Following the wild weekend ride in the cryptocurrency market, the situation appears less volatile now, at least among most large-cap assets. Bitcoin has returned to $11,200, while Ethereum hovers above $380. Some lower-cap altcoins, however, are displaying high fluctuations again.

A Breath Of Stability For Bitcoin

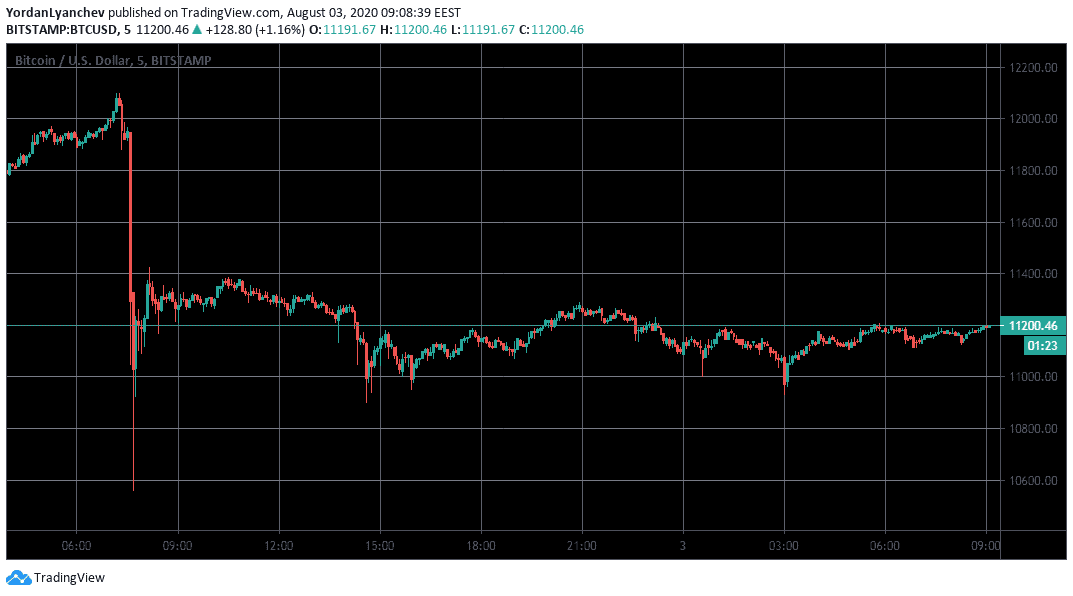

The weekend was nothing short than volatile for the primary cryptocurrency. On Saturday, Bitcoin went on a bull run and marked a new yearly high of above $11,700. Although it retraced slightly in the next few hours, BTC did it again on Sunday and exceeded $12,000.

However, after touching $12,100 on some exchanges, came a violent price drop. In just a matter of minutes, Bitcoin bottomed at $10,490 (on Binance), marking a $1,600 decrease (or 13.3%).

Since those eventful hours, Bitcoin has calmed. The largest cryptocurrency by market cap trades in a tight range between $11,000 and $11,350. At the time of this writing, it has stabilized at $11,200.

Interestingly, the $10,500 level that managed to hold BTC off from a deeper dive is the previous 2020 high, which is now a significant support line. Bitcoin can rely on it again if it breaks below the first three at $11,100, $11,000, and $10,800.

Should the asset head upwards, it would have to face the first resistance at $11,400, followed by $11,650, and $11,800 before having a chance to challenge $12,000 again.

Altcoins Reduce BTC’s Dominance

Most alternative coins followed Bitcoin’s wild ride from yesterday with some impressive moves. However, the large-caps have primarily calmed now with several exceptions. Ethereum is trading at $385, and XRP is closing down to $0,30.

At the time of this writing, double-digit price pumps are visible in the lower-cap alts. Those include Terra (20%), Swipe (18.6%), Ren (17%), Ocean Protocol (15%), Aave (14.6%), Loopring (13.6%), Flexacoin (13%), Syntethix Network (11.4%), and Kava (10.7%).

In contrast, there are three representatives of the double-digit decline club. The Midas Touch Gold is down by 16%, Ampleforth by 13.6%, and Quant loses 11.2% of its value.

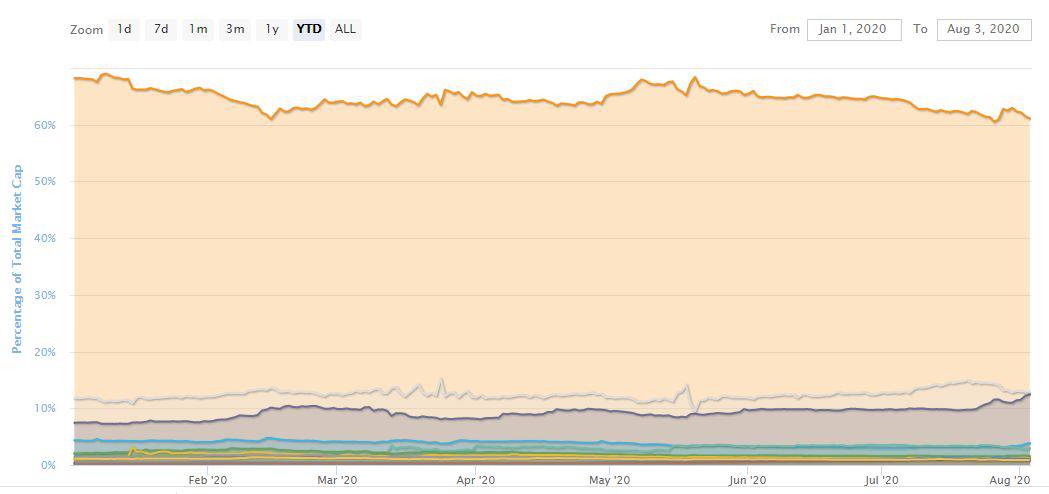

Nevertheless, since the majority of the alts are in green, this has affected Bitcoin’s dominance. The metric that tracks Bitcoin’s market cap relative to that of the entire market has dropped below 61%, after reaching 63% on July 30th.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato