With the local economy continuing to suffer and the Argentinian peso devaluating, over 73% of participants in a recent poll voted that cryptocurrencies are the most efficient saving mechanism. Nearly as many responded that they have invested in at least one digital asset.

Argentina’s Economy Following The COVID-19 Lockdowns

The South American country had been suffering even before the government initiated extreme measures in an attempt to fight the expanding COVID-19 pandemic threat. Argentina was one of the first nations in the region to introduce nation-wide lockdowns, which led to initially decreasing the number of infected.

However, as time progressed, the number of confirmed COVID-19 cases grew, but the country’s economy only worsened. April 2020 displayed a drop of 26.4% compared to the same month the previous year in raw GDP. Even in May, when the strict measures were loosened, the percentage dropped by 20.6.

A report by the Municipal Bank Foundation exemplified the real scale of the pain for citizens as it estimated that for every point of decline in GDP, there’s a point and a half decrease in formal wages.

Nevertheless, earlier this week, the country had a breath of fresh air as it successfully restructured almost all of its $65 billion debt with private creditors. Argentina’s economy minister Martin Guzman announced that 99% of creditors accepted the offer to extend maturities on the debt and to lower interest rate payments from an average of 7% to about 3%.

President Alberto Fernandez wished “we never again enter this labyrinth (of indebtedness),” and noted that in 2030, Argentina will owe $38 billion less than it did in 2019.

Local Economy Pushes People Towards Crypto

Despite the recent positive news, it seems that Argentinians are already looking outside the traditional financial space for a solution, according to the poll conducted by the popular peer-to-peer cryptocurrency exchange Paxful.

It reads that out of 1,113 surveyed participants, 73.4% (or 817 people) voted that “cryptocurrencies are the most effective way to save and protect their funds.” Their answers also indicated that Argentinians tend to steer clear from the local currency, as the Argentinian peso has lost nearly 90% of its value against the US dollar in the past five years alone.

70% of surveyed added that they had invested at least once in some digital asset citing as the main reason “the ability to provide an economical shelter from the depreciation of the local currency due to inflation.”

When asked about their perception regarding Bitcoin, in particular, the voters answered that they had purchased BTC after evaluating its global potential and singled out its decentralized nature as significant merit. 49% brought out that the asset could provide enhanced security within an otherwise tumultuous banking system.

Paxful’s Latin American Manager Magdiela Rivas, highlighted the growing demand from Argentinians towards cryptocurrencies. The exchange marked a 37.5% increase in the volume since the start of 2020 and even more after the COVID-19 lockdowns.

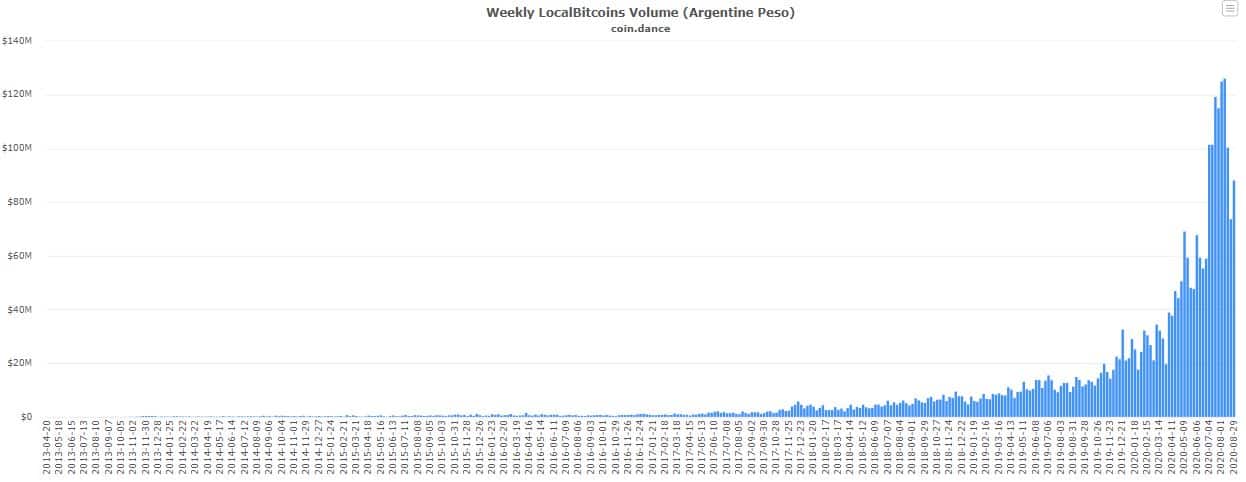

Another P2P digital asset exchange, namely LocalBitcoins, has experienced a surge in Bitcoin trading volume from Argentinians. According to data from coin.dance, the BTC P2P volume reached a fresh all-time high in early August after continuously expanding for weeks.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato