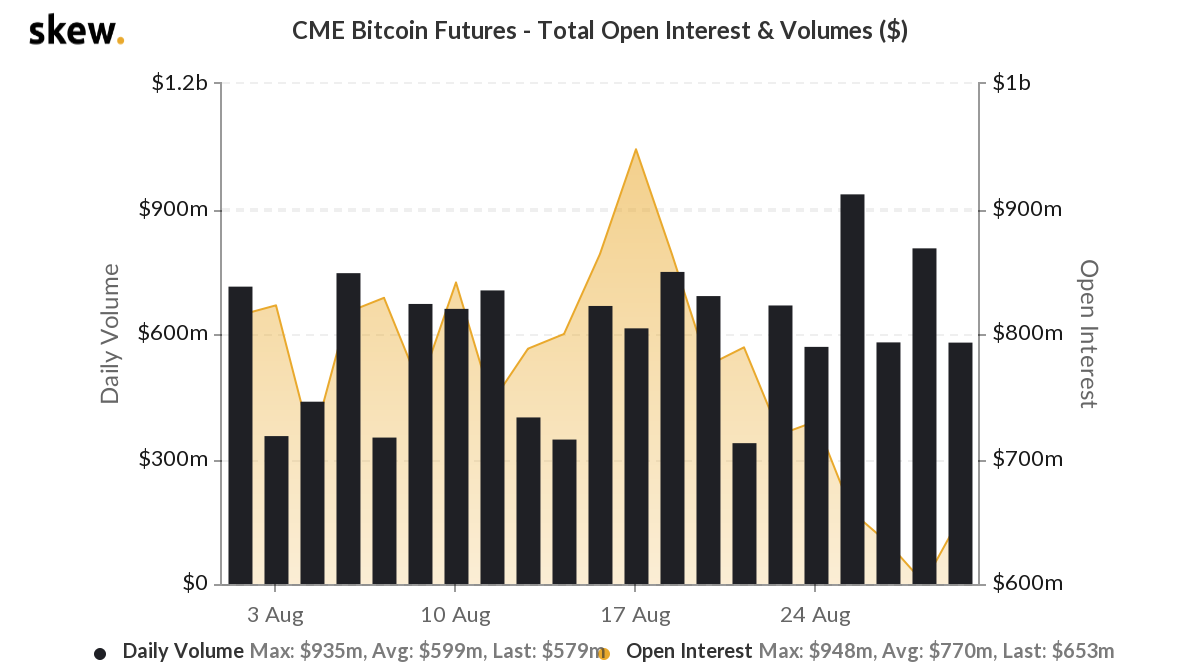

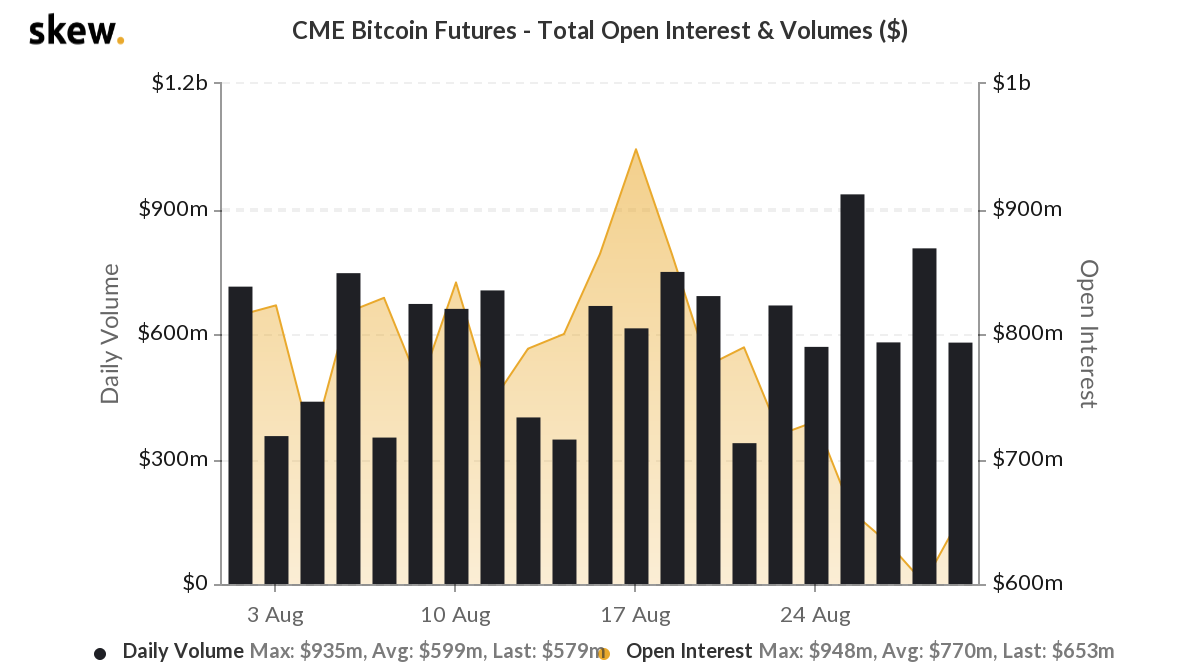

Institutional investors and their interest in Bitcoin Futures are driving growth on derivatives exchanges like the CME and Bakkt. In fact, just recently, Bakkt Bitcoin Futures volume hit a new high of $167M, while the CME clocked in a volume upwards of $930M on the same day, the 25th of August.

