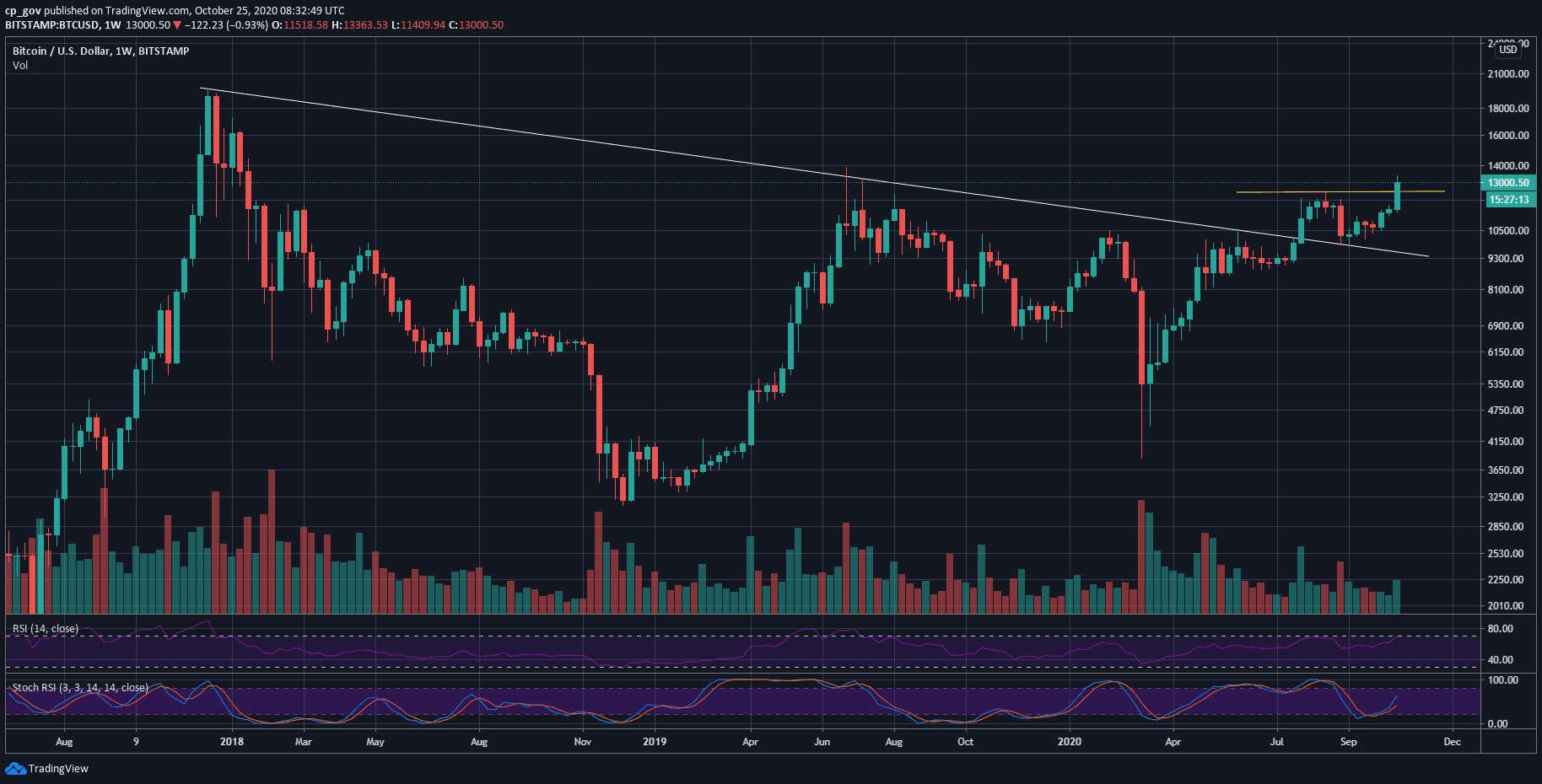

Starting by looking at the bigger picture, Bitcoin price had made a remarkable run since October began, gaining almost $3000 to its value.

Looking at the following long-term weekly chart, we can see this week’s greenish candle that will be closed later today. From a technical point of view, as long as the candle close price is above the $12,500 area (previous high) – we can safely say that BTC is on a healthy uptrend.

The Good and The Bad: New 2020 High but Bearish Divergence

Just a few hours ago, Bitcoin price recorded a new 2020 high close to $13,400 (on Binance Futures); however, the primary cryptocurrency could not hold there, and quickly slumped to $12,700 in a matter of one hour.

