Bitcoin and cryptocurrency exchange Kraken says that the drop in BTC’s volatility is not the end of the story. Historical observations suggest that after losing gains and remaining lifeless on the trading front, Bitcoin will galvanize into action soon, to end the year on an explosive note.

Despite September Crash, Kraken Bitcoin Volatility Report Has Optimism Written All Over It

A few hours ago, cryptocurrency exchange heavyweight released its August 2020 Bitcoin volatility report. As per the report’s data, the latest BTC price decline is nothing to be worried about as historically (over 9 years), September has been the worst-performing month for the top cryptocurrency.

🤔 Did you know?

September is #Bitcoin‘s worst performing month, with an average return of -7%.https://t.co/fAaXgFL2V7 pic.twitter.com/oLp6MXBKTE

— Kraken Exchange (@krakenfx) September 8, 2020

The report also noted that BTC’s ‘annualized volatility’ dropped to as low as 15 percent (around July end). According to Kraken, whenever this has happened and Bitcoin has slumped into the 15 – 30 percent annualized volatility range, it has always bounced back stronger.

On average, bitcoin’s volatility surge was marked by a peak at 140 percent, during which investors generated 196 percent returns over 94 days.

🤔 What is a ‘suppressed pocket’ and why is it good for #Bitcoin?

After falling into one, #BTC has historically averaged volatility of 140% and gains of +196%. https://t.co/fAaXgFL2V7 pic.twitter.com/1WJidPSgx7

— Kraken Exchange (@krakenfx) September 8, 2020

BTC Will Experience ‘Incremental Volatility’ In The Days Ahead

Kraken’s August 2020 Bitcoin Volatility report also talks about the factors that may pave the way for BTC’s new bull market cycle.

Although Bitcoin saw a stratospheric surge in volatility in March when it touched the 178 percent mark, BTC’s volatility meter has ‘yet to approach the 315-day moving average of 78 percent’. And only 38 days have passed since volatility rose from the dip at 23 percent.

Considering the historical 94-day trend, Bitcoin has almost two months to register fresh gains for investors and surpass the 315-day volatility moving average. A look at the last nine years of data confirms the occurrence of a rally into the year-end and ‘incremental volatility’.

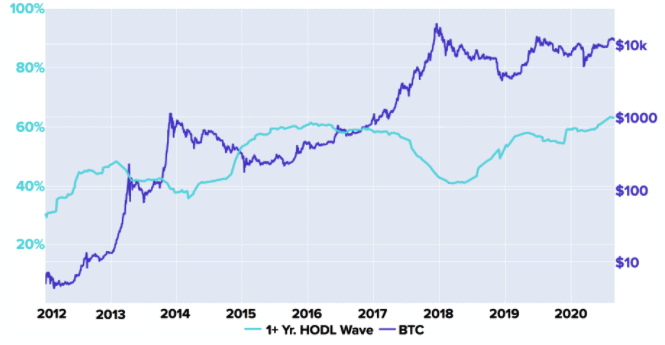

Also, keeping an eye on Bitcoin’s 1 year + HODL Wave’ pattern can help derive insights to predict the direction of the market. Going by the already available statistics, BTC is in for an ‘incremental volatility’ ride and a price movement to the upside.

Bitcoin Has Lost Market Dominance But Will Gain It Back Again

In the report, Kraken pointed out the loss of Bitcoin’s market dominance to altcoins, owing to the rise in the DeFi craze.

Since the start of 2020, altcoins have been stealing market share from bitcoin. Following the emergence of DeFi in 2Q, bitcoin’s dominance has fallen further.

The cryptocurrency exchange feels that BTC could continue to lose market share to gaining altcoins. But when traders are done milking them for profits, selloffs will lead to capital entering the Bitcoin market leading to a rise BTC’s dominance.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato