On the question of asset allocation, fund managers are spending more time looking for avenues to park funds, rather than assets for investing in. DeFi has proven to be a rather attractive avenue for parking funds. Investors look for capital efficiency as that is the driving force behind management fee cuts in traditional finance and its incentives have motivated traders to park funds here.

Why DeFi? Well, DeFi’s projects are offering much higher interest rates, when compared to traditional finance, and according to Ethereum’s Vitalik Buterin, this comes with unstated risks attached to it.

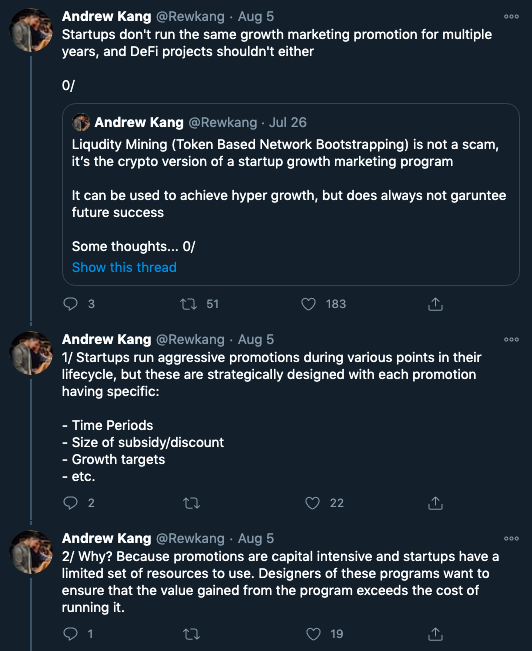

Most DeFi projects have spent their budget on incentivizing users and advertising their project and this has far exceeded their funds raised. As developers look to maximize their return on investments, DeFi projects are offering incentives ahead of value. In fact, influencer and crypto-investor Andrew Kang recently tweeted about DeFi Projects’ spend on incentives and said,

Source: Twitter

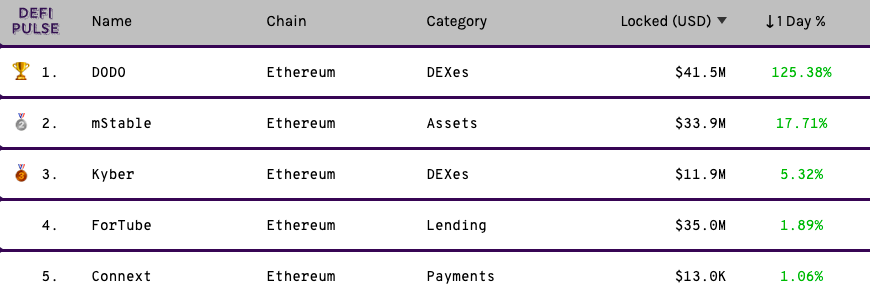

While incentives and promotions continue to be capital-intensive, DeFi’s TVL is climbing steadily. However, the aggressive incentive war may not be reason enough to dethrone the top 5 projects with the highest returns in the market.

Source: DeFiPulse

Liquidity mining offered by DeFi projects effectively links value islands in a decentralized dimension and accelerates the frequency of value exchange, promoting price discovery. However, with ‘incentive wars,’ DeFi projects may have taken this a step too far. There is a possibility that there is no reasonable allocation of investors’ resources.

Aggressive liquidity mining programs started by some DeFi projects are battling each other for limited liquidity by offering yields that are higher than the other’s. It’s no surprise that DEXs realize that assets under management are over 3x more valuable in less than a year. In fact, they may cross 10x or more in a year. The first chapter of liquidity wars is already here, and however speculative they may be, new projects are getting launched every week and there are more opportunities than ever before for traders.

Kang’s tweets suggest that this may be responsible for DeFi’s bubble bursting. However, spending on ads/incentives may not be the only reason for the bubble bursting. Episodes like SushiSwap, ICO-like price action, and unsustainable ROI growth may also be largely responsible for the same.

The post appeared first on AMBCrypto