Source: Skew

Source: Skew

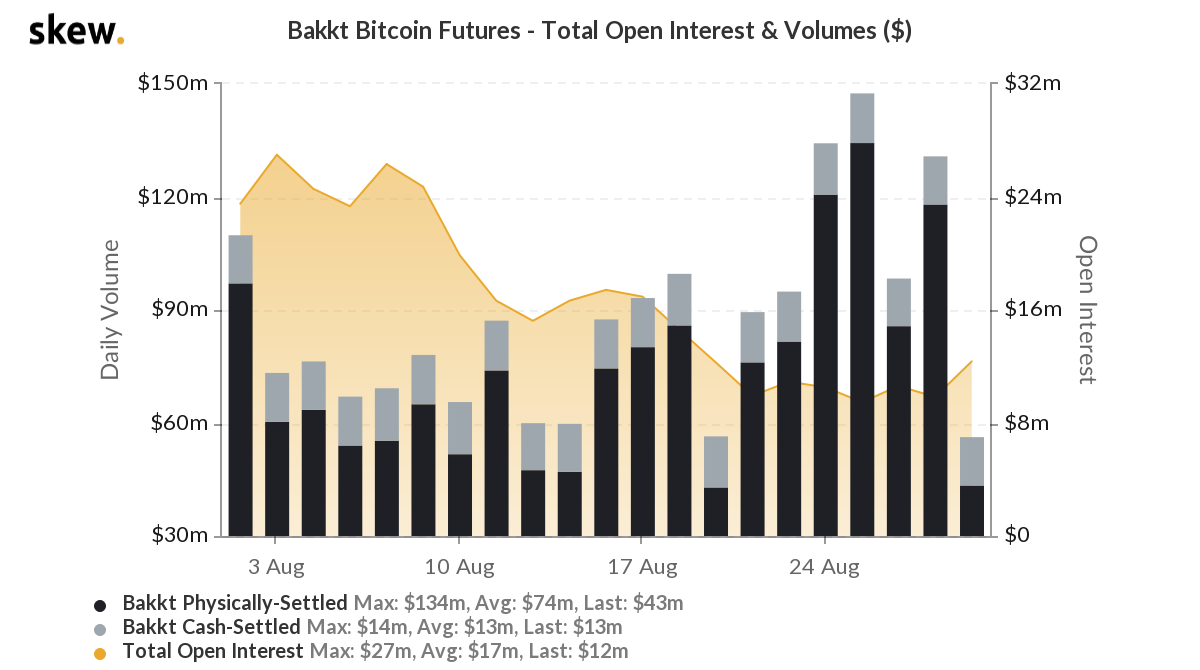

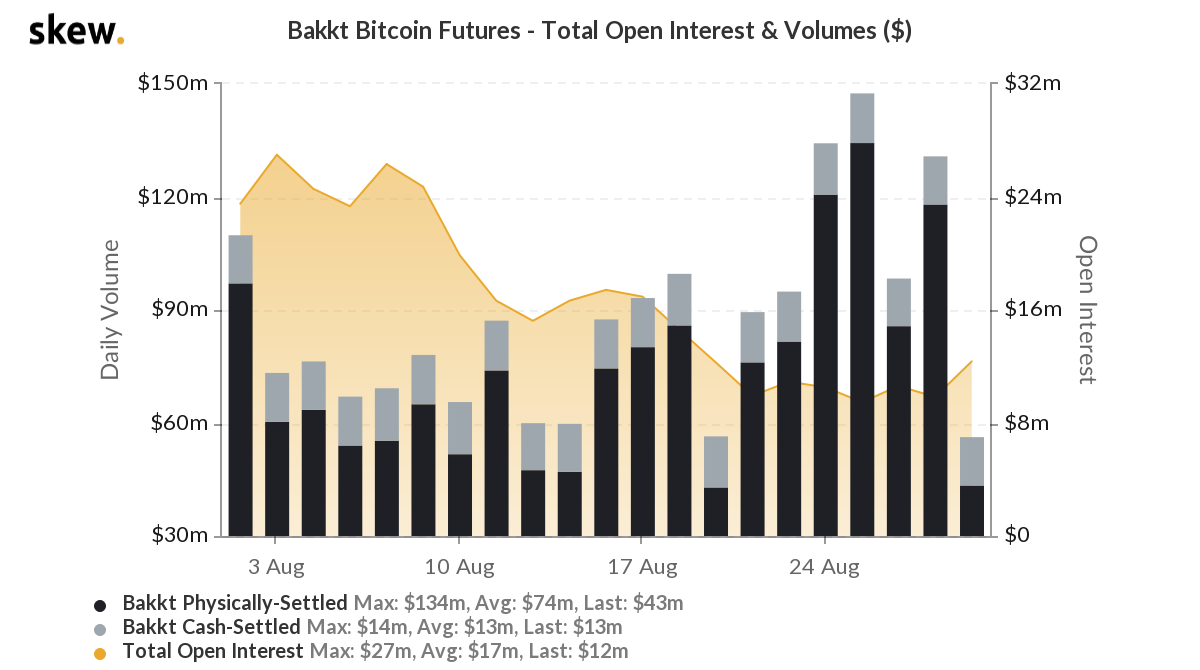

Though Bakkt lags behind when compared to the CME, Bakkt’s President Adam White believes that it will eventually gain even more traction. However, this narrative of institutional interest in Bitcoin is a highly debated one.

Most analysts and experts hold the opinion that institutional interest in Bitcoin can make or break the Futures market. After all, if institutions don’t infuse their capital and legitimacy into the Bitcoin Futures market, where will the liquidity come from? While this concern may be overblown to a certain extent, interest from institutional investors in physically-settled Bitcoin Options is far more debatable.

Trading volumes for physically-settled Bitcoin Futures on Bakkt dropped from $134M on 25 August 2020 to $118M within two days, according to Skew. Here, it is important to note that this sudden drop may not necessarily or directly reflect a drop in institutional interest.

Bakkt’s competitor, Chicago Mercantile Exchange (CME), has been providing cash-settled Bitcoin futures contracts for more than two years now. It is a popular opinion that mainstream and institutional investors’ awareness peaked in 2017 during the historic bull run. However, Bakkt started offering Bitcoin Futures only in September 2019. By then, most institutional interest had seemingly fizzled, with the CME readily available to handle the demand during and after the bull run.

To differentiate itself from the CME, Bakkt started offering physically-settled Bitcoin Futures. Alas, it did not receive the anticipated response. Here’s what happened when Bakkt went live – Minutes after the launch at 12:00 UTC, the first Bakkt/ICE Futures contract was exchanged at $10,115. The number of contracts in the first hour stood at just 5 in total. Bakkt’s flagship product, the daily Bitcoin contract, was traded 18 hours after Bakkt went live at a price of $9975.

This slow start drew criticism from experts. However, according to White, “As the market grows, more traditional institutional investors are becoming comfortable with holding and trading crypto assets, which is evidenced by Bakkt’s increasing market share.”

In support of Bakkt’s slow start and consistent growth, Bitcoin Futures volume on Bakkt has broken the record a few times this month. In fact, the daily volume is now consistent with institutional interest and institutional funds continue to flow freely.

On the contrary, looking closely at such rates of growth, some experts have suggested that the physical delivery of Bitcoin could be the one factor that has been hindering Bakkt’s growth in the crypto-derivatives market. Physical delivery entails actually holding the asset, as well as its associated risk.

Interestingly, institutions are evidently not shying away from these risks in 2020. Just recently, Grayscale Investments of NY purchased more than 1.5 times the number of Bitcoins mined since the third Bitcoin halving. The weakening USD, the Fed’s rate cut, and turmoil in the global economy have all made institutions more resilient. They are now exploring options that hedge their existing portfolios from downside risks.

Source: Twitter

What’s more, the use of cash-settled derivatives to hedge Bitcoin positions is controversial. Cash-settled Futures can be manipulated as the price is taken from spot exchanges. Physically-settled Bitcoin Futures are sure to make the market more resilient, robust, and less prone to manipulation. Instead of settling at market price, holding the real asset gives investors the opportunity to settle in for the “real” price.

Physically-settled Bitcoin Futures may not be the only solution for institutional investors. However, market manipulation and wash trading have raised questions on the authenticity of the price that cash-settled Futures rely on. In the long run, physically-settled Futures may be the answer to institutions’ need for hedging.

The post appeared first on AMBCrypto