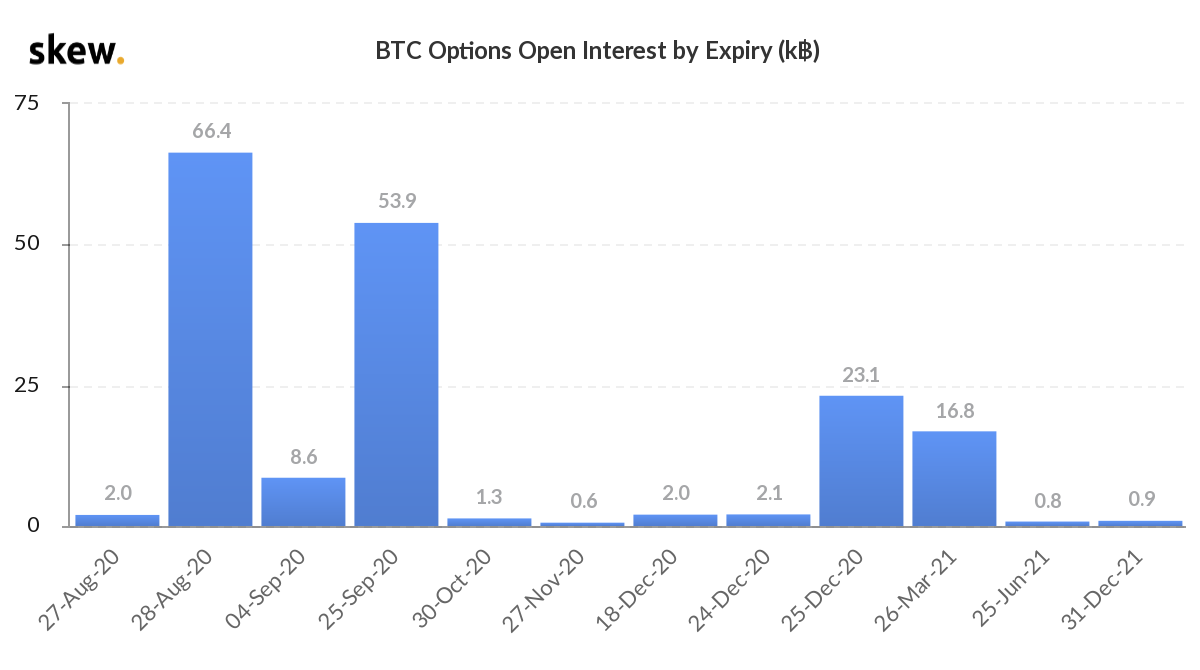

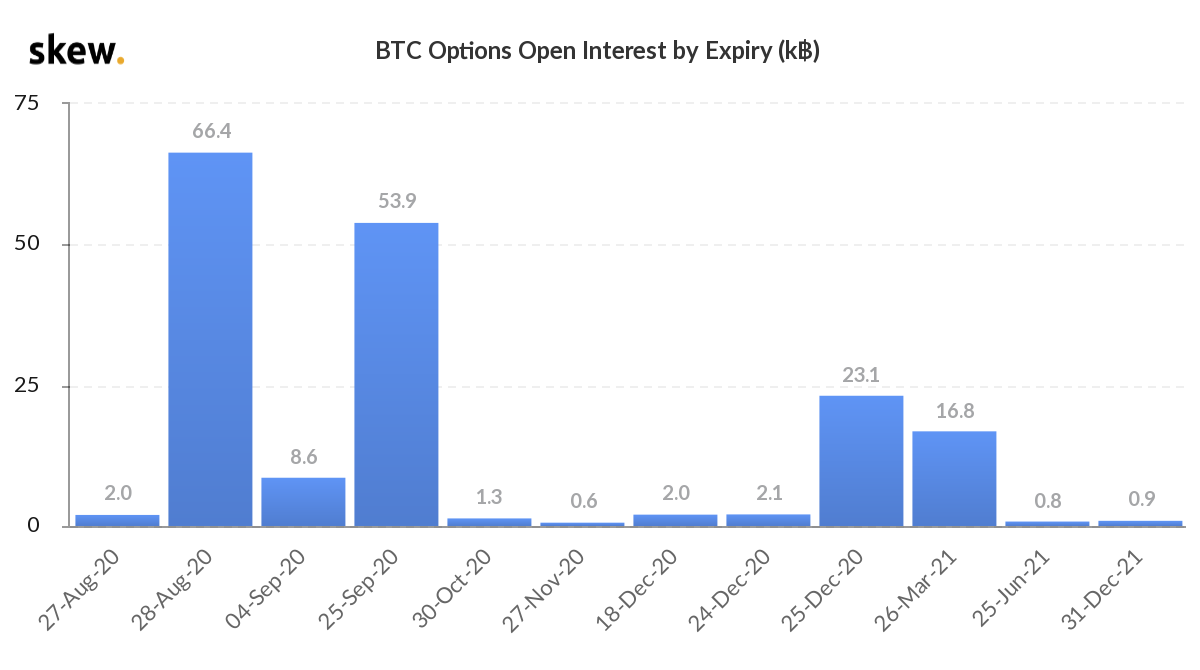

With another month coming to an end, it is important to note that month-ends are generally associated with the expiration of Bitcoin derivatives products. With the Futures and the Options market noting great interest from traders, there are now nearly 66,400 BTC Options set t0 expire on 28 August, as per data provider Skew.

Source: Skew

Even though Options have not seen much trading action recently, the expiration in question could bring in some volatility into the market. The Put/Call ratio was pointing to bearishness in the market as its value climbed to 0.71. This meant that the puts to call ratio was at 7 calls for every 3 puts, as per data provided by Ecoinometrics.

As per the observations from the data provider, since the contracts will expire on Friday, 87% of the puts will expire out of the money, an expression used to describe when the put option’s strike price is lower than the prevailing market price. On the contrary, 79% of the calls are expected to expire out of the money, meaning the call option’s strike price will be higher than the market price.

Further, the traders using a bull call spread trading strategy may witness their contracts expire without any returns. The strategy uses two call options to create a range consisting of a lower strike price and an upper strike price, $12.5k, and $14.5k in this case. While a bullish call spread helps to limit losses, it also caps gains. As per Ecoinometrics, there was 2000 BTC worth of bull call spreads. However, they will expire worthlessly as the price of BTC, at the time of writing, was well below the lower strike price.

Interestingly, as traders prepared themselves for the large expiry on Friday, prominent BTC Options exchange, Deribit, faced “hardware issues.” The exchange reassured that it was not a hack, but also warned that it may not be able to have its system back online in time for the daily Options expiry. Deribit has been the most popular Options exchange and fortunately, this outage did not take place tomorrow, or the crypto-space would have been up in arms since most monthly contracts are set to expire on the exchange.

The post appeared first on AMBCrypto