In the past six months, the pandemic has gripped the world economy. Companies are going out of business, governments and banks have bleak projections for 2020-21 and are comparing the current financial meltdown to the great depression. Despite this, it has played out counterintuitively for the global financial markets. S&P 500 broke records hitting an ATH of 3399 on August 21, 2020.

This price rally in the S&P 500 has made investors examine the market for its increasing correlation with alternative investment, like Bitcoin and Gold.

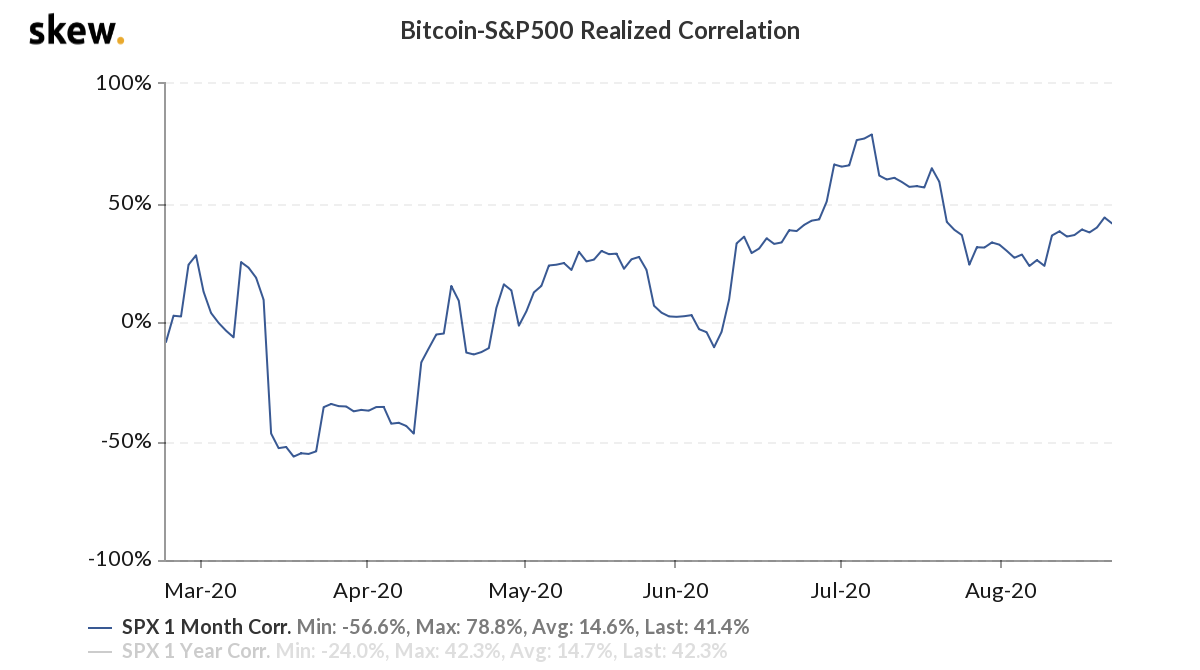

In February, correlation between S&P 500 and Bitcoin was negative and it decreased further in the following months until mid-April 2020 when it started increasing and hit an ATH of 78.8 percent on July 8, 2020. Correlation now stands at 41.4 percent, closer to the one-year correlation of 42.3 percent. This correlation increased in July 2020; this overlaps with the time when the Bitcoin rally started. Both assets have yielded positive RoI in the last 3 quarters.

It is important to deduce the reasons for the increasing correlation and price rally. One of the prominent reasons is that investors look at the future and not past performance while making decisions in derivatives/ spot trading. They are looking at projections 6,12, or 18 months down the line.

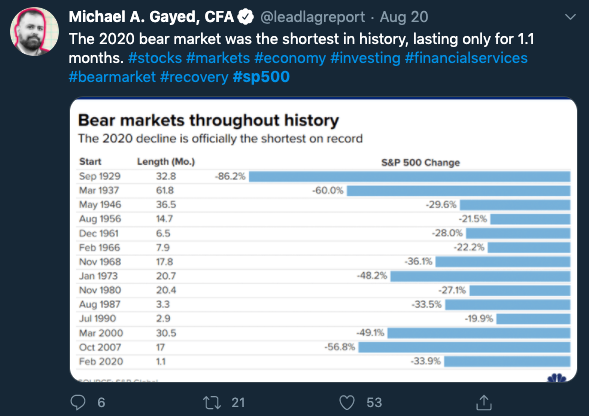

Traders are farsighted when making strategic decisions and acknowledge that financial markets may not necessarily reflect what’s going on in the world, they reflect expectations and RoI potential for the future. A lion’s share of the current gains in S&P 500 belongs to Tech giants like Facebook and Apple. Irrespective, traders are positive that the bear market is well behind us now.

Michael A Gayed, who warned the market of the stock market crash and melt-up bubble, confirmed that we are past the shortest bear market.

Another reason for the positive sentiment among stock and derivatives traders is that the USD has dropped 3% compared to the high in February.

Due to growing interest in Bitcoin, it has been dubbed ‘digital gold’ and this narrative is in line with rising interest from day traders and new buyers on fiat-crypto exchanges.

Investor interest has boosted the S&P 500 however, for Bitcoin to hit previously touched ATH or hit a new high, a steady rise in demand from institutional investors and steady retail investors are needed.

The post appeared first on AMBCrypto