Binance may have entered the derivatives space late, but within no time, it has established its place in the market and among users. The reason behind its success was the variety of altcoins offered by the exchange along with the major coins. 2020, has been the year of DeFi and Binance realized this and added DeFi tokens to enable interested users to trade on its platform. Just the previous month, Binance Futures launched a new line of products called the perpetual futures COIN-margin and as per their announcement on Friday, the exchange will be launching Cardano [ADA/USD] and Chainlink [LINK/USD] quarterly 1225 Coin-Margined contracts with 75x leverage.

Coin-Margin contracts were the second line of futures products, wherein the margin and the price are determined in cryptocurrency. The trading for ADA/USD will open on 6 September at 2:00 AM UTS, while LINKUSD will begin trading on the same day at 3:00 AM UTC. These were futures contracts that used base assets i.e. ADA and LINK as collaterals. Binance already had listed BTC/USD and ETH/USD in this category of products, now with the addition of LINK and ADA, it may welcome more interest from the investors as the two assets have been witnessing good growth.

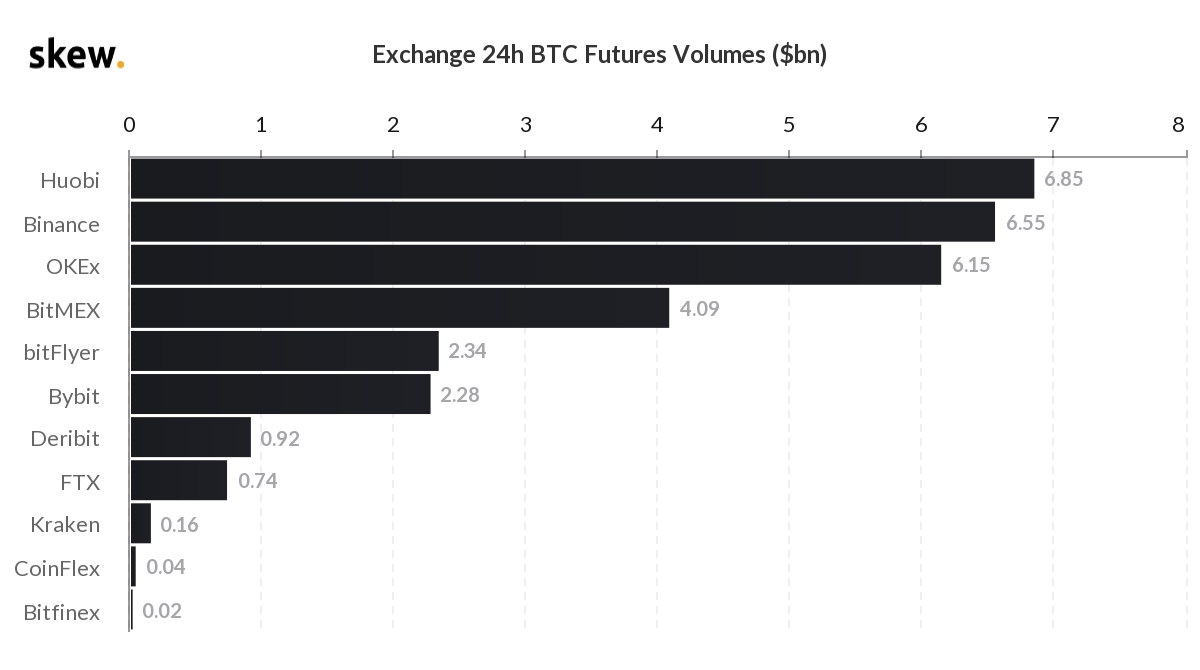

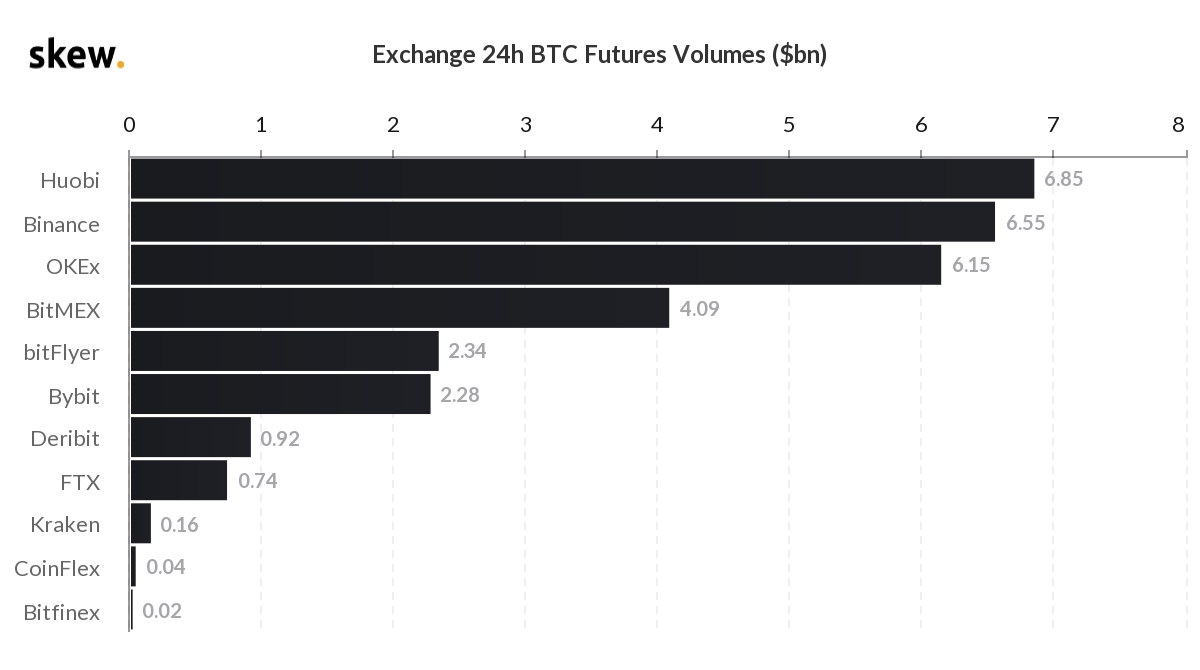

Interestingly, Binance announced listing the two digital assets, right after BitMEX announced its plans to launch quanto futures for LINK, ADA, EOS, and Tezos [XTZ]. Given the competition between the two exchanges, this wasn’t surprising. Binance has managed to acquire the market share of BitMEX ever since the crash in March. At press time, Binance’s 24-hour trading volume was at $6.55 billion, whereas, BitMEX remained quite low at $4.09 billion.

Source: Skew

Even though the open interest remained high on BitMEX compared to all other exchanges with $840 million, the volatility filled market still exhibited low trading volume on the exchange. On 3 September, when the crypto market was witnessing great volatility, the BTC trading volume on BitMEX remained at $3.8 billion, whereas, Binance noted a trading volume of $5.9 billion. Binance has established itself as a reliable derivatives exchange and with its long list of tokens, the exchange has managed to compete at high stakes.

The post appeared first on AMBCrypto