BitMEX the old?

Once the OG and pioneer, BitMEX seems to be getting old, or at least the contracts listed on the exchange are. There are contracts for 8 coins – BTC, ADA, BCH, EOS, ETH, LTC, TRX, and XRP.

Most of these coins were popular in 2017 but few seem to have survived and ADA is one among them. With defi and DEX gaining the spotlight, tokens are dime a dozen but BitMEX is living in the past. The proof is in the reduction in OI for the exchange over the past year.

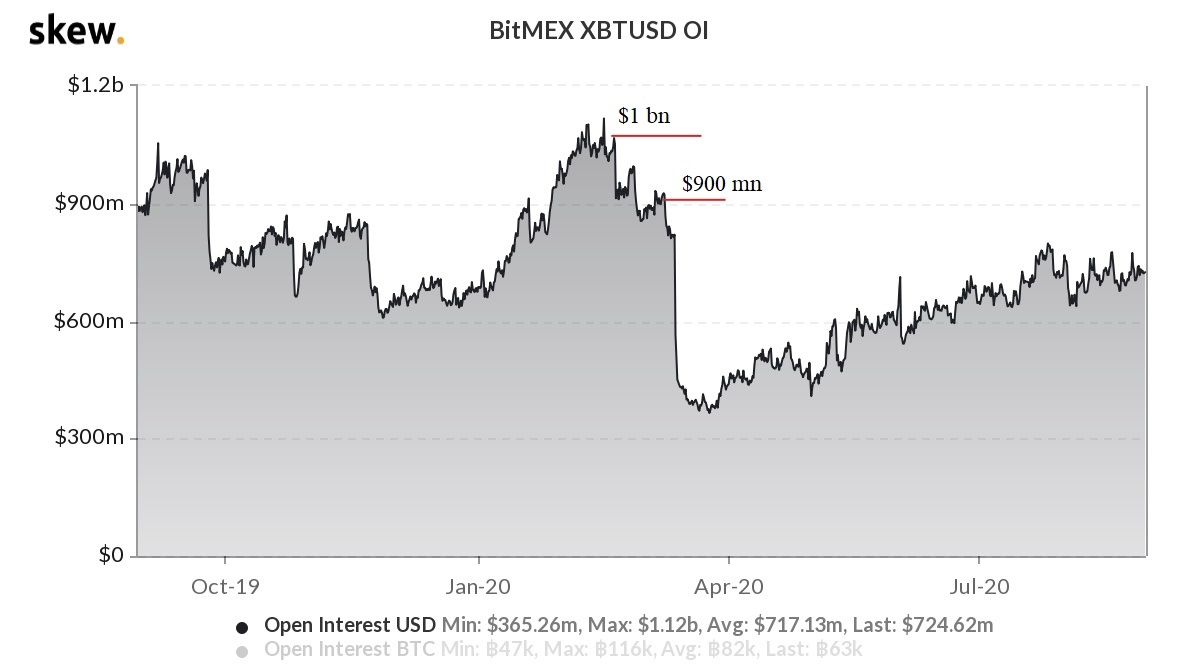

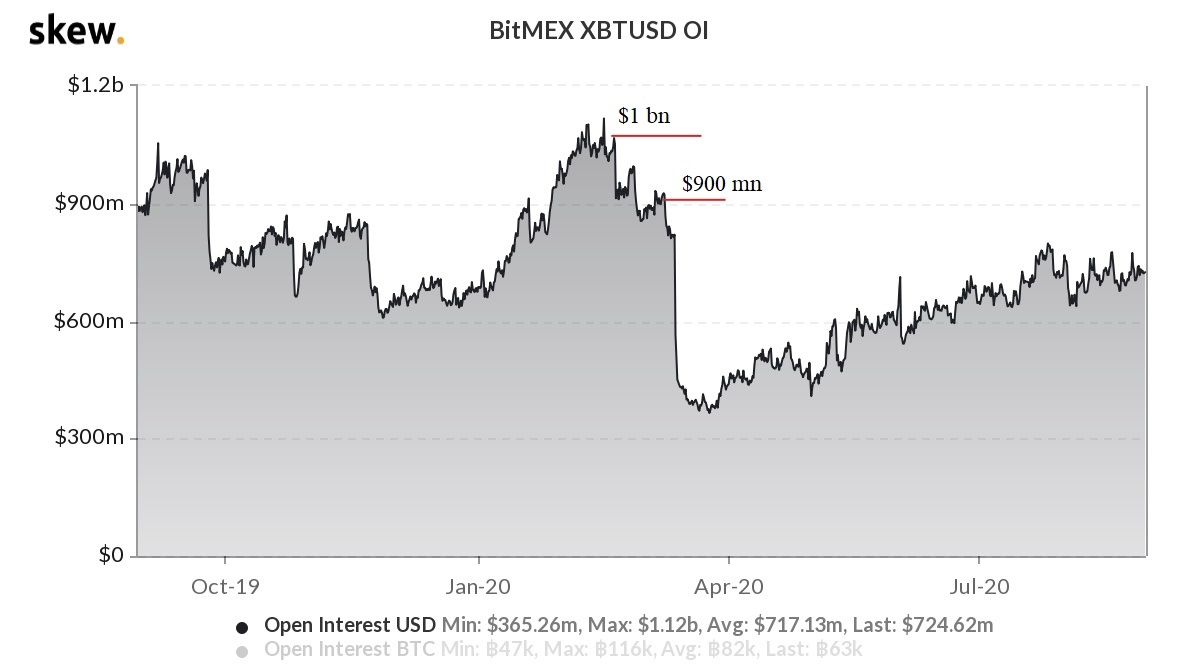

Source: Skew

OI on BitMEX hasn’t hit $1 billion in 6 months and $900 million in 5 months. While the indecisiveness of bitcoin’s price is understandable, BitMEX’s slowing growth isn’t.

