Altcoin prices were making a comeback this week, while Bitcoin and Ethereum price trends were mixed. Among the top 25 altcoins by market capitalization, only 7 showed positive 24h change in their price. Altcoins with large market capitalization may slow down the ongoing rally.

On Deribit (an exchange that commands over 70% of open interest), Ethereum contracts worth $80 M expire on August 28, 2020, which could impact spot market prices of altcoins, as options market has been a major influencer in the Bitcoin/ altcoin rally since March 2020. When the previous two expirations took place on 20 August 2020 and 21 August 2020, the expiring contracts were worth less than $37 M. The expiration on 21 August 2020 dropped the price by 12.23 %. If a similar drop were to occur on August 28, 2020, the price might drop by over 25 % in a single day across the spot market.

Source: TradingView

A similar event occurred on 26 June 2020 when Bitcoin contracts worth $1 B expired on Deribit. Traders on spot and derivatives exchanges anticipated massive volatility as positions unwinded. However, Deribit raised BTC margin requirement a week in advance and this reduced risk. Traders found it hard to roll over. While reducing risk reduces the volatility to an extent, it forces big players out of the game.

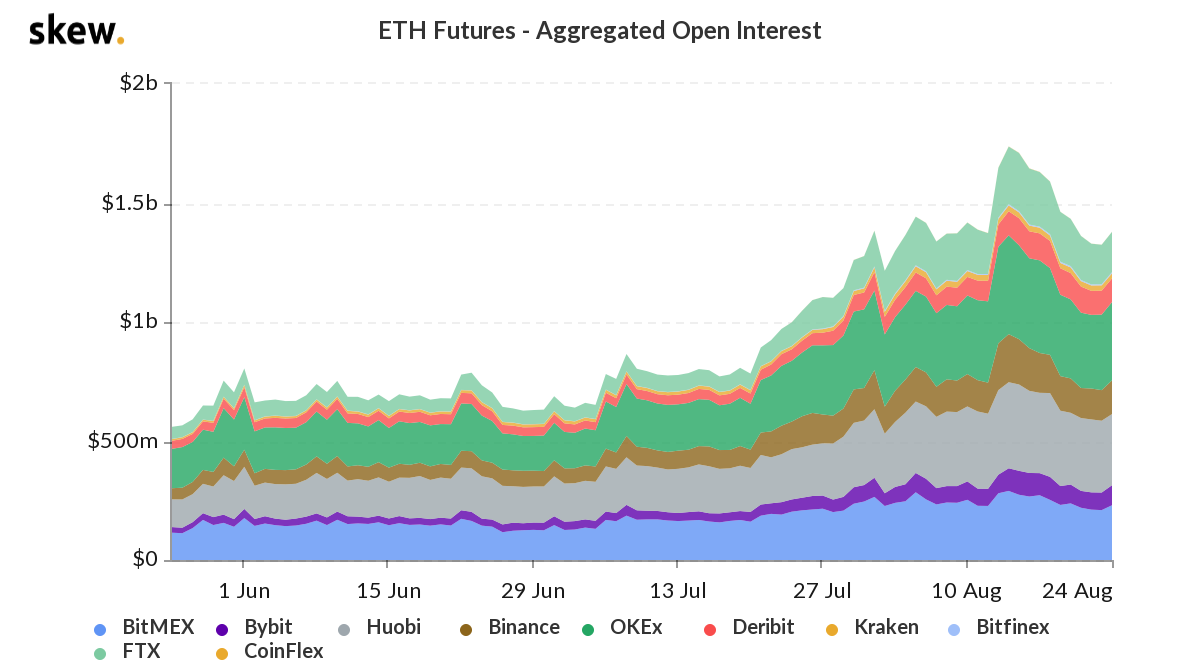

Volatility, even if reduced, will cause a negative change in price and the price of Ethereum on spot and derivatives exchanges may experience the same. Ethereum Options market is adjusting for the same with a rise in open interest.

Since the expiration of contracts on 20 and 21 August, open interest has been declining. It may further drop further after the August 28 expiration. In June and July, the trend was smoother and volatility was less compared to the first two weeks of August.

While the volatility is not as high as Bitcoin, Ethereum options continue to influence Ethereum price and the altcoin rally. A small drop in Ethereum’s price may cause discontent among new buyers; however, in the long run the price rally will gain momentum. In the past, a price drop triggered by a sell-off has been followed by a rally in less than 6 months. The price has increased by 91.26% since May 2020. If a sell-off is triggered on August 28, 2020, the altcoin rally may lose momentum however Ethereum’s price would eventually bounce back before the end of November 2020.

The post appeared first on AMBCrypto