Within an hour of Uniswap launching its long-awaited UNI token and yield farming incentives, Ethereum started to grind slower under the pressure, and gas fees have surged as the transaction queue lengthens.

Uniswap ETH Pools Launched

The big draw for DeFi farmers is the four ETH based liquidity pools the Uniswap has just launched to earn its new UNI token – ETH/USDT, ETH/USDC, ETH/DAI, and ETH/WBTC.

The announcement stated that 60% of the UNI genesis supply would be allocated to Uniswap community members, with 15% of these being airdropped to those that provided liquidity or held its SOCKS tokens before a September 1 snapshot.

We’re thrilled to announce that UNI, the Uniswap Protocol governance token, is live now on Ethereum mainet!

Read more:https://t.co/RD3mwEUyHn

Ethereum Address: 0x1f9840a85d5af5bf1d1762f925bdaddc4201f984

— Uniswap Protocol

(@UniswapProtocol) September 17, 2020

The governance model and long term token distribution is all broken down in the official announcement, which added that there would be a perpetual inflation rate of 2% per year, commencing after the first four years;

“This ensures continued participation and contribution to Uniswap at the expense of passive UNI holders.”

Five million UNI tokens, or 83,333 per pool per day, will be allocated per pool to liquidity providers proportional to how much liquidity is in each pool. So now, just like SushiSwap, Uniswap users can earn both a portion of the trading fees and a share of the native tokens.

Within a couple of hours, the top crypto exchanges such as Binance and OKEx listed UNI with some following up with instant derivatives options for the hottest token in DeFi.

It’s a Gas Gas Gas

The initial reaction from the crypto community was that this would be extremely bullish for ETH, and prices have been moving over the past couple of hours. ETH has currently topped $380 and is up 6% on the day.

Well played by @UniswapProtocol – this looks like a very well thought out governance and distribution model.

This is going to be crazy for the ETH market!

— Adam Cochran (@AdamScochran) September 17, 2020

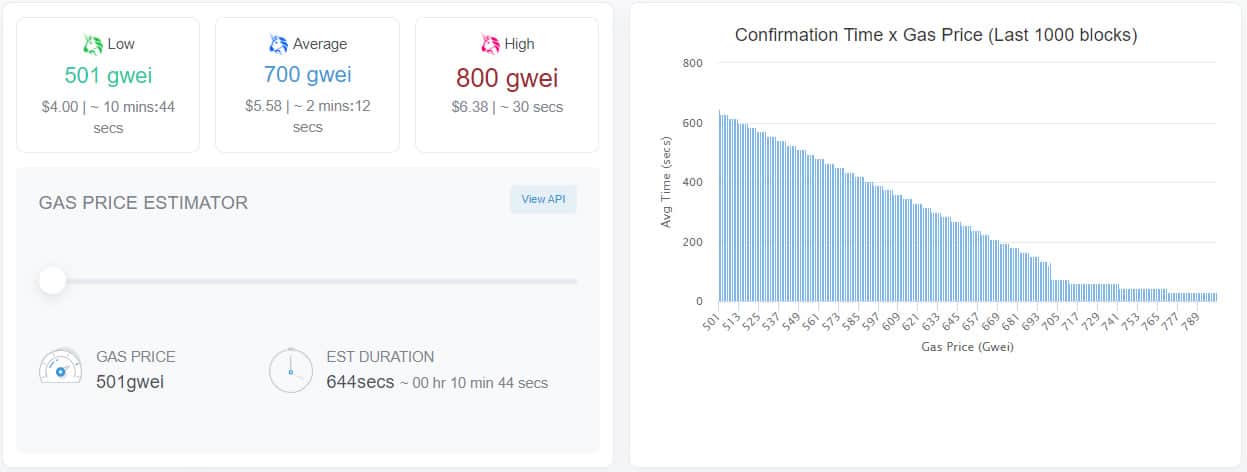

Prices are not the only thing climbing as gas fees have skyrocketed yet again. Before the Uniswap announcement, they had dropped to an average transaction cost below $4, but the resultant surge in activity on-chain has pushed prices as high as 800 gwei in extreme cases, which is almost double.

Regular users who wanted to make a transaction on the Ethereum network before the digital rush were still waiting over four hours later. Monero core developer Riccardo Spagni, aka @fluffypony, commented;

“It’s no wonder some ETH projects are discussing moving to Binance Smart Chain.”

ETH gas fees at ridiculous levels again. Just sending a simple ETH transaction costs $3.20 unless you want to wait for an hour, and you can forget about doing anything that involves a smart contract.

It’s no wonder some ETH projects are discussing moving to Binance Smart Chain. pic.twitter.com/LLyXv4iBPo

— Riccardo Spagni (@fluffypony) September 17, 2020

Hardcore Ethereans will still maintain that demand is a good thing, but that is of little comfort to those trying to use the network as of now.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato