Bitcoin continues to increase in price slowly and is currently hovering at $11,650. Larger-cap altcoins are in the green as well, as Ethereum’s 4.5% increase has taken ETH to $420.

Altcoins On The Move

The top ten cryptocurrencies have been recovering since last week’s dumps, and most of them have marked gains in the past 24 hours. Ethereum is among the leaders with a 4.5% surge, and ETH is trading at above $420. On a weekly scale, this is a 12% increase for Ether after bottoming at $380 several days ago.

Litecoin is up by 6% to $62, Ripple (2%) to $0.285, Bitcoin Cash (2.3%) to $277, BitcoinSV (2.8%) to $197, and Binance Coin (2%) to $23.5.

Sushi farming is attracting attention again, with two of its representatives surging by double-digit percentages. UMA is the most significant gainer of the day, with nearly 50%, and Ampleforth follows with 27%.

Reserve Rights (23%), Flexacoin (15%), Aragon (14%), Ziliqa (13.5%), NXM (12%), and bZx Protocol (10%) are also registering serious price increases.

DFI.Money is retracing by 22% after surpassing $5,500 yesterday. Terra (-7%), Golem (-6%), and Status (-5.4%) are also in the red.

Yearn.Finance has lost 3% of its value since yesterday’s pump to nearly $40,000. Nevertheless, YFI’s price continues to impress the community at $32,500.

Bitcoin Sits On $11,650

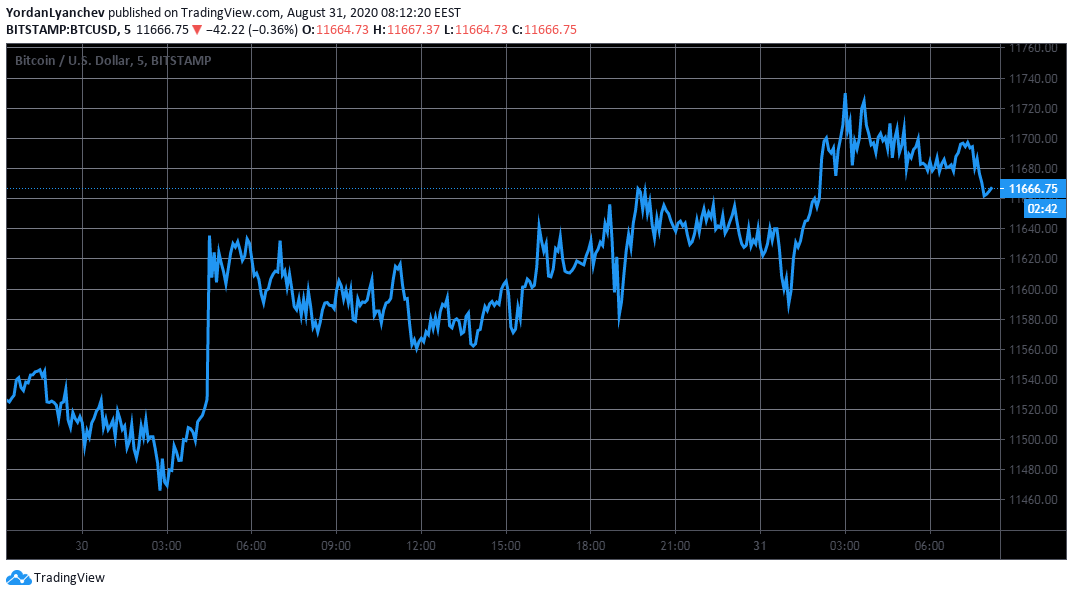

The primary cryptocurrency has successfully recovered from its weekly low to $11,100 charted last week following the US Federal Reserve’s announcement that it plans to target an average inflation rate of 2%.

Just a few hours ago, Bitcoin marked its intraday high of over $11,720 but couldn’t sustain it and retraced slightly to approximately $11,670. BTC sits above a significant resistance at $11,600. If the asset reaffirms its position above it, it could head further north to the next resistance at $11,800, followed by the psychological level of $12,000.

In case of a breakdown, the first support lies at $11,300. Below that, BTC could test $11,000, before $10,500 – the previous 2020 high marked in February this year.

Altcoins’ gains continue to put pressure on Bitcoin’s dominance over the market. After losing 1% yesterday to 58.4%, the metric comparing BTC’s market cap against all other coins has further decreased to 57.9%.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato