Bitcoin futures aggregated open interest hit the $5 billion mark yesterday, but the overall trend seems to be declining.

This points to a possibility that BTC derivative traders are quitting the market owing to lackluster price action. Will a gap at the $9700 price level result in a proliferation of short positions?

Bitcoin Futures Open Interest Drops Post Topping $5 Billion

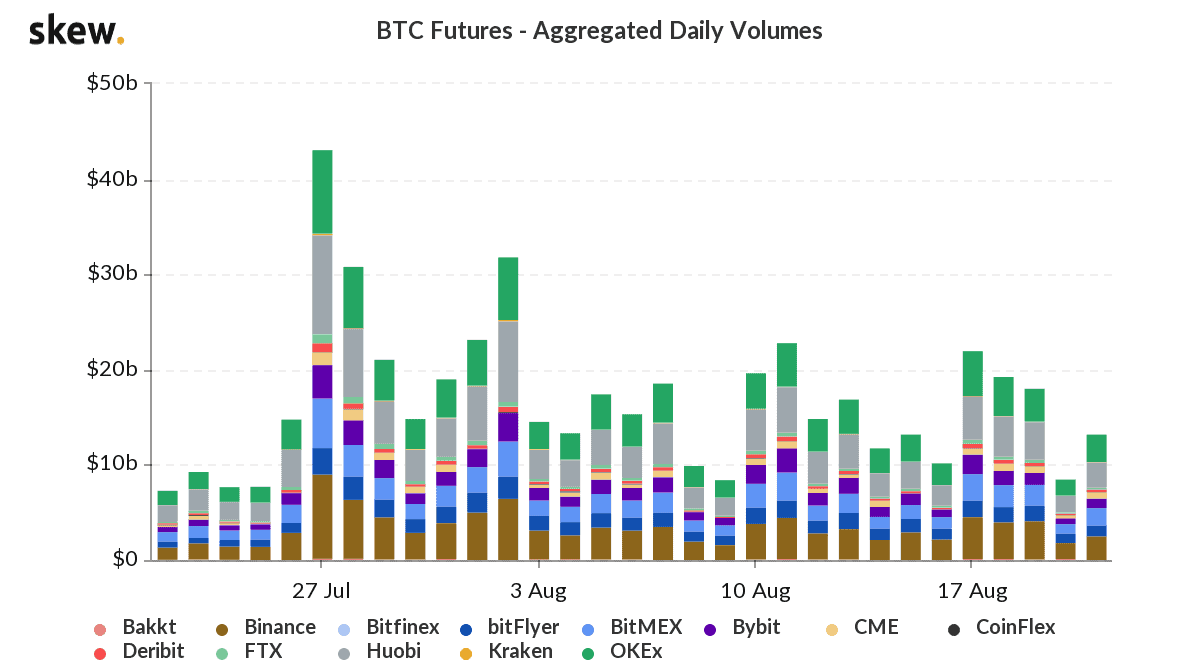

Data from UK based market analytics firm Skew shows that the aggregated open interest in Bitcoin futures trading hit an all-time high of $5 billion.

#bitcoin futures open interest is sitting at all-time-high at $5bln

Market has been quiet this week but there are a lot of open positions! pic.twitter.com/ljDDIQjLTO

— skew (@skewdotcom) August 21, 2020

But a glance at the developments from August 17 to date shows that the trend is declining.

As CryptoPotato explained, open interest in futures trading denoted the number of active contracts held by traders and investors. This amounts to open positions that have not been settled or closed out.

Open interest declines when buyers and sellers close more contracts than opening new ones. This inevitably points to futures markets losing strength. Something which Bitcoin futures markets are going through right now. But why?

The Rallying US Dollar Forcing BTC Derivative Traders to Move Out

As per reports from forex markets, the greenback appreciated in comparison to the Euro, for the first time since mid-June. Commenting on the US Dollar’s recovery against the Euro, Edward Moya, senior market analyst at OANDA, New York said:

The Markit PMI flash readings show the U.S. is outperforming Europe

This explains why Bitcoin futures traders are closing and exiting their positions as the US Dollar gains prominence as a superior store of value for the time being, all the more because gold is tumbling too.

Bitcoin (BTC) Price action is tepid, and futures traders are supposedly loading up on short positions.

The CME Gap Mark and Bitcoin Price Levels That Are Crucial

Reputed Amsterdam-based, Bitcoin and crypto trader Michael, has pointed out the current BTC market scenario in a tweet earlier today. He also mentioned the unfilled CME futures gap at the $9700 – $10,000 price level.

If Bitcoin manages to hold strong within the $11,400 – $11,600 area, a sideways trading pattern will ensue, but if BTC fails that zone, combined with the filling of the CME gap, then things could go south. Literally.

Well interesting, the crucial area for $BTC is the $11,400-11,600 area.

If we hold that, we can consolidate for a bit and have some decent bounces.

Losing the zone and I think the CME gap at $9,700 area is a serious scenario.

— Crypto Michaël (@CryptoMichNL) August 21, 2020

A fellow trader, while commenting, said that he agrees with Michael and that he is bearish. Mentioning the unfilled CME futures gap, that an ‘ascending broadening wedge’ pattern is developing. Although, he said that the Bitcoin ‘Fear and Greed Index’ is pointing to ‘Extreme Greed, ‘ which inadvertently hints at a buying sentiment.

It remains to be seen whether this greed will help Bitcoin get back and up above the new 2020 high it scored on August 17.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato