The price of Bitcoin reached a yearly high of above $12,000 yesterday, but it retraced heavily moments after. According to recent data, the correction was overdue since the number of daily active BTC addresses fell behind the price.

Bitcoin’s DAA Impact The Price

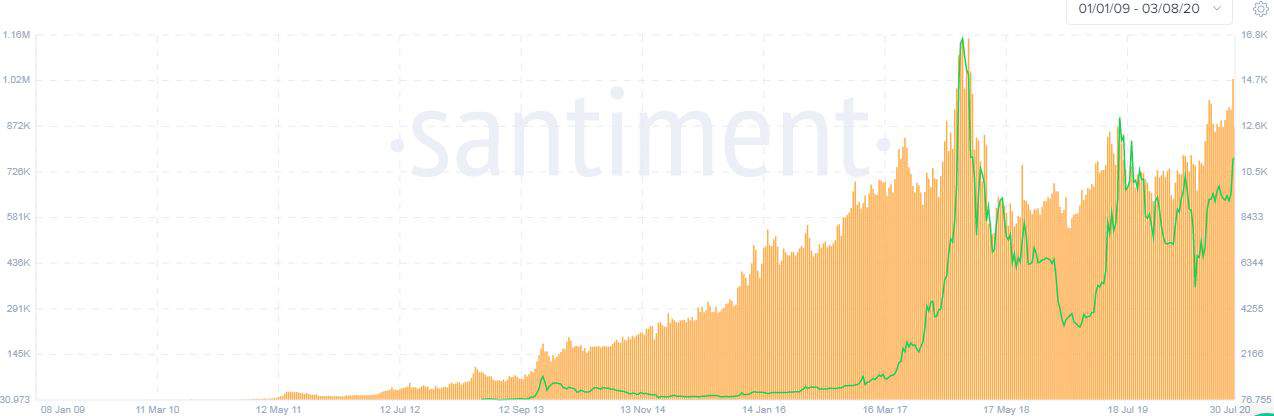

Daily active addresses (DAA) provide a general idea of how many users utilize the network of a specific coin. According to a study compiled earlier this year, the number of DAA displayed a somewhat positive correlation with the price of that same asset. Now, data from the cryptocurrency analytics company Santiment reaffirmed this narrative in regards to Bitcoin’s latest movements.

The leading cryptocurrency went through a volatile weekend. BTC marked two consecutive yearly highs of $11,700 and $12,100 before it tanked by more than 13% in just minutes and bottomed at $10,500. Aside from some technical aspects warning that this correction could have been expected, Santiment argued that the number of daily active addresses also played its part.

“As BTC scraped above $12k, there were warning signs flashing that indicated that daily active addresses on the network were not keeping up with the surging price, and a correction would be swift. A telltale bearish divergence formed yesterday, as the price continued to climb towards $12k in spite of DAA dropping from 1.06 million on Friday to 959,000 on Saturday.”

The Bigger Picture Approves

If the number of daily active addresses indeed affects Bitcoin’s price, it may be worth exploring a larger timeframe. Further data from Santiment revealed that BTC’s DAA have been increasing in the past two years. In fact, just last week marked their highest number since early 2018.

It’s worth noting that the all-time high came in late December 2017/early 2018 and coincided entirely with the price performance at the time. While Bitcoin was heading to nearly $20,000, the DAA topped at 1.15 million on two occasions.

As the price was quickly descending in the following months, so did the DAA. Something similar transpired during the mid-2019 price pumps when BTC reached approximately $14,000.

Now, however, the number of daily active addresses has surpassed the 2019 highs, especially after the mid-march massive sell-offs. This exemplifies the rising demand and the network’s growth. Interestingly, on a macro scale, the price appears to be sluggish and falling behind the large DAA number this time, which could imply that BTC may soon double-down on its recent bull run.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato