Recent data revealed that Ethereum miners have disposed of significant ETH holdings following the latest price jump towards $420. Additionally, the Twitter sentiment has turned rather bearish for the second-largest cryptocurrency after the consequent price drop.

ETH Miners Initiate Sell-Offs?

Ethereum miners, the lifeblood of the current proof-of-work consensus algorithm behind the Ethereum blockchain, have perhaps gained the most from the ongoing decentralized finance craze.

As CryptoPotato reported recently, they made a total of $166 million in fees in September alone. This was a new monthly all-time high and about six times more than Bitcoin miners.

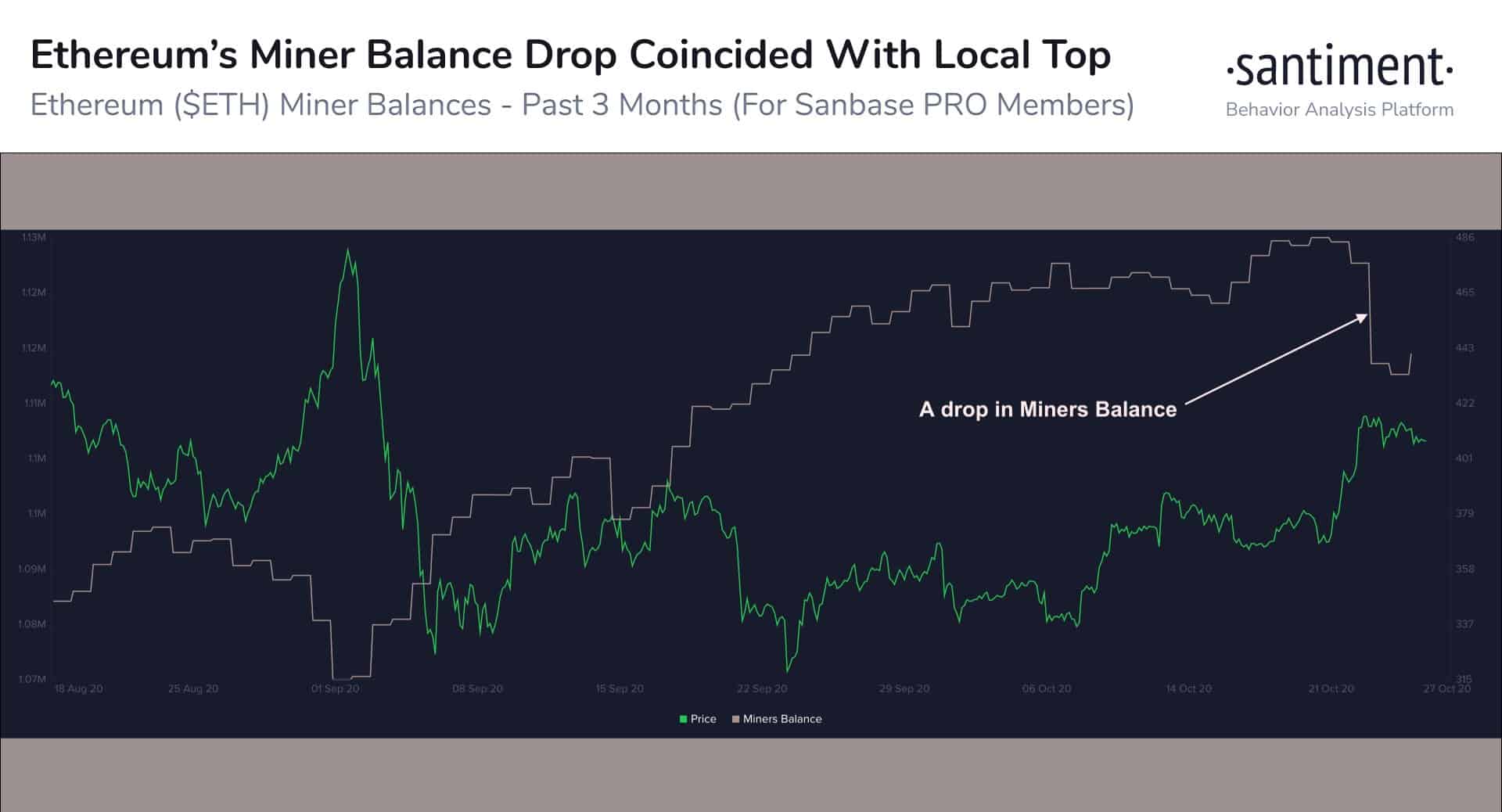

As far as their balances go, they began accumulating larger portions precisely at the start of September, as the graph above illustrates. Apart from a few brief drops in their holdings, the trend continued until a few days ago.

However, as ETH’s price surged to a 7-week high of $420, miners changed their minds. The data analytics company Santiment highlighted the massive drop of ETH miners’ holdings.

Interestingly, those sell-offs coincided with ETH’s price peak. Since then, the second-largest digital asset by market cap has lost some steam and currently trades below $400.

Further Losses To Come?

Despite being one of the best-performing assets since the start of the year, Santiment’s data suggested that Ethereum may be heading even further south. Apart from miners disposing of their ETH coins, the analytics company said that the traders FOMO and the increased on-chain activity visible recently have slowed down.

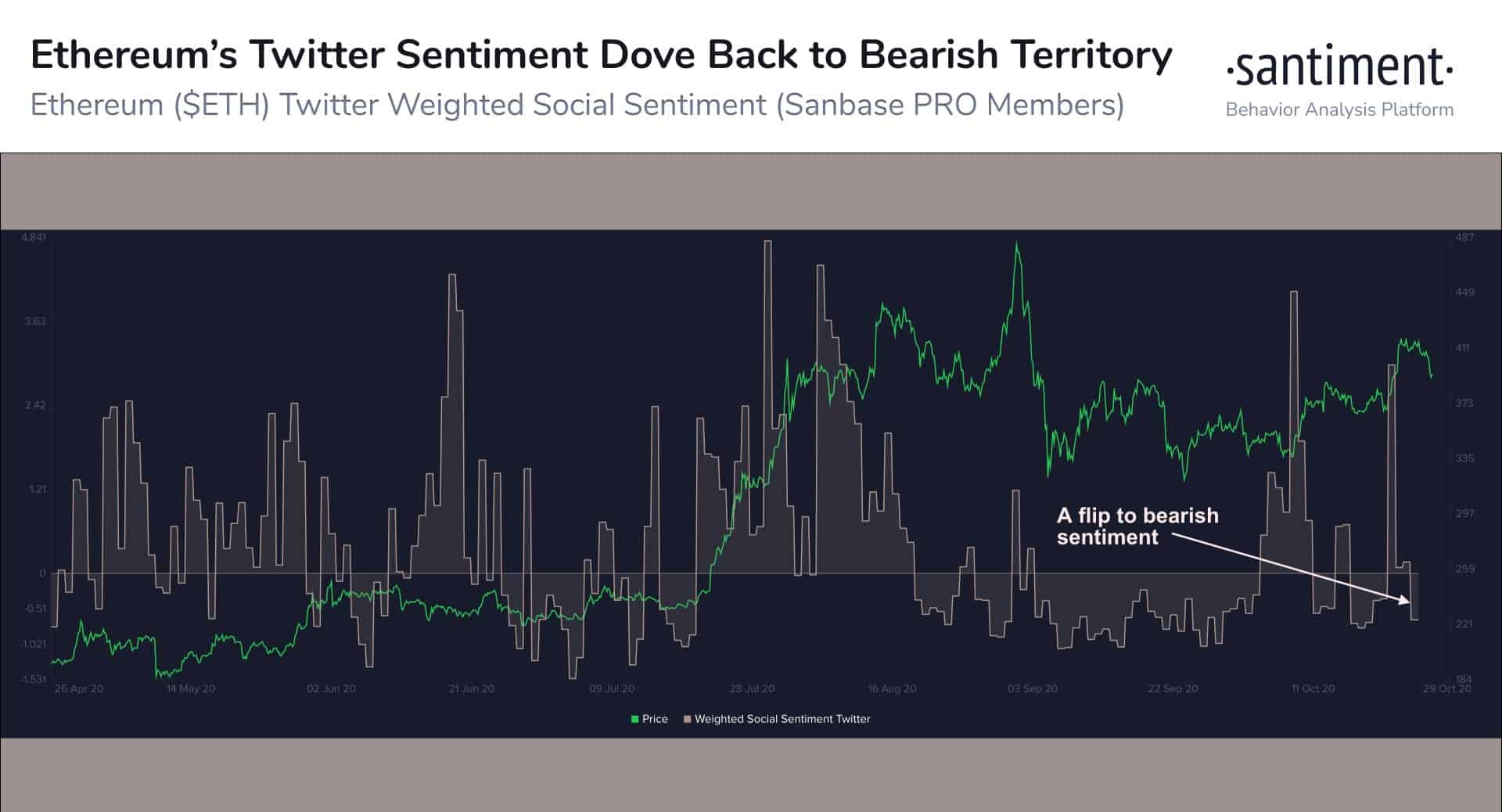

Additionally, the Twitter sentiment has turned against Ethereum. Somewhat expectedly, the sentiment performs in correspondence with the price most times. For example, when ETH dipped to about $300 in September, the metric remained in negative territory for weeks.

Contrary, when ETH started pumping, so did the sentiment. Now, the trend has reversed after a sharp spike. The analytics company concluded that since the crowd sentiment has flipped back into bearish territory, the ETH token could be in for further short-term price declines.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato