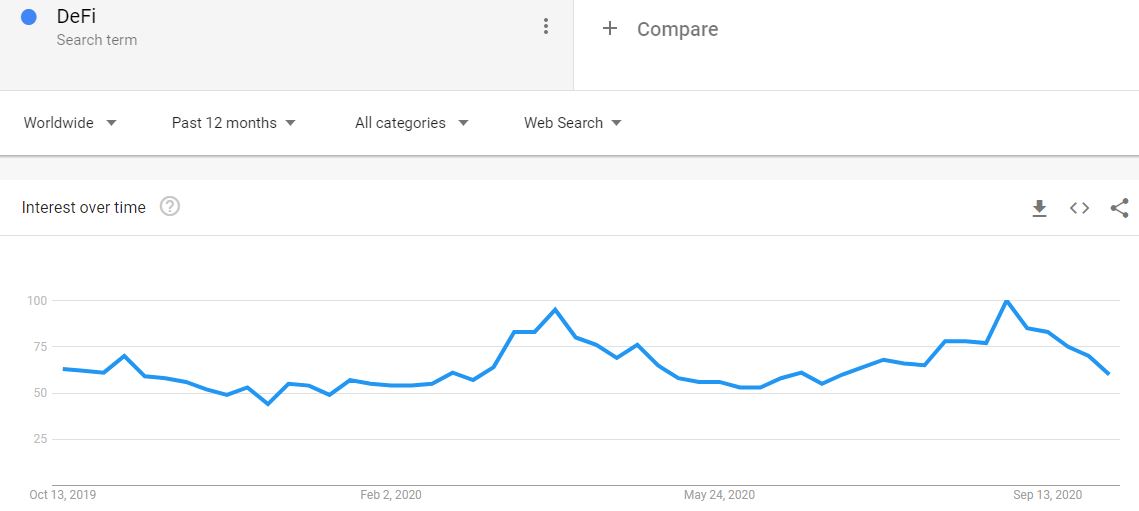

Google trends data suggests that the worldwide interest in DeFi has been continuously declining since early September. Although the TVL remains high, the question arises if the decreasing interest has something to do with the growing number of screw-ups in the field.

DeFi Interest Drops?

The start of the new century brought a new trend in the cryptocurrency industry – decentralized finance. Although it’s not a 2020 invention, DeFi exploded in popularity approximately when the COVID-19 pandemic infiltrated the Western World – in March.

Data from Google trends confirms that the “DeFi” searches worldwide experienced a sharp increase in late March and early April. In the following few months, the searches declined to some extent before exploding back to new highs in August and September. The interest growth coincided with the rising total value locked in different DeFi-based protocols.

However, the situation has reversed since then. During the first few weeks following the peak, the “DeFi” searches have been sharply declining, as the graph above demonstrates.

Nevertheless, the decreasing interest on Google for DeFi hasn’t really impacted the TVL. According to DeFiPulse, there’s no evident decrease as investors have locked nearly $11 billion – close to the all-time high of just above $11 billion.

Is It The industry Screw-ups?

Being a relatively new concept that lacks experience, the DeFi field is prone to make mistakes. However, some issues have been rather painful for investors, resulting in lots of funds being stolen or lost.

Popular cryptocurrency commentator going by the Twitter handle Dark Pill recently highlighted some of the issues that transpired in a matter of months.

As CryptoPotato reported before, one of SushiSwap’s lead developers cashed out his SUSHI tokens for Ethereum. This opened a wave of disagreement against him, led to massive changes within the project before he ultimately admitted his mistake and apologized to the community.

Andre Cronje, the founder of another popular protocol, Yearn Finance, developed an NFT-focused platform called Eminence. However, a hacker exploited the network for the full $15 million and then sent $8 million back into his Yearn deployer account.

After receiving several death threats, Cronje said he will refund the $8 million. Shortly after, he seized posting on Twitter apart from a brief update.

One of the biggest DeFi hits this summer, namely Yam Finance, also went through a roller-coaster. After investors locked hundreds of millions of dollars in just hours, the developers admitted a mistake in the rebasing mechanism. Although the project has endured after several upgrades, lots of investors lost money from the initial mistake.

Other hacks on DeFi protocols that drained millions of dollars could raise further issues among potential investors. All of this unfavorable advertisement could be the reason behind the decreasing “DeFi” searches on Google trends.

The post appeared first on CryptoPotato