followed suit. Ethereum broke above the $400 mark, and when it all seemed favorable for the second-largest digital asset by market cap, ETH tanked to $325 on Binance before mostly recovering to its current level of about $375.

Ripple’s drop came from its high of $0.326 to $0.25, yet in a matter of minutes. XRP has also recovered from its most significant daily losses and is now trading at $0.3. Litecoin went from $65 to $51, Bitcoin Cash from $338 to $235, Chainlink from $8,4 to $6.87, and Binance Coin’s dive started at $22,18 and bottomed at $19.1.

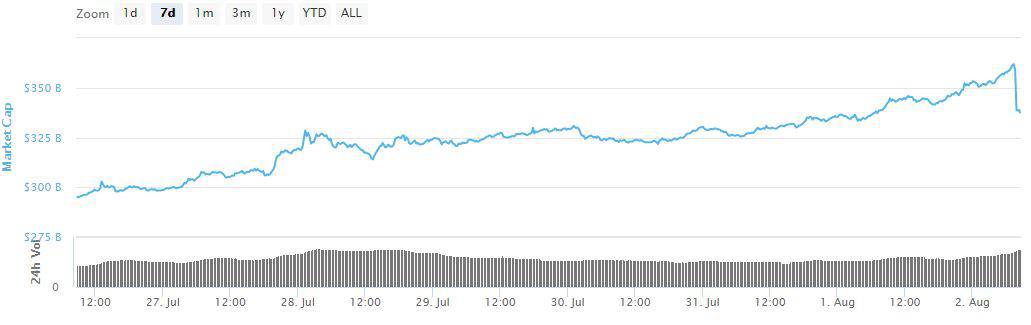

The market has stabilized since those eventful minutes. Despite the drops, however, the cryptocurrency field ends quite a positive week in terms of price developments. Most assets surged in value and, in doing so, increased the total market capitalization by 15% from $295 billion at the start to $329 billion at the time of this writing.

Interestingly, the latest movements have affected Bitcoin’s dominance over the market, which has dropped from 62.5% yesterday to 61.5%.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato