2020 saw Ethereum [ETH] briefly take over Bitcoin’s lead in the market. However, this growth was the result of the boom witnessed by the decentralized finance [DeFi] ecosystem.

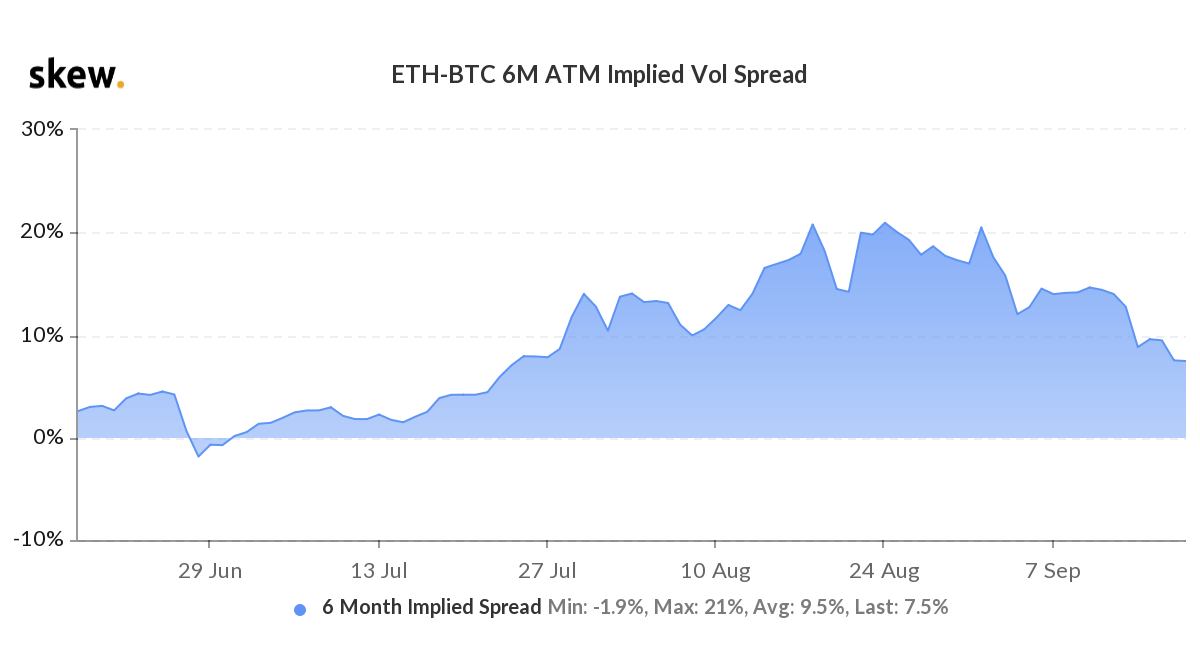

According to data provided by Skew, the price volatility of Ethereum and Bitcoin are converging. The converging spread of the Ether-Bitcoin 6-month at-the-money [ATM] Implied Volatility had dropped to 7.5%, since the peak observed at 21% on 1 September.

Source: Skew

This was the sign of a retracing Ethereum, as Bitcoin once again took the lead. This was also mainly because of DeFi that had built enormous pressure on the Ethereum blockchain, especially with Uniswap launching its governance token UNI. The launch resulted in the transactions on the blockchain to spike and drove the fees higher than ever. Glassnode’s data suggested that this growing number of transactions and high gas cost resulted in the users spending $1 million within a single hour on 17 September.

Whereas, the Bitcoin market was seeing the value of the digital asset once again get closer to $11k and interest among institutions and retail platforms remain high.

Ethereum Options expiring

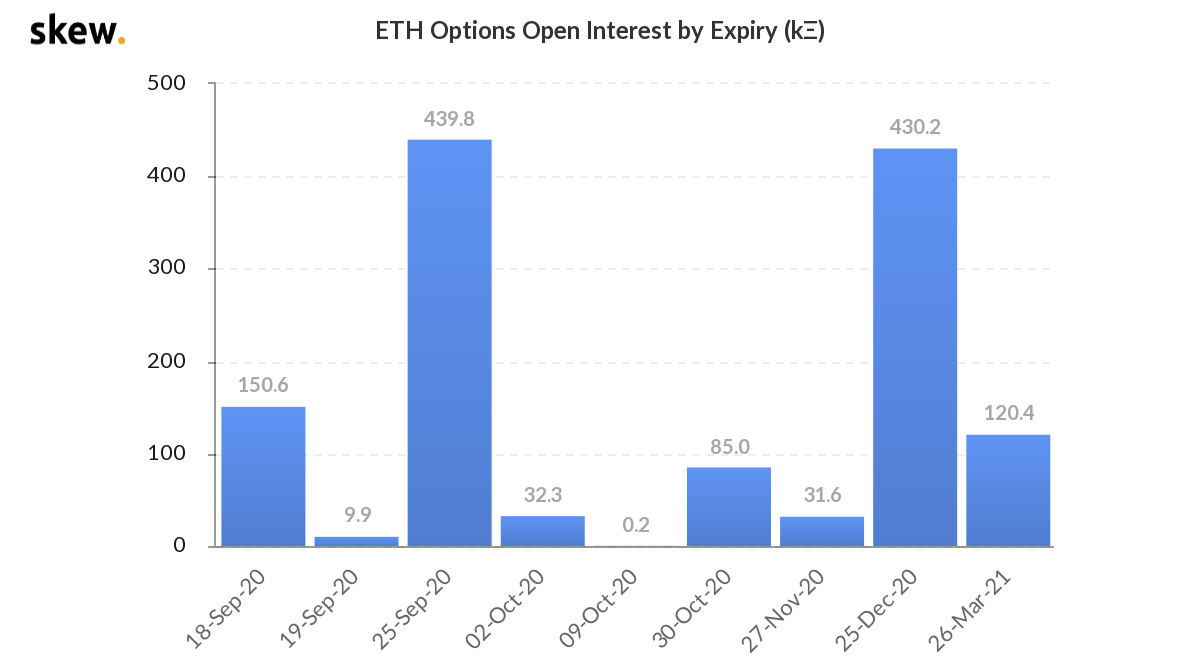

While the spot market has become dependent on DeFi, the options market suggested huge expiry coming its way. ETH Options Open Interest by Expiry was reporting close to 600k ETH options contract were to expire between today and the end of the month.

Source: Skew

This expiration was a conflicting sign as other metrics were highlighting bearishness in the market.

To put things in perspective, the Put/Call ratio was suggesting that the puts were taking a lead over Calls, as the ratio had reached 0.86. The bearish sentiment was mounting and with 150.6k ETH options contract expiring today, the sentiment in the market will become clearer.

The post appeared first on AMBCrypto