Bitcoin’s value has been appreciating over the past week and it currently stands at $11, 377. The value of the digital asset peaked a couple of days back at $11,731, but could not hold on to this level and slipped lower. However, BTC staying above the $11k mark has been a sign of relief for most traders as they continue to bet on the bullish future of the coin.

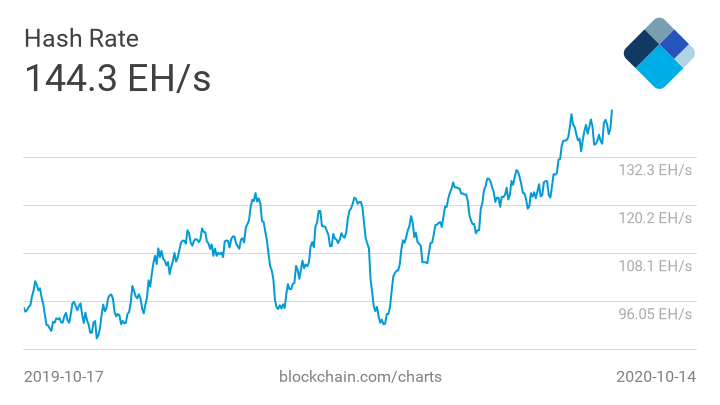

The positive sentiment has been on a rise as the value accelerates along with the flowing interest from private companies like Square. The institutional and retail interest has prevailed in the market and has been increasing as BTC’s sentiment that was in the fear area until recently, moved towards the Greed index. This growing confidence in the market was supported by the hash rate that hit an all-time high on 14 October surpassing 140 EH/s.

This was 36% higher than the hash rate at the beginning of the year, suggesting the bitcoin fundamentals are as strong as ever, with the network being the most secure.

Adding to the secure network was its growing transaction fees. Previously, when the price of Bitcoin began consolidating in June, the transaction fees had also dropped. However, as the digital asset sets on a bullish path, the transaction fees have also begun to climb.

Currently, the transaction fees account for nearly 9.5% of the miner revenue and have become a significant contributor to the miner revenue following the halving in May.

As per Arcane research, miner revenue has not been so heavily influenced by transaction fees since the 2017 bull run.

With hash rate rising and miners remaining profitable, the market has been made up of confident traders and even the old traders are waking up to this new market. As per reports, another 2010 block reward was spent on 14 October adding to the number of ‘Satoshi era’ bitcoins moved in 2020. It seems that the market is preparing for a rally, however, the length or the intensity of the same cannot be known.

The post appeared first on AMBCrypto