So, Bitcoin crashed again; this time, it dropped from $11,000 to $10,280. This only confirms that bitcoin is range-bound again, between $11,000 and $10,000 with a tolerance of $500 on either side.

Like any other crash, this article will identify the reason for the crash and what to expect hereon.

Markets move in unison

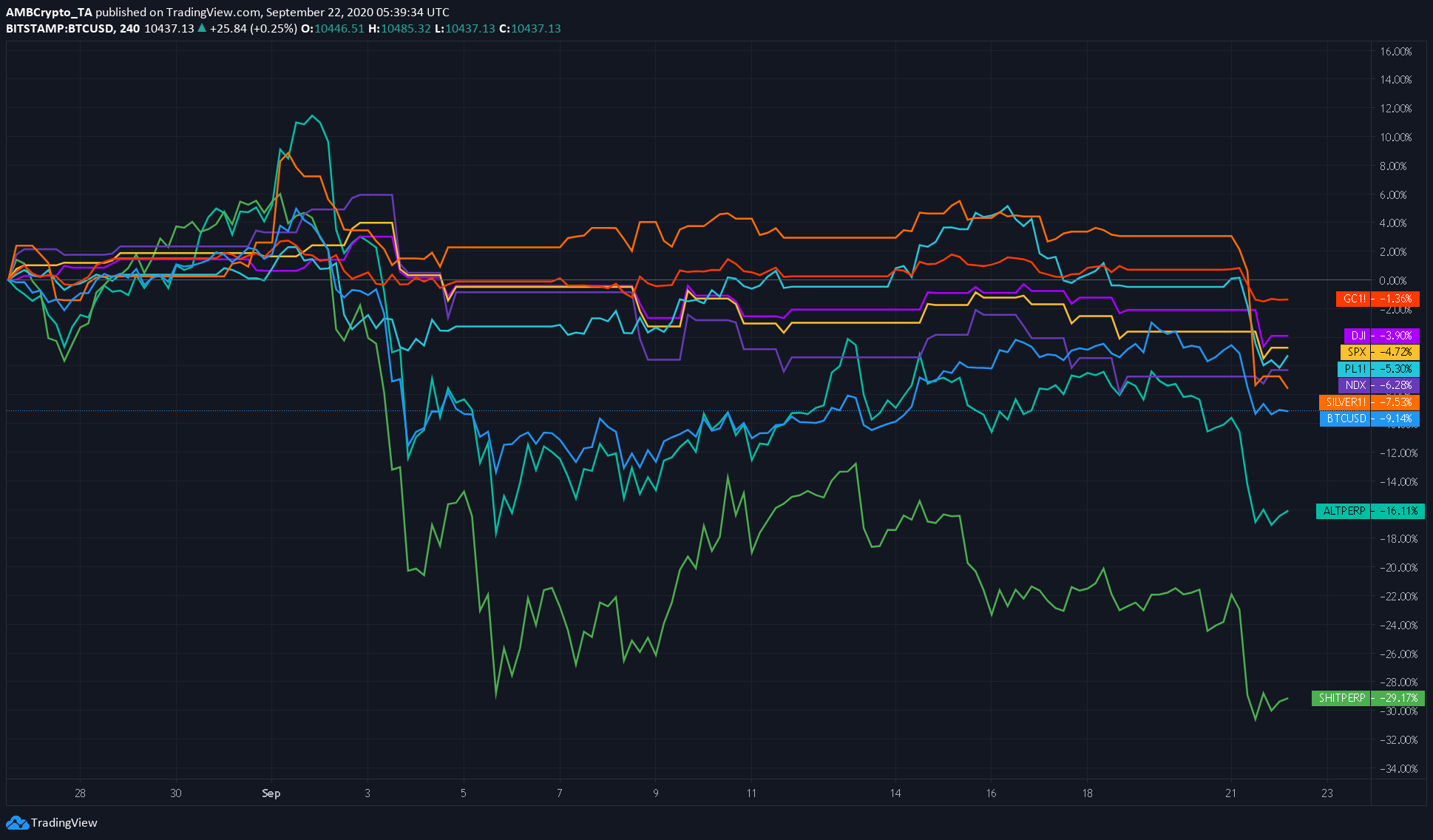

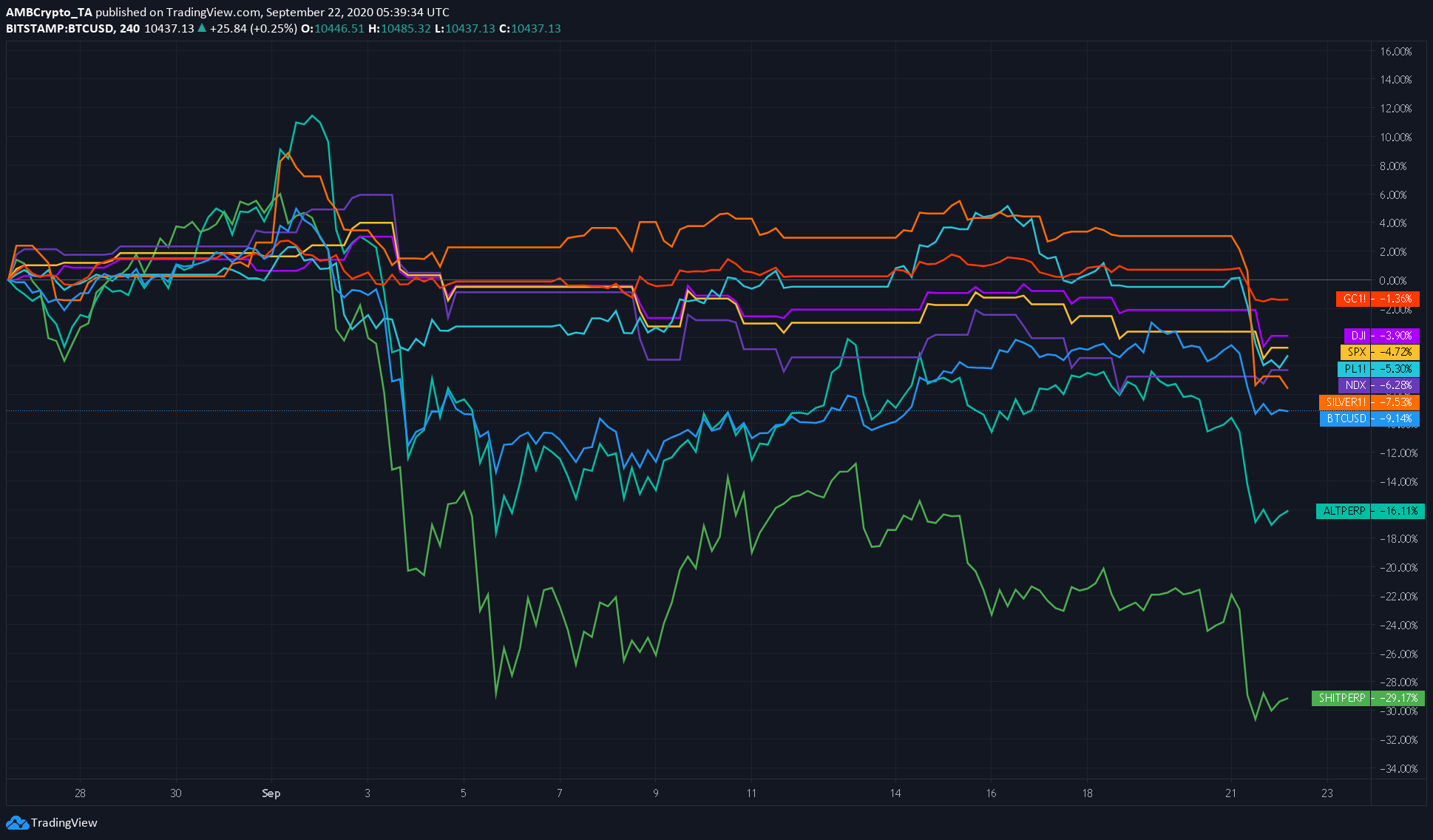

The first thing to understand about this crash is that it wasn’t localized; ie., the crash was not just for Bitcoin or the broader crypto market, but it was witnessed in the stock markets, metals like gold, silver, etc.

Source: TradingView

It is uncanny how the crypto market is in sync with the broader, traditional market. This correlation is not just a surprise but has been apparent for more than a month.

Although the fiscal stimulus package to ease the woes caused by the COVID seemed to have worked, the house of cards that was built on top of this is facing troubling winds. A good measure of the metaphorical winds is CBOE’s VIX, which is comfortably above the 20-mark and hit a high of 31.

The higher the VIX goes, the more volatility and uncertain the market is. This metric usually surges during unstable market conditions like the recession of 2008 or before the intervention of feds during the COVID pandemic.

So, here are a few reasons why this crash might be happening

- The fear of another wave of COVID in the U.K. and talks of a lockdown. Another lockdown will definitely hurt the U.K. economy and this definitely has investors rattled.

- Negotiations of a new COVID stimulus bill in the U.S. and its effect on the elections.

What to expect?

As for the Bitcoin price – it currently stands at $10,460, trying to reclaim the resistance at $10,500. However, in the daily time frame, the bearish crossover has just reared its head, and hence, we can expect a few more downtrends. Perhaps a tussle with the $10,500 level before sweeping for the lower $10,000 levels.

With the VIX above 20, we can expect choppy price action in the stock markets. Due to its correlation, we can expect the same for bitcoin. Hence, deleveraging could be the best idea here.

Last but not the least, never trust the weekend pump/dump, as Bitcoin tends to retrace its steps as the new week begins.

The post appeared first on AMBCrypto