After a relatively calm weekend without any major price developments and following a retest of the $11,400 support on Friday, Bitcoin slowly recovers. It is currently trading around $11,700. Large-cap altcoins follow Bitcoin as ETH getting closer to $400 once again.

After Friday’s crush, this is the day of the low-caps altcoins.

Contrasting Altcoin Moves

Ethereum and Ripple display somewhat similar performances in the past few days lacking significant fluctuations, slightly up judging by the last 24 hours. ETH is now up by less than 1% to $393, while XRP heads upwards by slightly over 1% to $0.285.

Chainlink and Cardano record minor losses to $15 and $0.124, respectively. On the other hand, Litecoin is up by 4% to $61, Crypto.com Coin by 2% to $0.17, and Bitcoin Cash (2%) to $290.

The top 20 coins see several more impressive price pumps. Tezos is up by nearly 6% to $3.67, NEO (4.5%) to $19, and Cosmos surges by 12% to over $8.

The most impressive gains come from lower-cap alts. Aragon (26%), Swipe – SXP (15%), Basic Attention Token – BAT (14%), NEM (13.5%), Siacoin (11%), Terra (11%), JUST (10.3%), and THETA (10%) are all pumping by double-digits.

In contrast, Augur drops 6% of its value for the second day in a row after peaking on Saturday. Ren is down by 5.66%, Bytom by 5.6%, and Yearn.Finance by 4%. However, one YFI priced at over $13,000 is still more than one Bitcoin, and the company recently marked a notable milestone with over $1 billion in Total Value Locked (TVL).

Bitcoin Stays Still

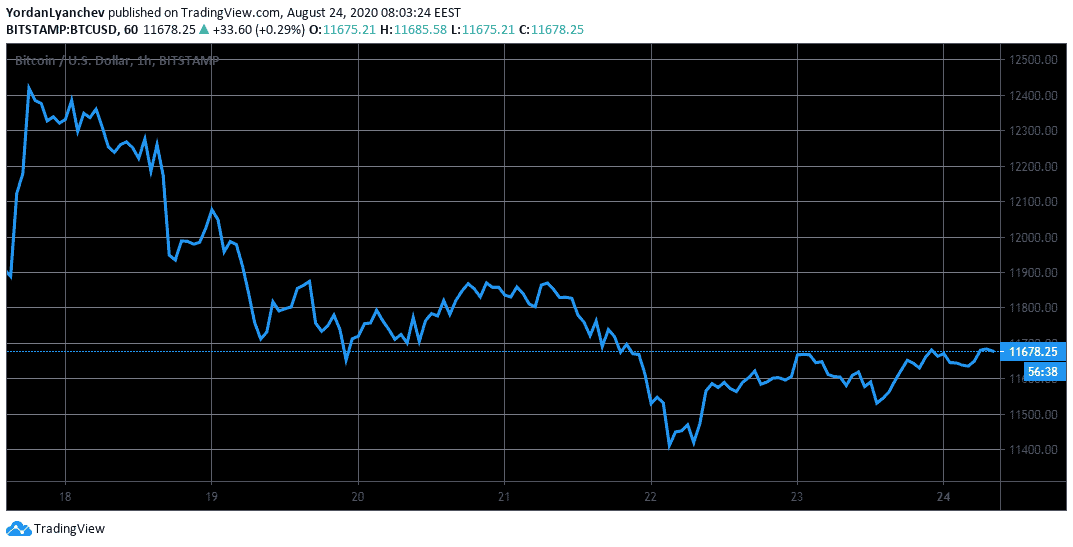

Unlike most of the altcoins, Bitcoin’s recent price developments have been somewhat stable, to what we were used from the primary cryptocurrency. BTC hasn’t seen much volatility since the false breakout to $12,500 during the past Monday. For almost a week, BTC is trading in a $400 range between $11,400 and $11,800.

Even Binance CEO Changpeng Zhao (CZ) complained about this, stating that that “Bitcoin feels like a stablecoin to me. It’s moving up so slowly.”

From a technical standpoint, as BTC trades around $11,700, it will have to break above $11,800 and then challenge $12,000 in order to get back to the higher lows bullish trajectory (short-term). For the longer term, as long as BTC maintains the $10,500 previous high, we can say the market is bullish in the long term. From below, the first support lies at $11,400, followed by $11,200 and $11,000.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato