Crypto.com is an exchange that opened up for beta testers back in November 2019. The platform bolsters the vision of the company’s CEO, Kris Marszalek, who intends to create a full-service experience to the millions of users who are already using it.

Along with the benefits that come with its relatively simple online trading interface, API, and low-cost Crypto.com application, the exchange undoubtedly strengthened the company’s standing within the cryptocurrency field.

In any case, the exchange does offer a few exciting features, including discounts on trading fees, access to a large global platform through the advanced Vortex Liquidity System, as well as enhanced custody and safety management.

It’s worth noting that Crypto.com is among the first platforms to receive multiple ISO certifications, including ISO/IEC 27001:2013, ISO/IEC 27701:2019, as well as PCI: DSS 3.2.1, Level 1 compliance and CCSS (Level 3).

Before we dive into the trading, it’s worth discussing a few critical infrastructural upgrades the team has committed. These include:

- Revamped matching engine and order management system to enhance performance and throughput.

- Redesigned architecture to improve latency, security, scalability, and to pave the way for high-level margin and derivatives trading.

- Addition of high-availability and resilience to every component of the exchange to increase the stability and eliminate single points of failure.

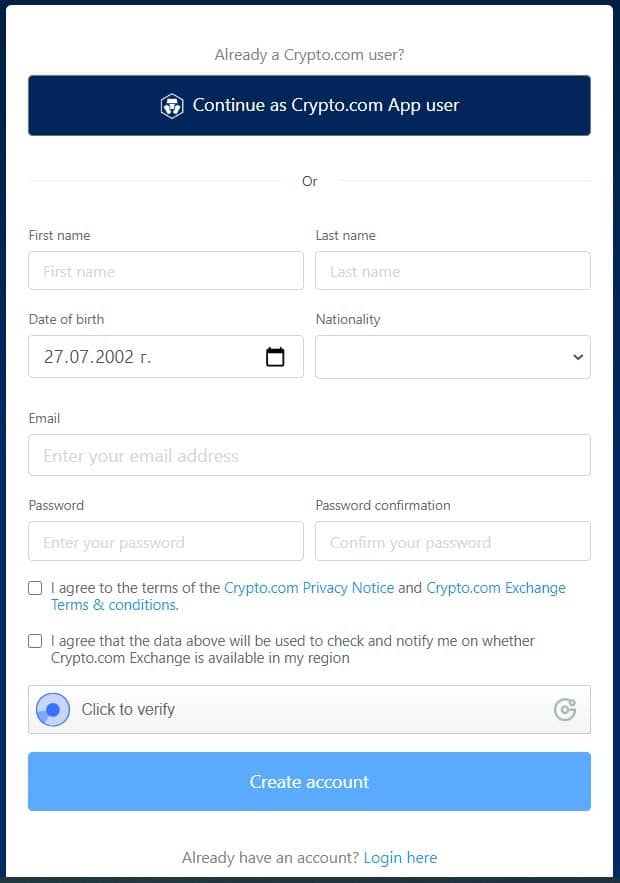

How to Register on Crypto.com

First things first, you’d need to open an account. The procedure is rather straightforward. As seen in the below picture, all you have to do is input your names, nationality, date of birth, email, and choose a password.

Once you do this, the system will send a confirmation email, and as soon as you follow the link, you can access the trading platform.

It is particularly important to go through additional security steps. You should enable your two-factor authentication to secure your account, and it’s highly advisable to enable the anti-phishing code.

It’s worth noting that you won’t be able to withdraw funds without enabling the 2FA verification.

How to Deposit and Withdraw Funds On Crypto.com

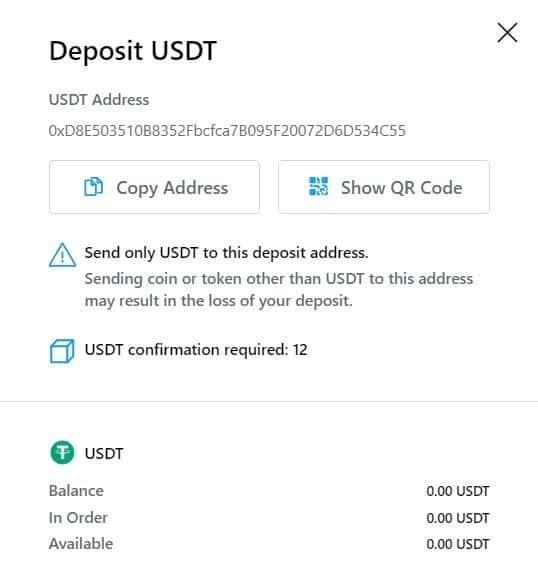

Once you have our account ready and secured, you can deposit some funds and start trading. First, head to the Balances section from the top right button, you will find on the navigation menu.

Once you click it, you will see all the available cryptocurrencies that you can use to deposit. For this example, we’ve decided to deposit the stablecoin Tether (USDT). Find USDT in the list and click the “deposit” button on the right. This is the screen that will pop:

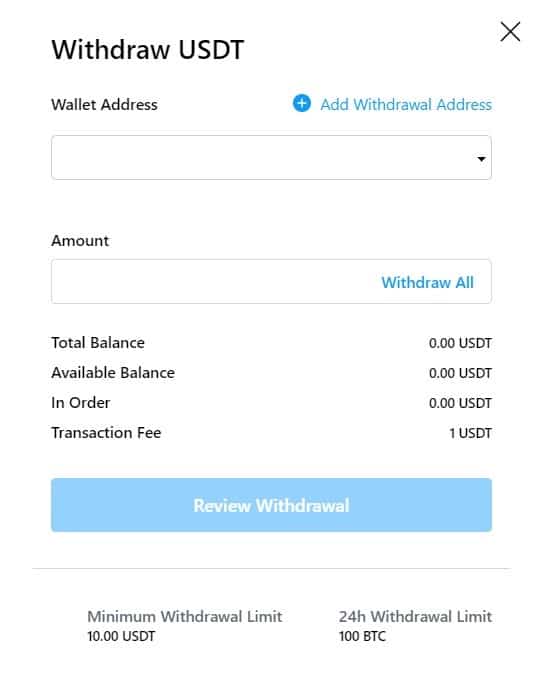

Here, you can find your address that you have to deposit to. That’s pretty much it. Now, if you want to withdraw, you have to click the “withdraw” button, and you will be given the option to withdraw to an external wallet or to transfer cash to the Crypto.com app. For this guide, let’s see how to withdraw to an external wallet.

This is the window you will get:

As you can see, all you have to do is put in the withdrawal address and specify the amount you’d like to withdraw.

How to Trade on Crypto.com

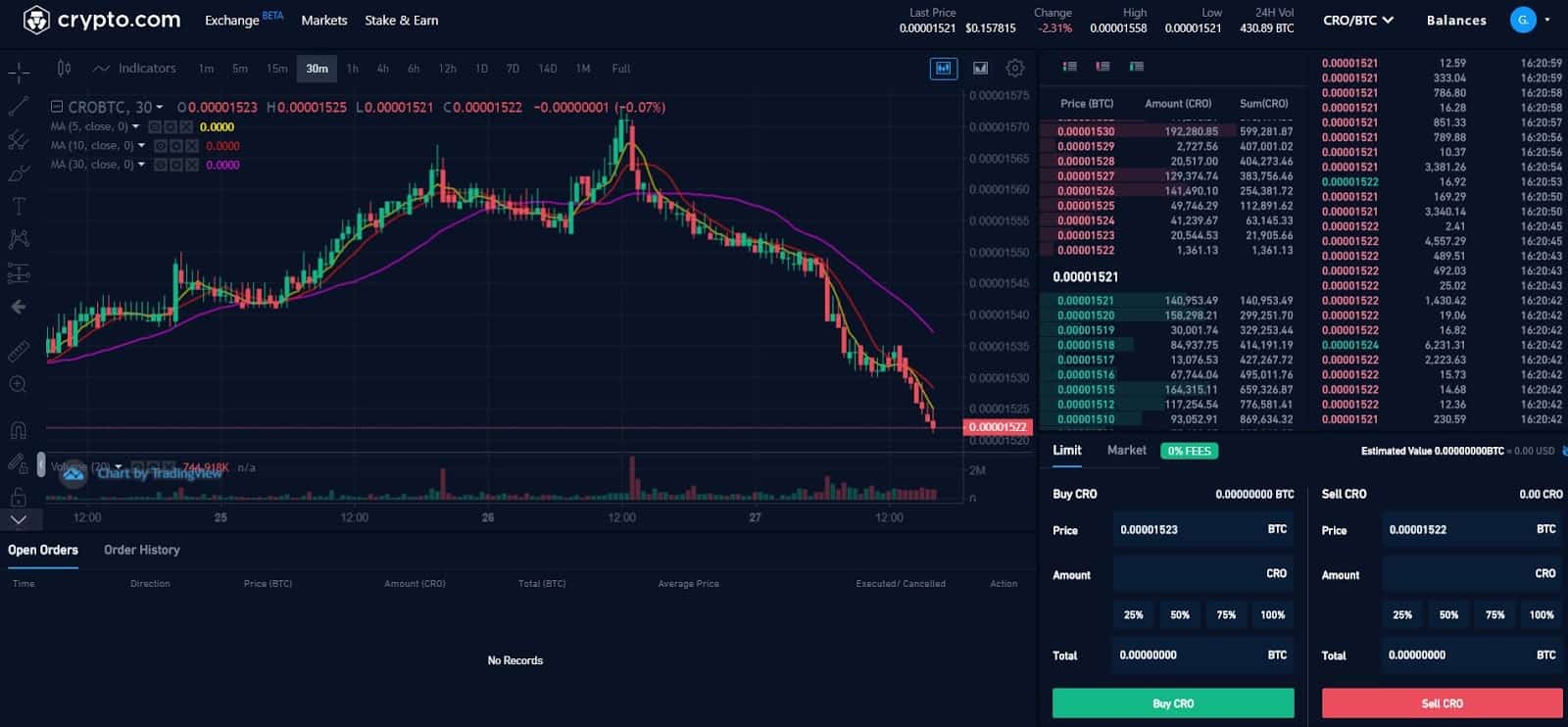

The user interface of the exchange is relatively easy to use. This is how it looks like when you open the exchange platform:

It’s pretty standard, on the left side there’s the trading chart, and on the right, you can see the order books and the different types of orders you can use to trade with. Below the chart is where you monitor the position’s performance, but more on that later.

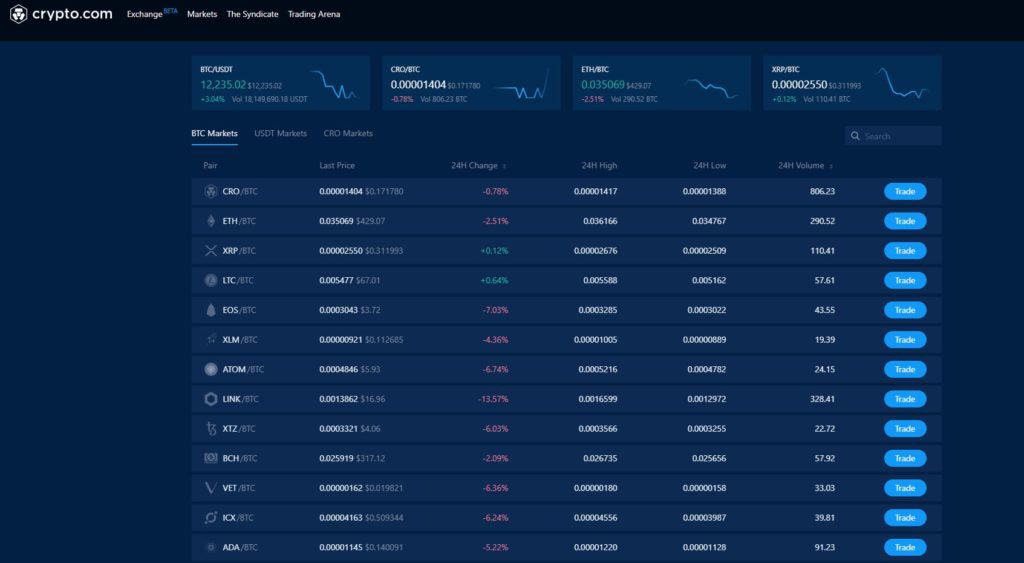

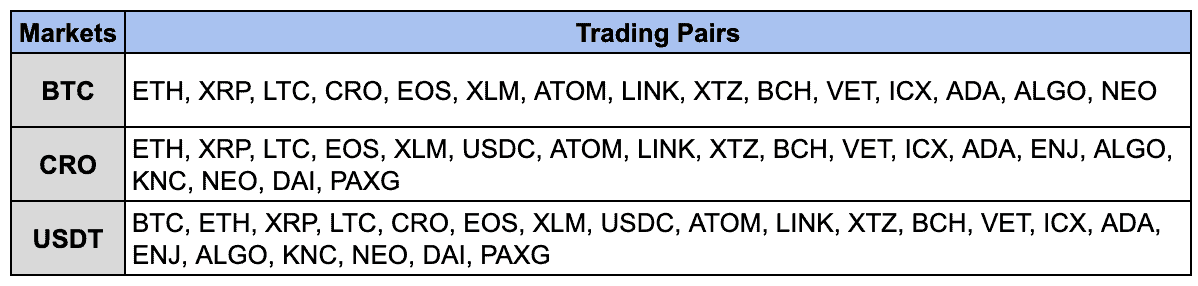

In terms of market pairs, the below chart shows what’s currently available:

There are three major trading pairs with BTC, USDT, and CRO, offering up to 44 markets. There are two types of orders that you can use on the Crypto.com exchange – limit and market orders.

Limit Orders

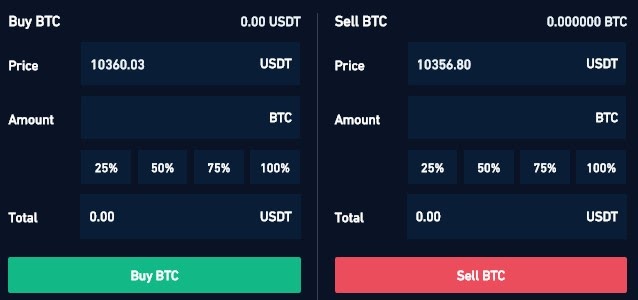

Limit orders are very frequent and are used to purchase the asset at a price different than the current market price.

For instance, at the time of this writing, Bitcoin is trading at around $11,200. Say, you want to buy when the price drops to $11,000, you can set a limit order for that and buy at a lower price as soon as it’s reached.

Market Orders

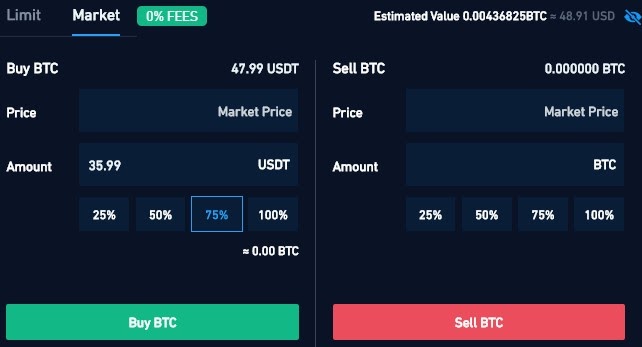

These are the simplest orders that you can use. All you have to do is specify the amount you want to buy, and the order will be executed instantaneously at the best available rate from the order book.

How to Open a Position on Crypto.com?

Opening a position on Crypto.com is very easy. For this example, let’s use the standard market order. All you have to do is specify the amount that you want to invest.

In this case, we’ve decided to purchase $35 worth of BTC, which represents 75% of our balance in the exchange, as you can see in the picture. All that’s left to do is hit the “Buy” button. And just like that, we’ve bought 0.003226 BTC. Now, if we want to sell it, all we have to do is repeat the process with a selling order for the same pair.

That’s pretty much it. There’s absolutely nothing challenging when it comes to using the exchange – it’s rather intuitive.

What Are the Fees on the Exchange?

This is one of the most important things that you ought to consider when choosing a trading platform.

First off, the exchange offers a 90-day fee-free period, so you won’t have to worry about them in the first three months.

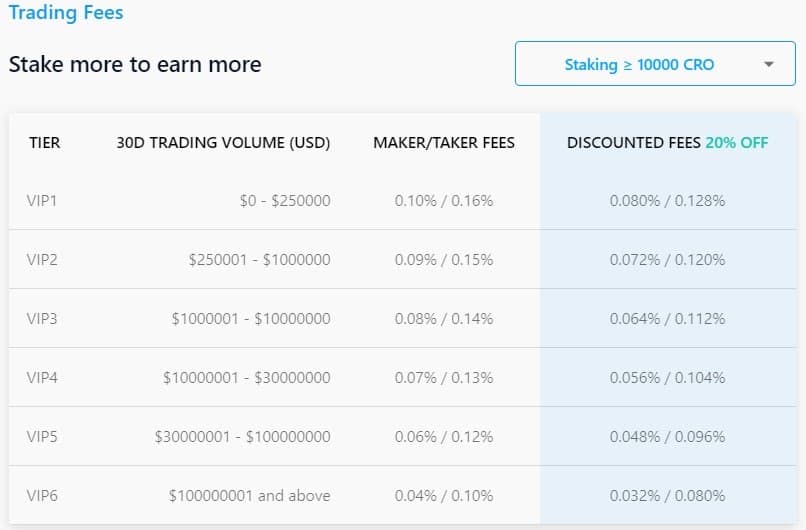

After that, you would have to refer to the following table:

As you can see, the 30-day trading volume, as well as the amount of CRO you are staking, are important for the formation of your fees. The more you trade, the less fees you pay.

There are no fees for deposits, and to withdraw, you only have to pay the on-chain transaction cost, which depends on the network of the transacted token itself.

Crypto.com Coin (CRO)

This is also an important part of the entire Crypto.com ecosystem, and it’s worth discussing it. The exchange is actually powered by CRO. Those who hold it are equipped with more features and benefits, which include lower fees, competitive execution costs, accessibility, and so forth.

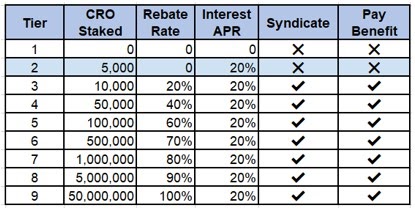

The system is tiered, meaning that the amount of CRO you stake will determine the benefits you receive. Here’s a visual representation of how it works:

To clarify, here is a breakdown of the features.

Rebates

Users are allowed to receive up to 20% APR interest, staking a minimum of 10,000 CRO.

Access to the Syndicate

This is a fundraising platform where projects list their coins or tokens to the exchange. CRO holders receive priority token allocation at a discounted price.

Benefits of Projects

The listing projects provide an allocation of their own token for sale on the exchange with up to 50% discount where all the proceeds from the sale are passed back to the project.

Conclusion

All in all, the trading experience in Crypto.com’s exchange is very intuitive. The platform is straightforward to use. There’s plenty of liquidity and a lot of cryptocurrencies to choose from.

The CRO token mechanisms are also in place for holders to receive a range of different benefits, which diversifies the overall experience on the platform, turning it into more of an ecosystem.

Pros

- Intuitive trading experience

- Sufficient liquidity

- A lot of different trading pairs

Cons

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato