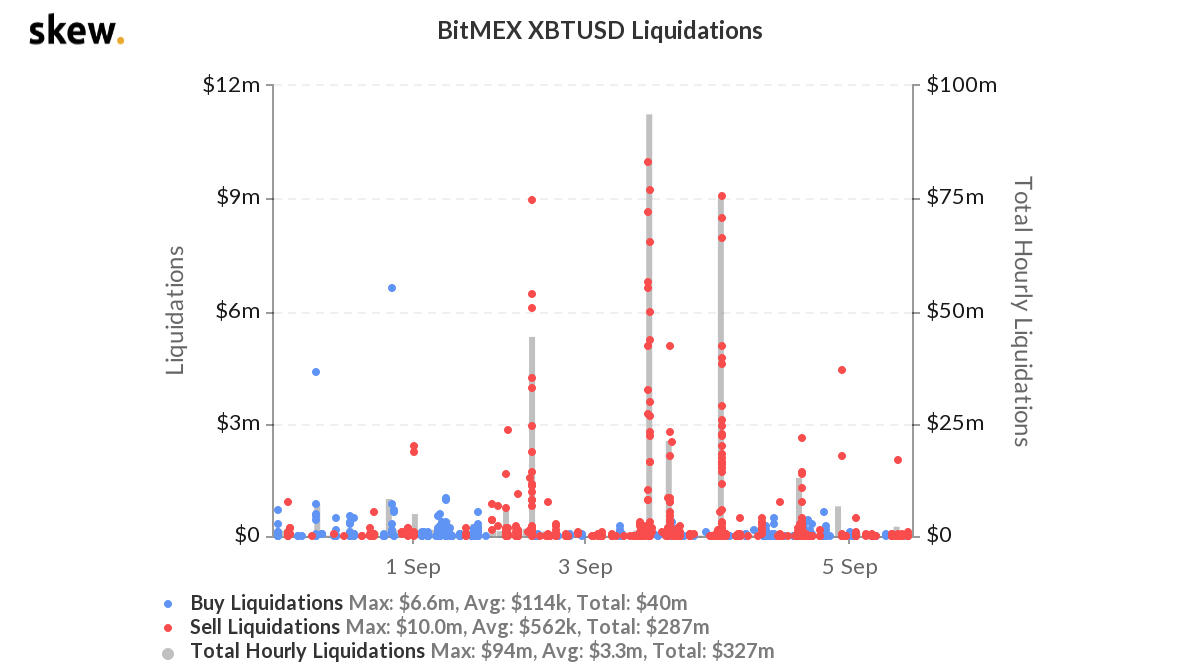

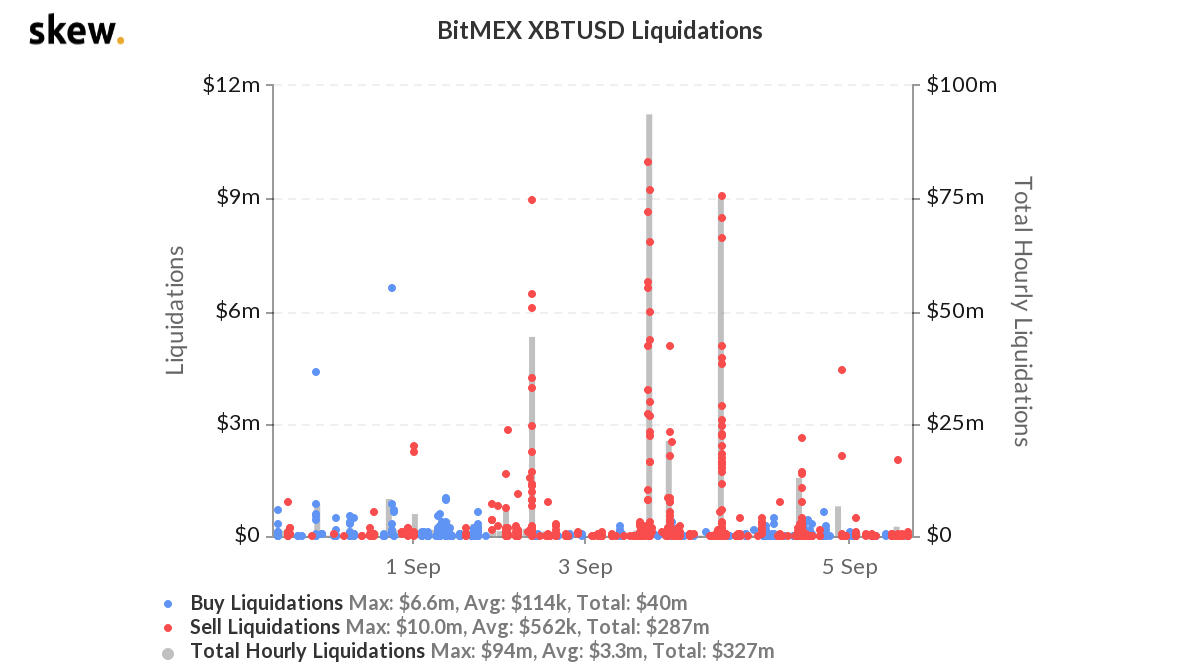

Bitcoin’s recent price action triggered a cascade of sell liquidations on BitMEX. In fact, a total of $264 million sell orders were liquidated following Bitcoin’s price drop below $11,500. Interestingly, the U.S stock market also suffered a similar fate.

However, perhaps the reactions of traders on derivatives exchanges are most important since those reactions influence the price on spot exchanges. Significant liquidations on derivatives exchanges happen in times of high volatility. The last time such an event transpired was back on 12 March, a time when the price of Bitcoin on spot exchanges dropped by over 50%.

At the time, it took weeks for Bitcoin’s price to recover from the slump that followed. On 27 July, however, a price rally started and it gave a boost to trading sentiment on spot exchanges. This Bitcoin price rally continued for over a month, until a few days ago when Bitcoin fell below the $11,500-mark, a development that was accompanied by a host of liquidations. But, the scale of the same also highlights the need for a shift in trading strategy.

Liquidated positions save traders from incurring higher losses. However, on spot exchanges, this most affects HODLers and day traders. The liquidity from such events is rarely absorbed by the demand created by new buyers. The result, therefore, is one price drop followed by another. Within 24 hours, a week, and a month, several such drops usually follow. The same was observed when the BTCUSD price charts for the period 12 March to 27 August were checked out.

Source: tradingview.com

However, in some ways, this is also an opportunity as the market’s day traders and arbitragers can leverage liquidation events if they choose to read the signs soon enough.

Source: Skew

Some liquidations are simply an aftermath of the price drop and some others are a forced unwinding of prevailing bullish sentiment. The latest price drop was of small order, worth about $1500, so this can be attributed to retail traders’ sentiments. However, a drop of the magnitude seen on 12 March 2020 usually denotes a shift in the strategy of institutions. This can be used as a point of reference for day traders.

Altcoin traders are affected by events such as a dip in Bitcoin’s price since such events trigger panic and a dip in altcoin prices is almost always anticipated. In fact, the latest price drop wiped out over $40 billion in market capitalization. Since trading is a zero-sum game, there are many losers on spot exchanges in situations such as this.

Though forced liquidations is an integrated feature on many derivatives exchanges, traders are often caught unaware by price drops within a short period of time. Traders entering into overleveraged bets may come under pressure from a cascade of forced liquidations with positions associated with high risk.

Here, the risk is evident from the fact that 87% of the total liquidations in Bitcoin Futures on BitMEX over the past week were all sell liquidations. Such risk and price volatility hurt retail traders’ sentiment and the price may take a while to recover.

Capitalizing on the price cascade and being wary of the liquidity on spot exchanges are two simple ways to trade with calculated risk on spot exchanges. There is no guarantee that prices will always continue to move after a liquidation, but reading the charts to pick up on signals can empower traders and boost profits in day trading.

The post appeared first on AMBCrypto