As is often the case in the digital asset market, an altcoin may perform extremely well over the course of a bull rally. In fact, it may even outperform Bitcoin, which is why in the eyes of many, such tokens might even look like the real thing. However, many of these would soon crumble under pressure whenever the market’s bears got a grip on the market.

Chainlink has been looking to change that narrative with its present-day price performance. Chainlink demonstrated its strength during its recent bullish rally. Now, against all odds, the crypto-asset seemed to be showing resilience amidst a bearish storm.

After the bloodbath between 2-3 September, most of the market’s cryptos hit a local bottom. While Bitcoin went briefly under $10,000, LINK dropped down to $9.22 as well. However, over the past couple of days, LINK has been exhibited an admirable intent to recover on the charts.

Source: Trading View

When comparing the price performances of Bitcoin and Chainlink, it can be identified that Bitcoin has been struggling to breach its 50-Moving Average to reduce the apparent selling pressure. In comparison, LINK has held a position above the 50-MA for the past 24-hours. Out of all the top altcoins, LINK is the only one above its 50-MA right now, with the crypto leading the charge to break the bearish deadlock on the market.

One of the major reasons for its reduced dependency on Bitcoin has been its minimal correlation. During the bull rally, many speculators suggested that the correlation would rise during a period of correction. However, LINK is presently defying the odds, using that same metric as an advantage to rally back on the charts.

In fact, Santiment’s latest analysis highlighted a similar sentiment as well. The analytics platform tweeted,

$LINK is back in recovery mode and toward the top of #altcoin pack on a #bullish Sunday. Part of our community’s strategy involves tracking the 30d MVRV of #Chainlink and others. Avg trader returns in this time are -29%, capitalizing on the buy signal. 📈 https://t.co/vKY6YuoCgH pic.twitter.com/ci6i69Pgox

— Santiment (@santimentfeed) September 6, 2020

On-chain activity supports LINK’s incline

Moving the spotlight away from the price, another important sign of the strength in LINK’s rally is its on-chain data.

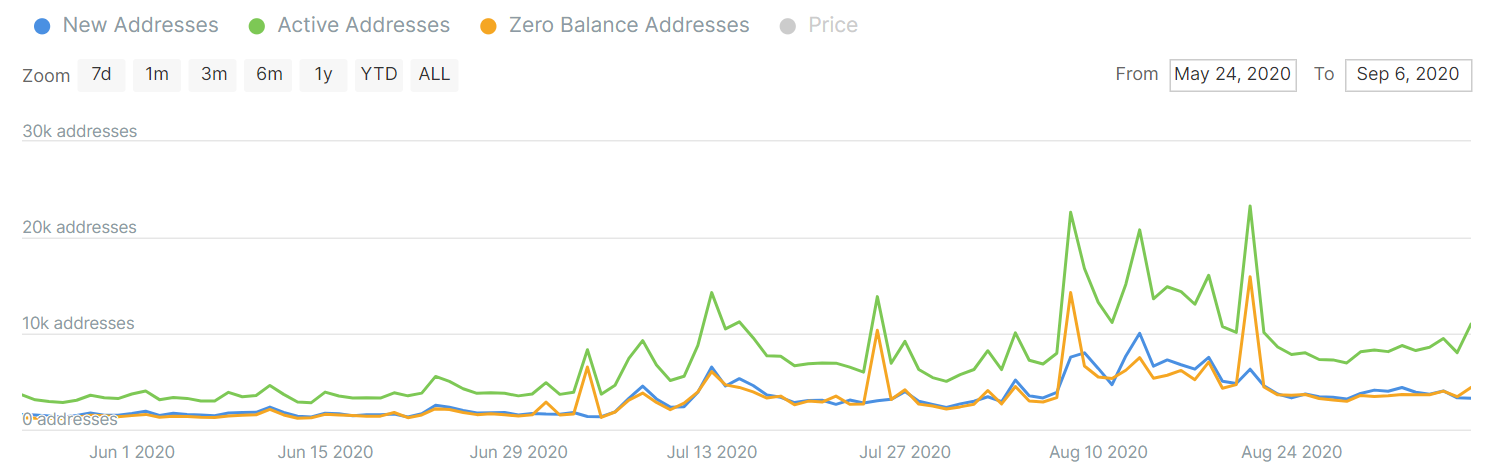

Intotheblock’s data revealed that without noting a negative impact from the price drop, active addresses in LINK’s ecosystem registered an incline over the past week, a finding that points to the presence of credible trading volume.

New addresses haven’t seen much of a change, but the increase in active addresses is a real positive. Bear in mind, however, that it is still not as high as it was during LINK’s peak, but in the current bearish market, it is doing fairly well.

There is no doubt such metrics will further improve LINK’s credibility in the market. LINK may undergo further corrections as well, especially in light of the fact that this was the token’s first collapse since March 2020. Alas, from the way of things, it seems like it will not crumble like previous altcoin projects.

The post appeared first on AMBCrypto