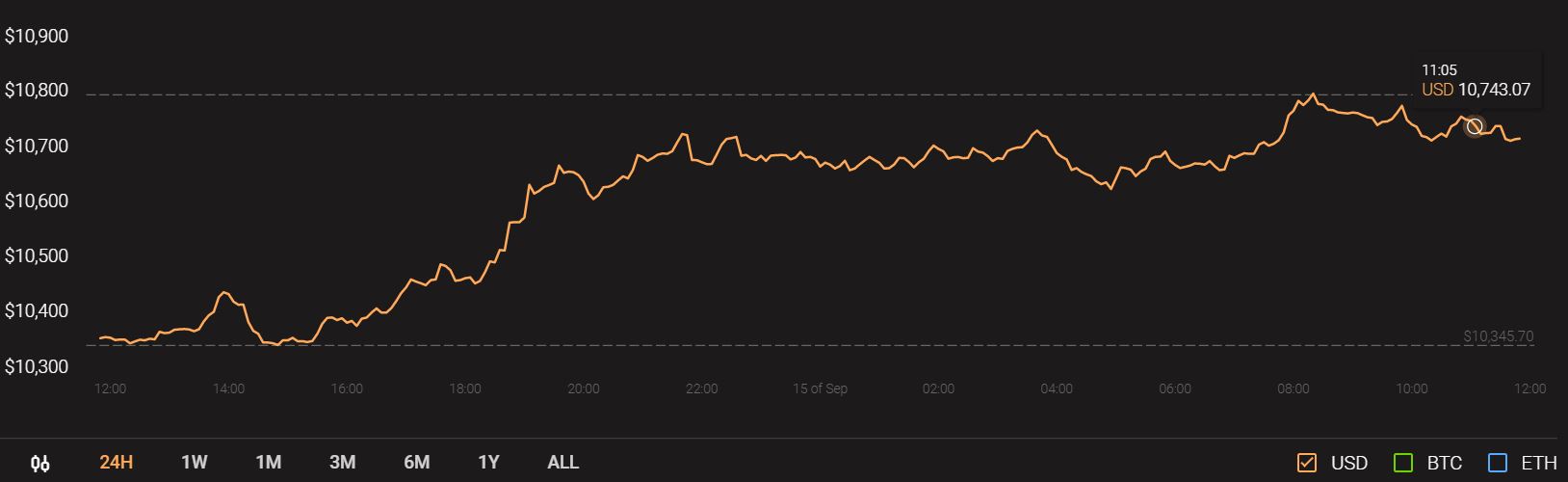

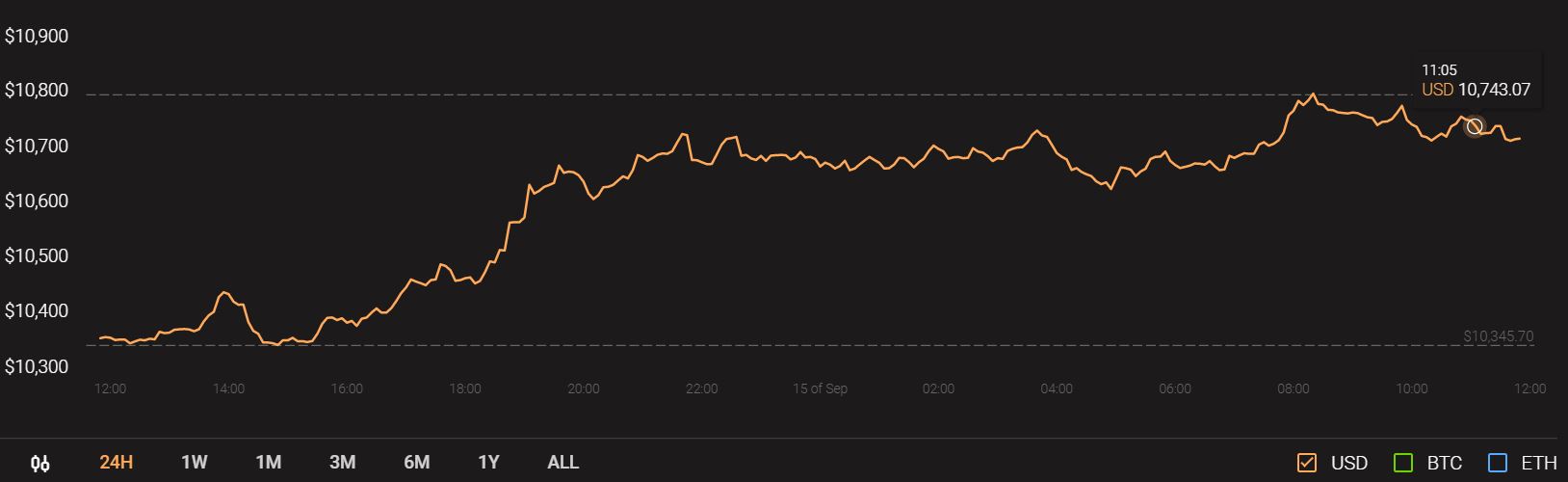

Bitcoin briefly slumped to $10,200 in the past couple of days as traders feared another sell-off but recovered swiftly to breach the $10,500 level and was trading at $10,737 at press time.

Source: CoinStats

However, evidence of BTC inflow to exchanges could forecast another wave of selling pressure for Bitcoin. Bitcoin Cash and Monero showed strength in the markets as they moved upward with momentum. Dogecoin continued to languish in a downtrend.

Bitcoin Cash [BCH]

Source: BCH/USD on TradingView

Bollinger bands constricted around BCH’s price for a week, before BCH broke out upwards on a move with good trading volume.

The mouth of the bands widened to show higher volatility as the price surged toward resistance at $244.

It is possible that BCH will breach the $244 level and flip it to support. Such a flip would indicate the beginning of an uptrend after a period of consolidation.

Monero [XMR]

Source: XMR/USD on TradingView

Monero bounced off the support level at $75.6 region to begin moving in an ascending channel. XMR also moved past resistance at $88. It is possible that XMR retests this region before another leg upward.

Chaikin Money Flow showed healthy capital inflows into the market. OBV was also making higher lows. Both indicators agreed that the upward movement of XMR is backed by buyers.

Next level of resistance for the asset lies in the $97 zone.

It was recently reported that the IRS has offered a bounty of $625k for anyone who can crack Monero’s privacy might have given the asset a publicity boost and affected the price positively.

Dogecoin [DOGE]

Source: DOGE/USDT on TradingView

At press time, Dogecoin had not closed a trading session above the yellow trendline that captures DOGE’s downtrend. Such a close to the 4h chart is the first step for DOGE to reverse its bearish momentum.

20 SMA (white) and 50 SMA (yellow) were closely intertwined, suggesting a lack of movement in the asset’s price over the past few days.

Parabolic SAR gave a buy signal. But if the price loses the moving averages as support, it is likely DOGE sets new local lows.

Next level of support for DOGE is at the $0.026 region.

Dogecoin held the 46th rank on CoinMarketCap, with a capitalization of $353 million.

The post appeared first on AMBCrypto