Bitcoin went through a significant price surge in the past month, jumping from $9,000 to about $12,000. By heading into five-digit price territory, this 33% increase has many people speculating that the primary cryptocurrency may be too expensive, and the train has left the station.

However, looking at Bitcoin’s pre-programmed deflationary mechanism and several macroeconomic factors, the asset’s price may actually be (still) cheap.

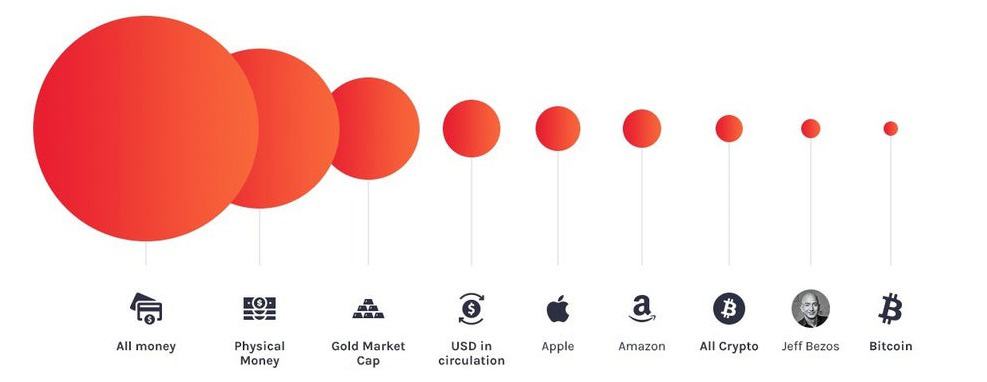

Before we begin, let’s face some sizing facts. As of writing these lines, Bitcoin’s total market cap is approximately $220 billion, whereas the entire crypto market cap is $370 billion. The all-time high was over $800 billion in the peak of the crypto bubble of 2017.

In contrast, all Gold existing worth $12 trillion (55x Bitcoin’s), whereas the world’s 2000 billionaires alone worth $8 trillion. The stock market value is roughly $100 trillion.

Some would still say that Bitcoin’s market cap is overvalued; however, keep the above figures when thinking how tiny this market is compared to other types of investments.

Bitcoin Market Cycles and History

While examining BTC’s relatively short history of just over a decade, one could spot several main outtakes. For instance, it’s volatile – Bitcoin has seen double-digit percentage moves in a matter of hours and sometimes even minutes.

Despite multiple substantial price dives, however, the increases are much more evident, and Bitcoin became the best performing investment asset throughout the past decade with an ROI of 8,900,000%.

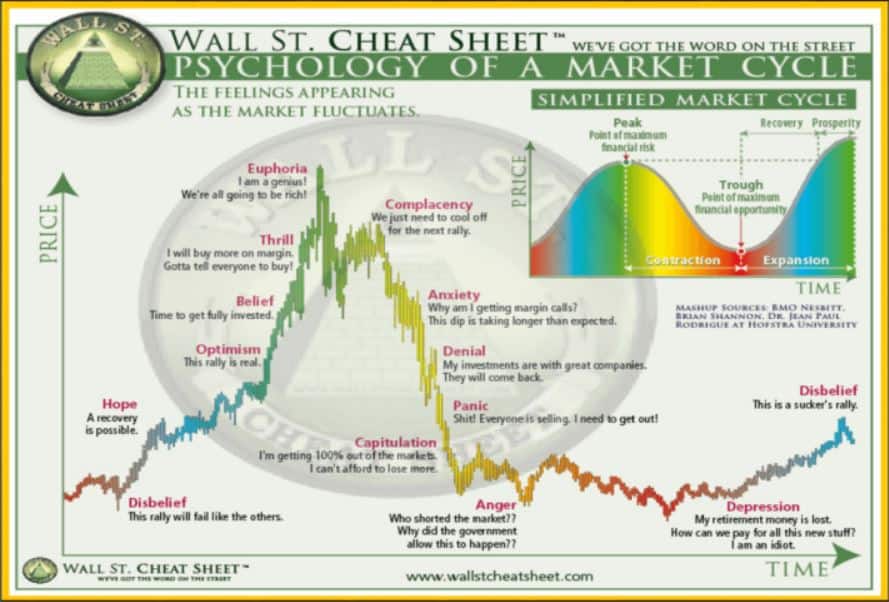

Aside from vigorous short-term price movements, BTC also tends to move in more extensive cycles. According to one theory, the primary cryptocurrency moves in so-called expanding cycles. Meaning, each cycle is longer than the previous one. So far, there have been three completed, and the last one coincided with the end of the 2017 bull run when Bitcoin topped at nearly $20,000.

Then came a prolonged bear market as the largest cryptocurrency plummeted to $3,100 a year later. However, that massive dip has initiated the fourth and current expanding cycle, which will supposedly end in late 2022. This theory suggests that when it ends, BTC could be as high as $100,000. As such, the current price doesn’t seem all that expensive.

Bitcoin’s Fundamentals Highlighted In Today’s Economy

Since supply and demand are the factors that arguably weigh in the most in pricing an asset, it’s worth outlining some of BTC’s features. As it was created during the last financial crisis in which world governments initiated large-scale money printing, the creator(s) Satoshi Nakamoto decided to base its supply in precisely the opposite manner.

Instead of having an unlimited supply, Bitcoin has a pre-programmed number of coins ever to exist – 21 million. Moreover, the rate in which the new tokens are created is also pre-determined and doesn’t rely on a central authority (like a government or a central bank). After an event called Bitcoin halving that occurs roughly every four years, the network slashes the number of new coins created in half.

By doing this, Bitcoin’s supply actually decreases over time, which ultimately reduces the inflation rates. At the same time, as the world witnessed during the COVID-19 crisis, governments can print excessive amounts of fiat currency, which not only depreciate its value against other currencies and asset classes but could increase the inflation rates.

Simultaneously, banks provide 0% interest rates on deposits and even go into negative territory in some countries. According to experts, this is another bullish factor for Bitcoin, hinting that the price could still be cheap. Rich Dad Poor Dad author Robert Kiyosaki recently said that only the rich would be able to afford Bitcoin once they realize BTC grows “more valuable as the Fed prints trillions” of USD.

Don’t Time The Market

Although Bitcoin has increased its value by over 60% since the start of the year, the asset also experienced some of the aforementioned significant price drops. In mid-March, during the most intense days of the COVID-19 pandemic, BTC plummeted by almost 50% to below $4,000.

Such vigorous price developments could scare away investors and hodlers or provide alluring opportunities to buy the dip. Nevertheless, knowing that this is indeed a dip and being able to time it ideally to maximize the best possible entry point is rather challenging, to say the least.

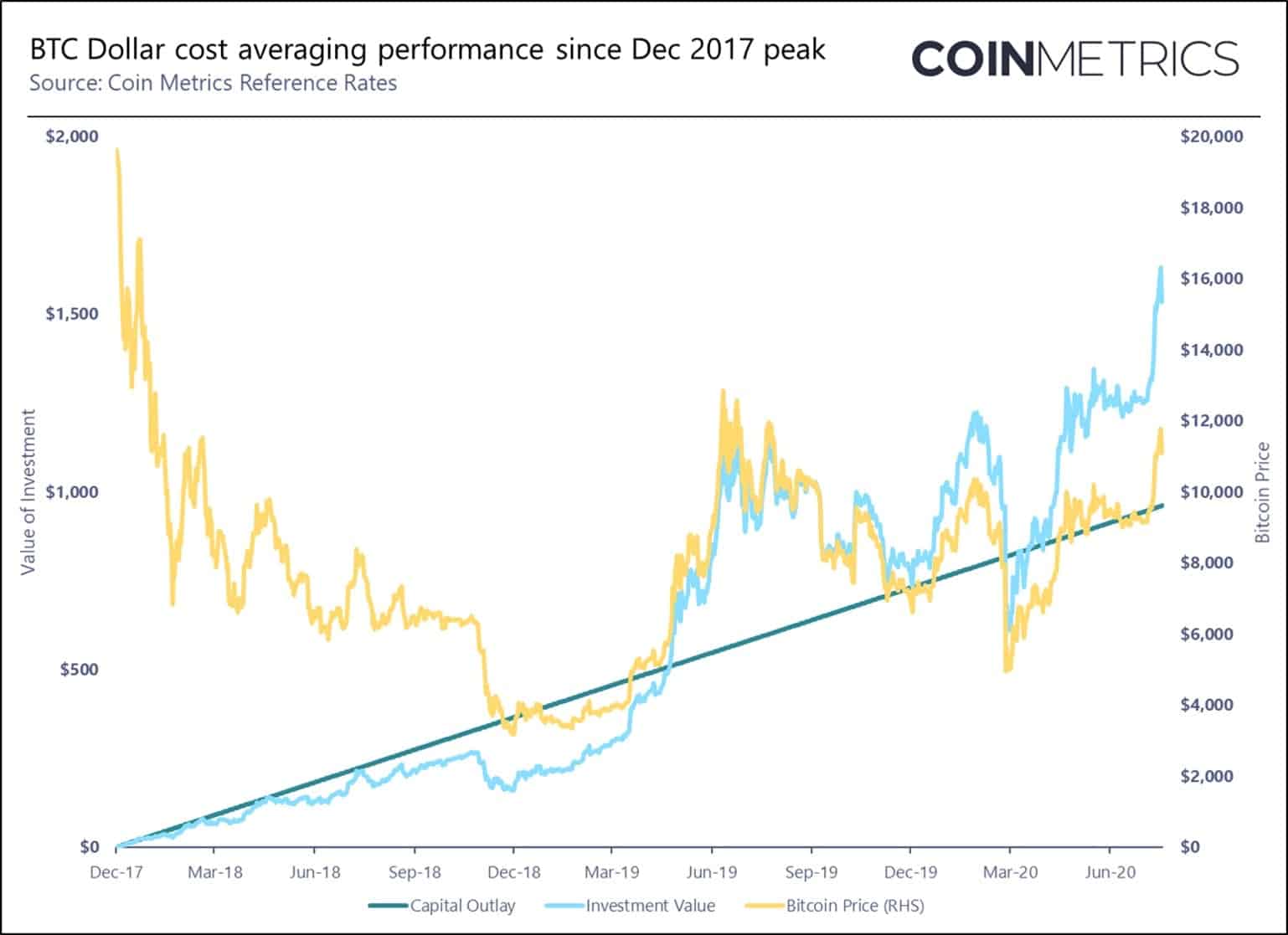

Consequently, applying the popular dollar-cost average strategy might be the best solution. DCA allows investors to average the entry price by purchasing specific portions at a specific timeframe. For instance, one can decide to buy $100 worth of BTC on the same day of every month.

Time has proven DCA as a successful strategy. According to a recent research, even if the investor started to DCA $1 per day from the $20,000 top in late 2017, his position would be over 60% up today, despite the price being 40% down from the ATH.

HODL and Risk Management: Must Read

As mentioned above, you can’t time the market properly. Another strategy to keep in mind is the HODL methodology. Those who believe in Bitcoin insist that it will increase over the long-term.

Hence, they are holding it ( the simple explanation of the verb “HODL”), and not selling despite the stages of the market cycles. After all, most of us were not born traders and especially crypto traders. And if you’re HODLing, this means that the funds are not accessible. So if you plan on using those funds to pay the mortgage – do not invest them in Bitcoin.

Only invest amounts you afford to lose completely. Bitcoin might go to zero (as it might go to $1 million). If you aren’t able to sleep, thinking that your crypto investment is down 80% – you’re investing too much.

Conclusion

During times of economic uncertainty, investors start looking into possible, and sometimes untraditional, assets to protect and even enhance their savings. While central banks are printing lots of cash and risk raising the inflation levels, Bitcoin offers a pre-programmed deflationary approach with its maximum cap of 21 million and supply cut every four years.

The primary cryptocurrency indeed seems to move in cycles, and its merits are working in contrast with the rest of the market. In theory, this should increase the demand in the following months and years. Adding the decreasing supply due to the halving, this could (again – in theory) spike its price up, thus making Bitcoin seem like a bargain to buy today.

Or, as Gemini co-founder Tyler Winklevoss recently put it – “it’s still the bottom of the first inning.”

People ask me all the time if it’s too late to buy #Bitcoin. I tell them that it’s the bottom of the first inning and that one day they’ll look back and understand just how early it is.

— Tyler Winklevoss (@tylerwinklevoss) August 11, 2020

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato