Over the past ten years, crypto-exchanges have emerged to become extremely crucial, not just with regard to adoption levels, but also when it comes to directing the overall growth of the industry. The previous year saw a lot of interest in greater levels of decentralization, an interest that contributed to the DeFi boom and renewed interest in Decentralized Exchanges [DEXes].

In fact, recently it was announced that cryptocurrency exchange Gemini was enabling the trading for seven new DeFi tokens – Balancer (BAL), Curve (CRV), Ren Network (REN), Synthetix Network (SNX), Uma (UMA), Uniswap (UNI), and Yearn.finance (YFI).

While decentralization is one of the key factors that differentiates a majority of the digital asset market from traditional finance, it also demands greater care, especially when one considers aspects like private key storage, etc.

In a recent interaction with Charlie Shrem, Changpeng Zhao [CZ], Founder of Binance, highlighted some issues pertaining to the need to bridge the gap between decentralized and centralized exchanges and noted that this can be done in quite a few different ways. He said,

“Some people like to make one giant leap forward and think you’ve got to become fully decentralized and you’ve got to hold your own keys. But if we want mass adoption, 99.9% of the people today do not know how to hold their private keys properly securely.”

While the notion of a centralized exchange is somewhat contradictory to many of the advantages cryptocurrencies painstakingly offer, greater adoption is beneficial to the industry and its individual stakeholders. The last ten years are testament to that, and as adoption grew, regulations got better, fueling a feedback loop of sorts.

CZ also highlighted the intrinsic contradiction of using a centralized exchange, pointing out that there is a gradient scale when it comes to levels of decentralization on offer. He said,

“We have centralized servers, but our centralized servers services a decentralized economy, right? So we list DeFi, we’ll list out other blockchain tokens, etc. So I think there’s a gradient scale of an increment and I foresee the incremental steps to get to the ultimate goal of a higher degree of freedom of money.”

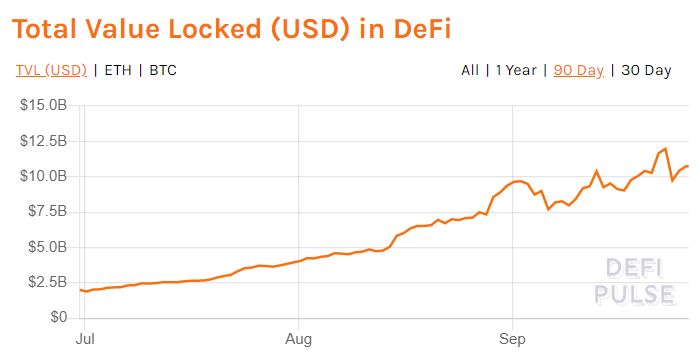

Source: DeFi Pulse

While 2020 seems to have not followed any pre-defined script, DeFi as an industry has seen unprecedented growth. The space hit the $1 billion mark in terms of TVL in February and was greeted with a lot of fanfare. However, since then, the TVL has grown 10 times and was valued at over $10.73 billion, at press time, growth that was reminiscent of the ICO bubble of 2017, according to many commentators.

However, when it comes to the actual use-case value for total decentralization, despite the growing demand, a majority of users are still not fully ready to share such responsibility. With crypto no longer being a niche industry, especially since it is now welcoming investors and users who are familiar to traditional markets, centralized exchange offerings seem to have a less steep learning curve. CZ concluded,

“For most of the population, they will most likely be more comfortable using a combination of centralized and decentralized services.”

The post appeared first on AMBCrypto