Bitcoin’s latest price drop below its crucial support level of $11500 has once again re-ignited the question of ‘buying the dips’. However, not all dips are alike, and buying the dip may not always be your best bet. @CryptoWhale was among those who recently commented on the narrative of “buying the dip.”

Source: Twitter

Some dips are expensive when you take into account the fair value of Bitcoin. In fact, buying these dips is equivalent to buying Bitcoin at a premium. This is where Bitcoin’s fundamentals come into play. The fair value of Bitcoin as a digital asset can be derived based on its utility as a payment network.

And its market value can be calculated using on-chain data. Determining the fair value is more challenging, however, as unlike traditional financial assets, Bitcoin is a millennial asset. Its emergence and value are based on public network infrastructure, which is why, analysts like Willy Woo and Kilichkin have developed adaptations of traditional approaches to assess Bitcoin’s fair value.

Willy Woo applies a 28-day moving average to transaction volume, taking 14 days forward, and 14 days backward facing. However, this is of little relevance for day traders since it does not give many insights or signals.

The most effective indicator in determining fair price is the 1 year MA. It strikes a balance by filtering out the noise of Bitcoin’s price movements without altogether destroying the signal. It is a relatively simple approach, when compared to the NVT, and its variations introduced and popularised by Willy Woo and others continue to remain so. The purpose of identifying a fair valuation using the 1 year MA is to pinpoint Bitcoin’s overvaluation and break the chain of herd mentality. However, this is not a forecast or prediction.

The velocity of investment in Bitcoin is driven by the trader’s willingness to exchange value for Bitcoin and this is believed to change over time. To account for such a change, the 1 year MA filters the outliers.

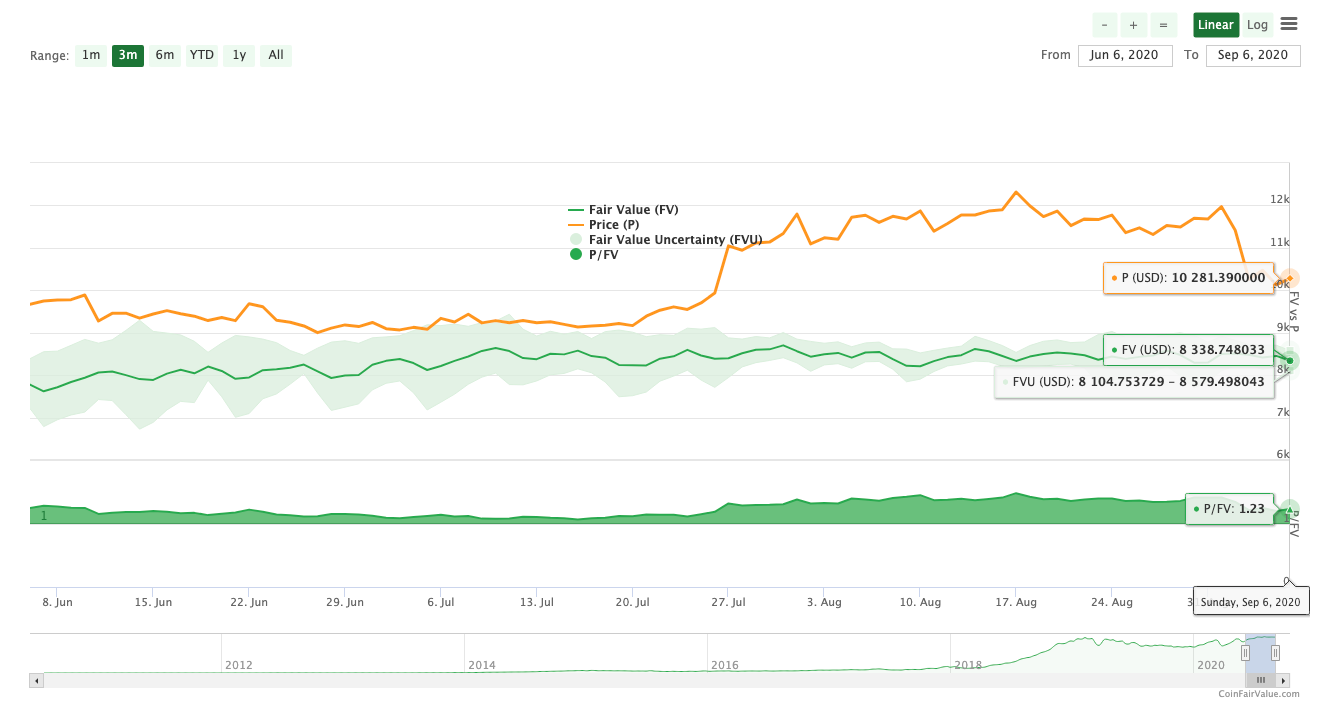

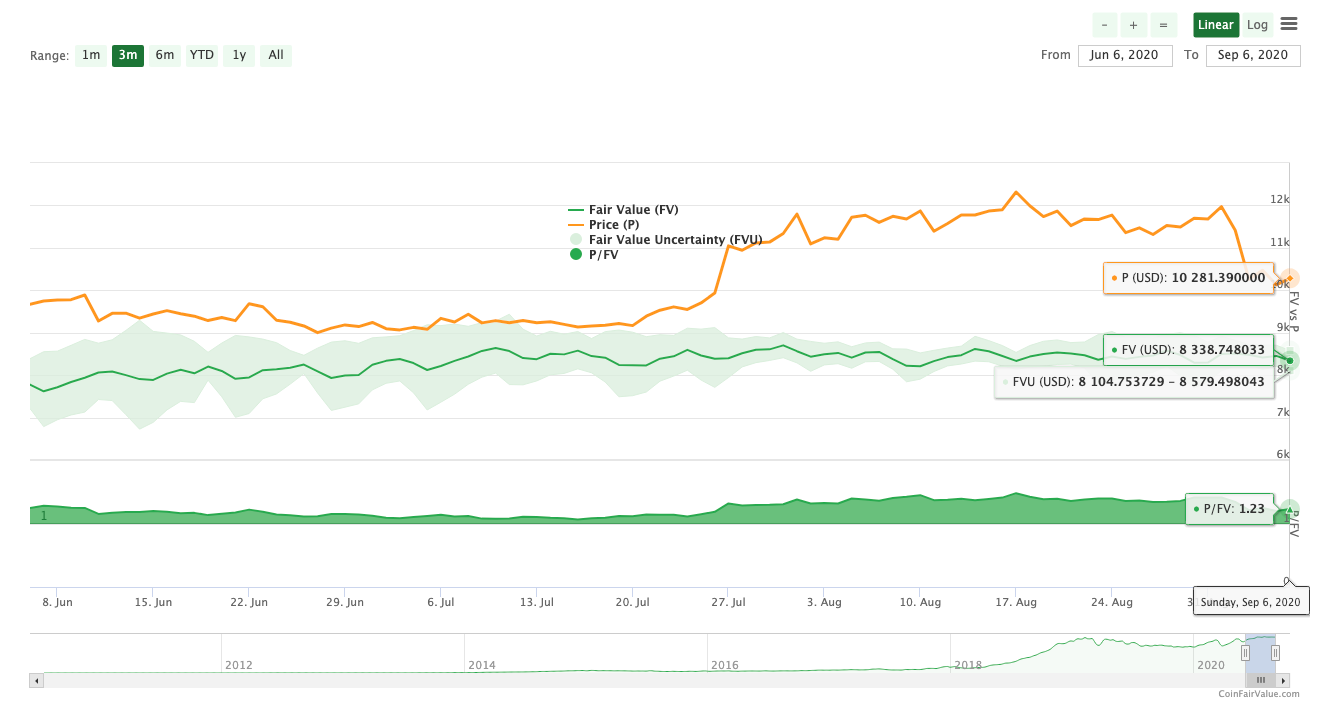

Source: coinfairvalue.com

Based on the attached chart, when applying the 1 year MA to Bitcoin’s charts, the fair value for Bitcoin was found to be $8338.75 with a 24-hour change of -1.36% and 1-year change of 25.05%. At press time, Bitcoin’s price was $10,165, a price point that was 21.9% higher than the cryptocurrency’s supposed Fair Value.

Ergo, buying the dip may not always be the best bet. If you don’t watch out, you may get robbed blind.

The post appeared first on AMBCrypto