By Dmitriy Gurkovskiy, author at RoboForex Blog

On Tuesday, August 4th, the XRP is looking for a foothold to go on growing, but the impulse is yet very feeble. The cryptocurrency is generally trading at 0.3070 USD.

Technically speaking, on D1, the XRP demonstrates the development of growth after a breakaway of the resistance line of the descending channel. In the medium term, we may expect growth to the resistance level of a new channel. This is the level of o.4350 USD; the growth is supported by the ascending dynamics of the MACD lines. In the short term, the price may pull back to the support level – 0.2285 USD. The correction is supported by the Stochastic lines entering the overbought area; however, the control signal will be a Black Cross.

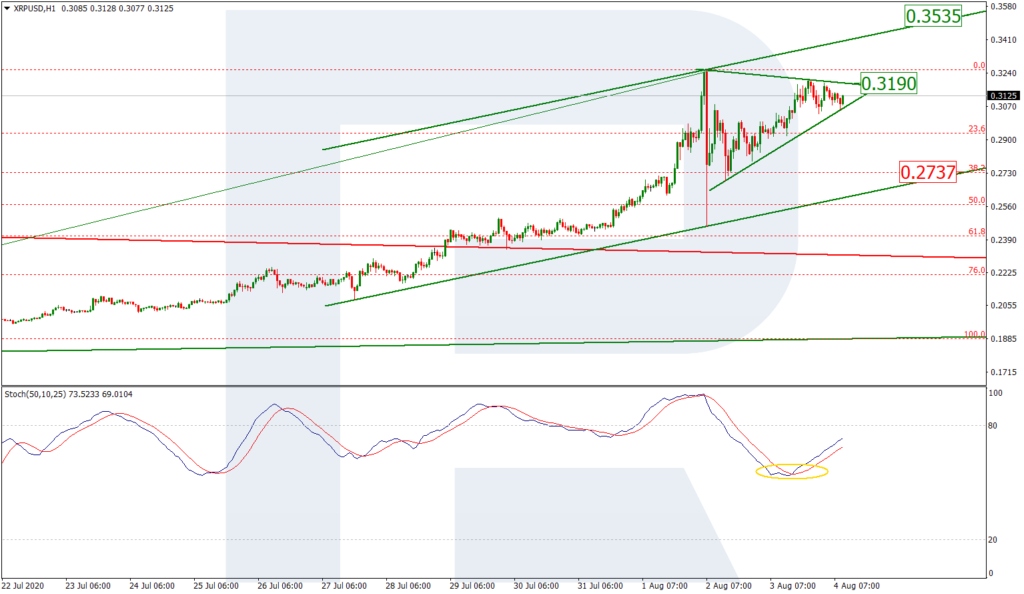

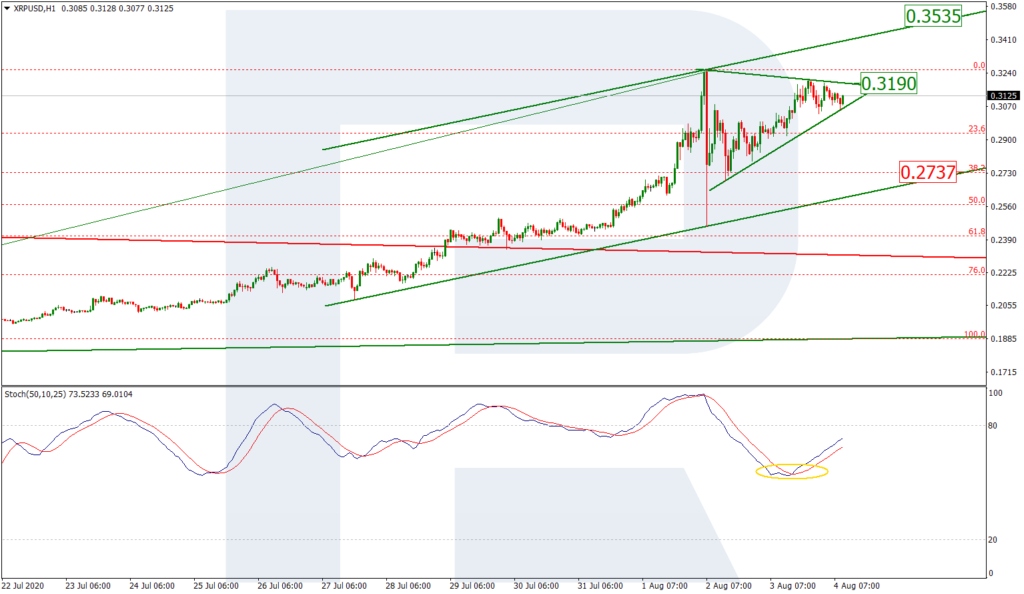

On H1, after an ascending wave, the market corrected and tested the support line by a single strong descending impulse. After a bounce off the support level, a new ascending wave is forming. The quotations are currently consolidating near the high. A breakaway of the local resistance level at 0.3190 USD will open the way to 0.3535 USD. Further growth is confirmed by a Golden Cross on the Stochastic. After the short-term goal is reached, we may expect a pullback to the support level of 0.2737 USD.

The OTC sales of the XRP in the 2nd quarter of 2020 reached 32.55 million USD, as Ripple announced at the beginning of the week. For you to compare, in the 1st quarter of 2020, the company sold tokens for about 2.00 million USD. These digits could be considered satisfactory if we did not know that in the 4th quarter of 2019 the sum was 13.00 million USD.

This report also indicates that Ripple itself buys the tokens in the secondary market but the sums are unclear. Ripple comments that it is interested in a healthy and ordered XRP market for the clients’ risks and expenses to be minimized. The company exaggerates its responsibility in forming the liquidity of the tokens. According to Ripple, the more financial entities use the ODL service based on RippleNet, the better is the liquidity of the XRP.

Earlier we heard that Ripple paid MoneyGram 15.10 million USD in the XRP to stimulate partnership.

Disclaimer

Any predictions contained herein are based on the author’s particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

The post appeared first on The Merkle