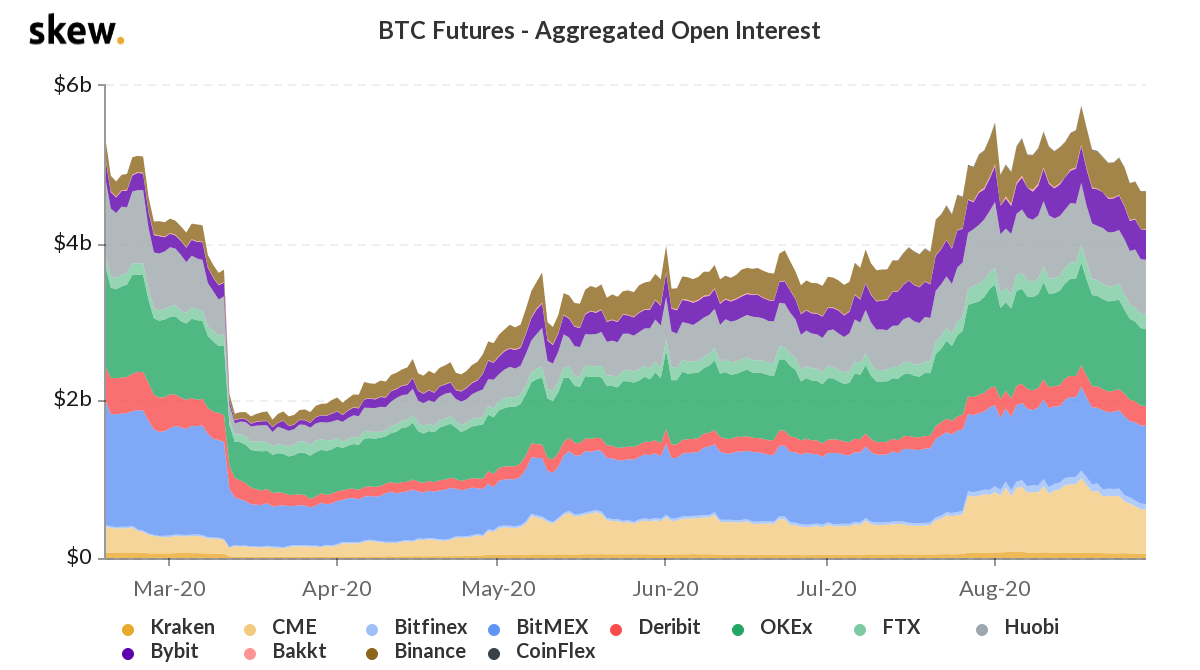

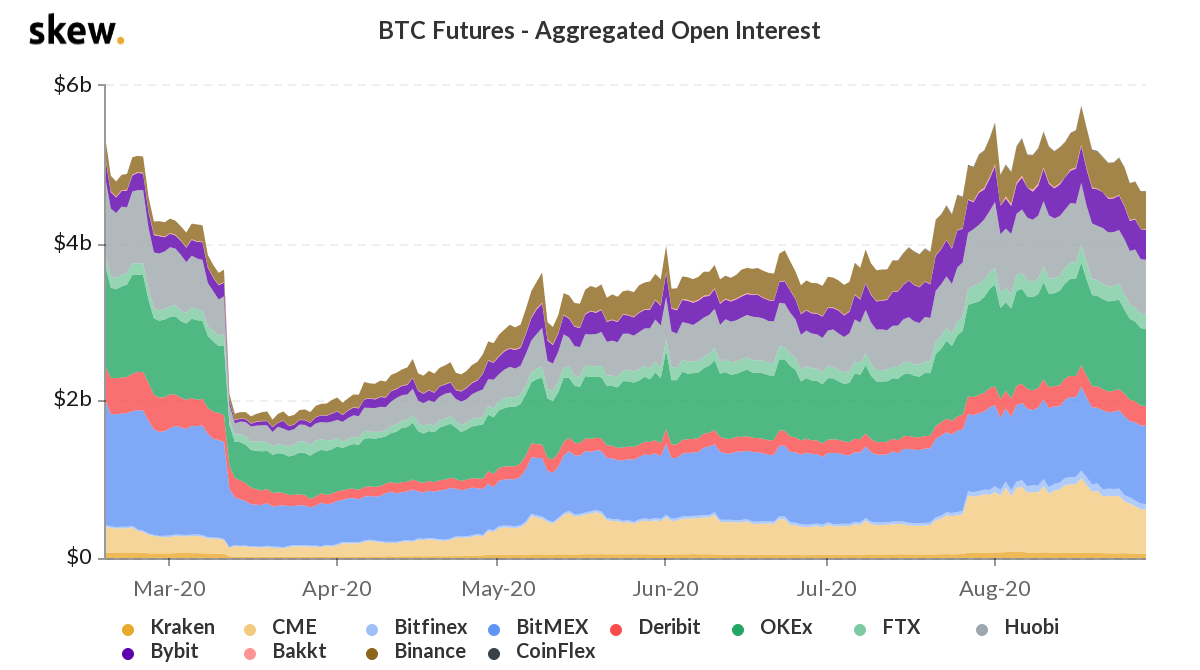

Other exchanges across the same time period have seen a substantial increase in their OI. Take, for example, FTX – its BTC OI has increased from $130 million to $200 million.

Source: Skew

Similarly, CME has seen an increase of 157% from $350 million to $900 million and down to $663 million. Binance’s BTC OI has grown 146% from $194 million to $479 million.

Other factors that support the argument that BitMEX has grown sluggish include visits to the site ( gathered from SimilarWeb) and Google trends. Both indicate that metrics have been reducing.

Source: SimilarWeb

The monthly visits almost halved for BitMEX in the last six months from ~$14 million to $6.84 million. Google trends also showed levels last seen in late 2017 and early 2018.

Why is BitMEX slacking?

- Bitmex is the same it was in 2018, with the exception of the Twitter handle and a redesign of the logo.

- Does not include new and exciting projects or tokens.

- Altcoins of 2017-18 are not just old due to their age; new capital is less inclined to flow into altcoins that haven’t seen a decent pumped since 2018. Moreover, capital will flow into defi coins like YFI, Polkadot, or other ‘promising’ ecosystems.

The most important reason is that the crypto narrative is changing. Bitcoin is being noticed by institutions and they don’t want a small piece of the pie but the whole pie. This is mostly due to bitcoin’s property as a hedge against the rising inflation and the broken financial system.

While defi is definitely in pre-pubescent stages, it is making more noise than ICOs did but with a hint of promise. Although defi’s promises might never come true, giving it a chance to play out or pop would be in the best interest of the involved players. This is something that BitMEX seems to be missing out on. As FTX and Binance’s cold war to be the most innovative exchange carries on BitMEX is still lagging in the race.

The post appeared first on AMBCrypto