Binance Futures was launched a year back and today, as per CoinGecko’s ranking of top derivative exchanges, it stands third. The exchange has been popular among users due to its active listing of in-demand products like Chainlink [LINK] quarterly 1225 coin-margined contracts with leverage of 75x. At the time, LINK wasn’t being significantly affected by the falling market, with LINK’s charts showing a degree of recovery instead.

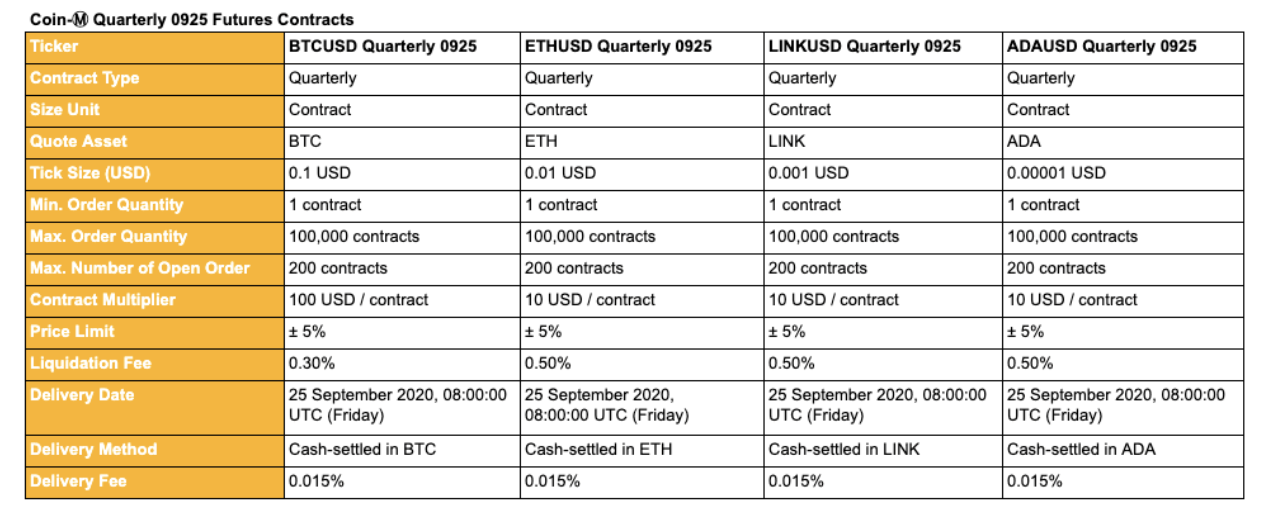

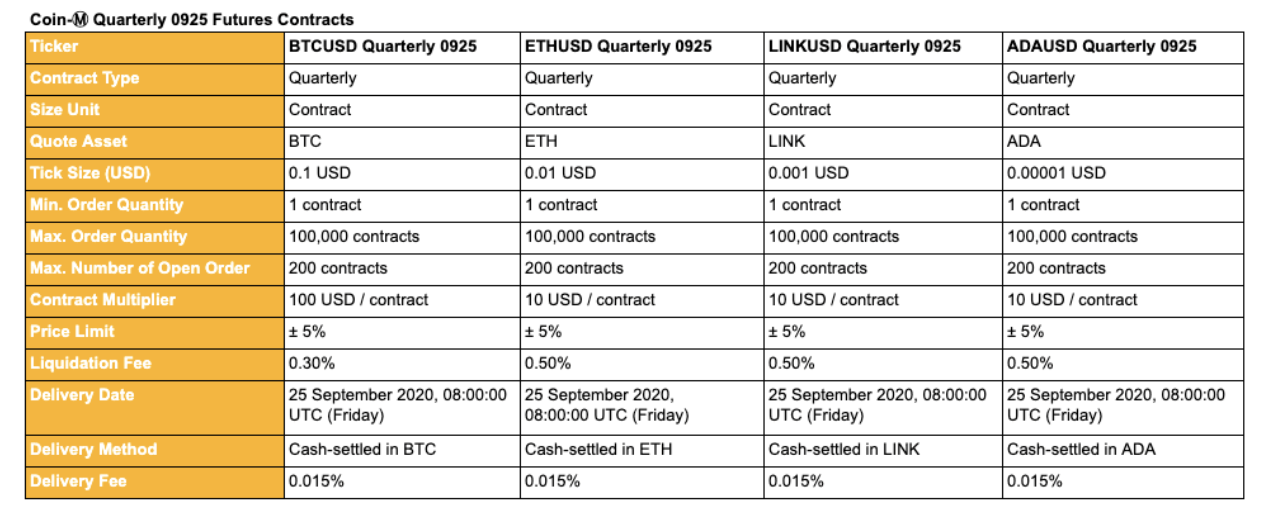

Binance Futures launched Coin-Margined Futures only in Q2, offerings that allowed settlement in cryptocurrencies, instead of cash. The cryptocurrencies that made it to the coin-margined quarterly 0925 contracts were Bitcoin [BTC], Ethereum [ETH], Cardano [ADA], and Chainlink [LINK]. Now, these quarterly contracts are expiring on 25 September.

Source: Binance

With the impending expiry and settlement looming closer, Binance Futures have announced that it will list BTC, ETH, ADA, and LINK coin-margined quarterly 0326 Futures contracts on the same day at 08:00 AM [UTC].

The coin-margined quarterly 0925 Futures contracts included the aforementioned coins, with no other major crypto-asset listed. However, coin-margined perpetual Futures contract included Binance’s native coin Binance coin [BNB], along with Polkadot [DOT], both cryptos that also attracted great interest from users.

Binance’s keen eye

Binance has been making use of the market momentum associated with a project by listing their tokens and beating the competition. The most recent instance was when it listed Uniswap’s UNI token within 90 minutes of its launch, followed by the launch of UNI USDT-Margined perpetual contract with up to 50x leverage. The users were able to benefit from the rallying market, especially when the remaining market was undergoing consolidation.

Such a pro-active listing of coins has pushed Binance Futures YTD trading volume to $1 trillion. The exchange witnessed a month-on-month increase of 74% in August, which was equivalent to $184.6 billion, in volume. It was also the highest holder of daily Bitcoin Futures trading volume. However, interestingly, according to the VP of Binance Futures, Aaron Gong, altcoins accounted for about 40% of the exchange’s volume.

With Binance Futures slowly taking over like the Binance exchange in terms of trading volume, other derivatives exchanges may want to pick-up their game.

The post appeared first on AMBCrypto