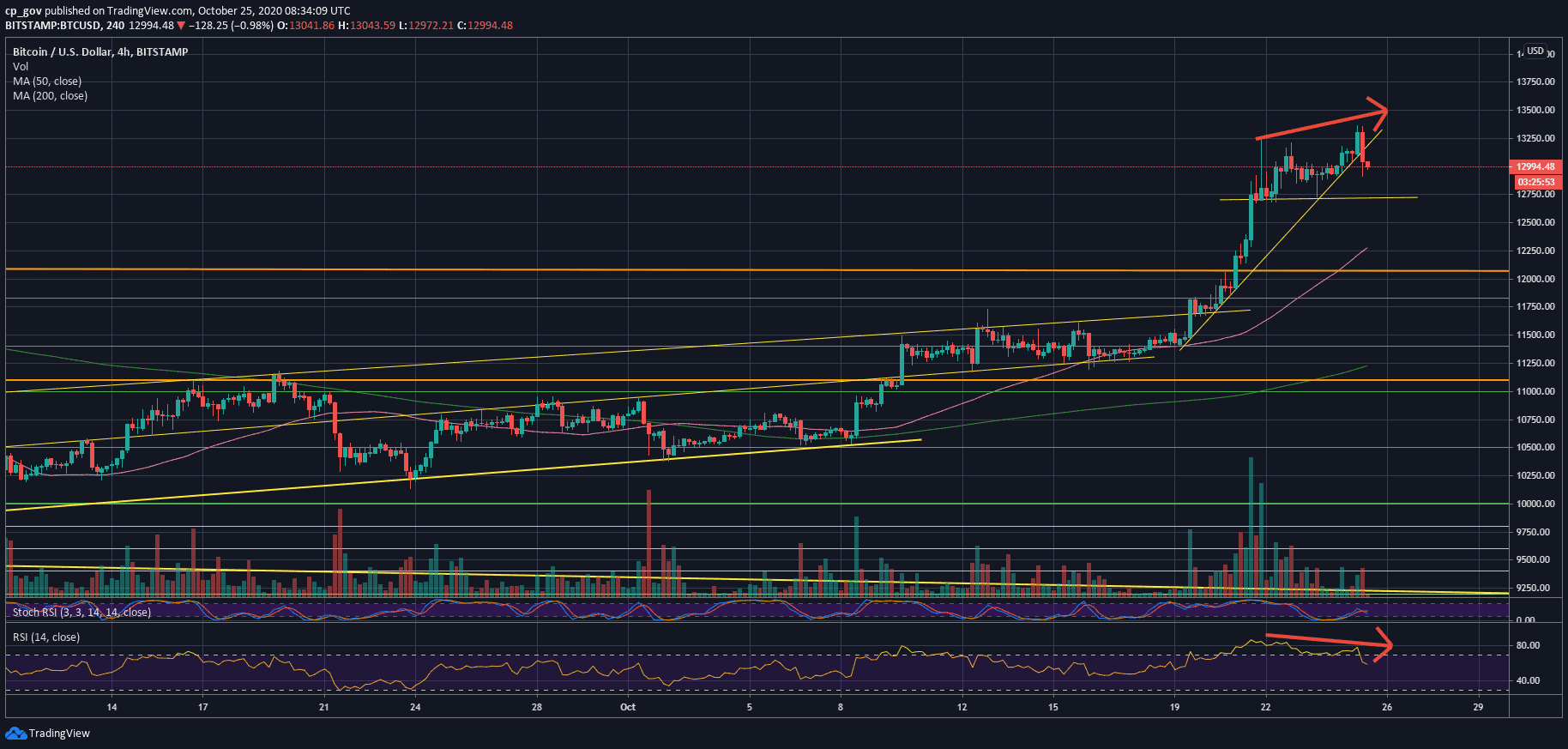

Looking at the shorter-term chart, the 4-hour, we can identify a bearish divergence on the RSI. This is a bearish pattern and might indicate that the buying power is fading away.

This happens when the price goes through a higher-high, but the RSI indicator is doing the opposite and going through a lower-high.

Another worrying sign is the trading volume. Since its peak volume on October 20-21, four days ago, the trading volume decreased even though the BTC price had actually gone up.

BTC Support and Resistance Levels To Watch

As mentioned above, if BTC were to correct, then the first major level of support lies at the current levels around $12.9 – $13K. If Bitcoin breaks here, then the first significant level lies at $12,700, followed by the previous 2020 high from August at $12,400 – $12,500.

From the bullish side, if Bitcoin holds the $13,000 – then the first levels of resistance lie at $13,200, followed by today’s high around $13,400. Bitcoin will be looking to break the 2019 high from June – at around $13,880.

Total Market Cap: $400 billion

Bitcoin Market Cap: $240 billion

BTC Dominance Index: 60%

*Data by CoinGecko

BTC/USD BitStamp 4-Hour Chart

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato