Occurring every four years, the US Presidential elections gain attention not only from US citizens but from the entire world. Being the largest country by nominal GDP and the US dollar serving as the global reserve currency, the consequences of elections’ results will be felt in the next (at least) four years everywhere.

That “everywhere” part definitely includes the traditional financial markets and, more specifically, the US stock markets. In fact, their performance could even hint who might end up as the 46th US president.

According to Strategas Research Partners’ Dan Clifton, every president who had averted a recession during the two years leading to the elections has remained in office. Only Calvin Coolidge managed to win the reelection despite the 1920s economy hurdles.

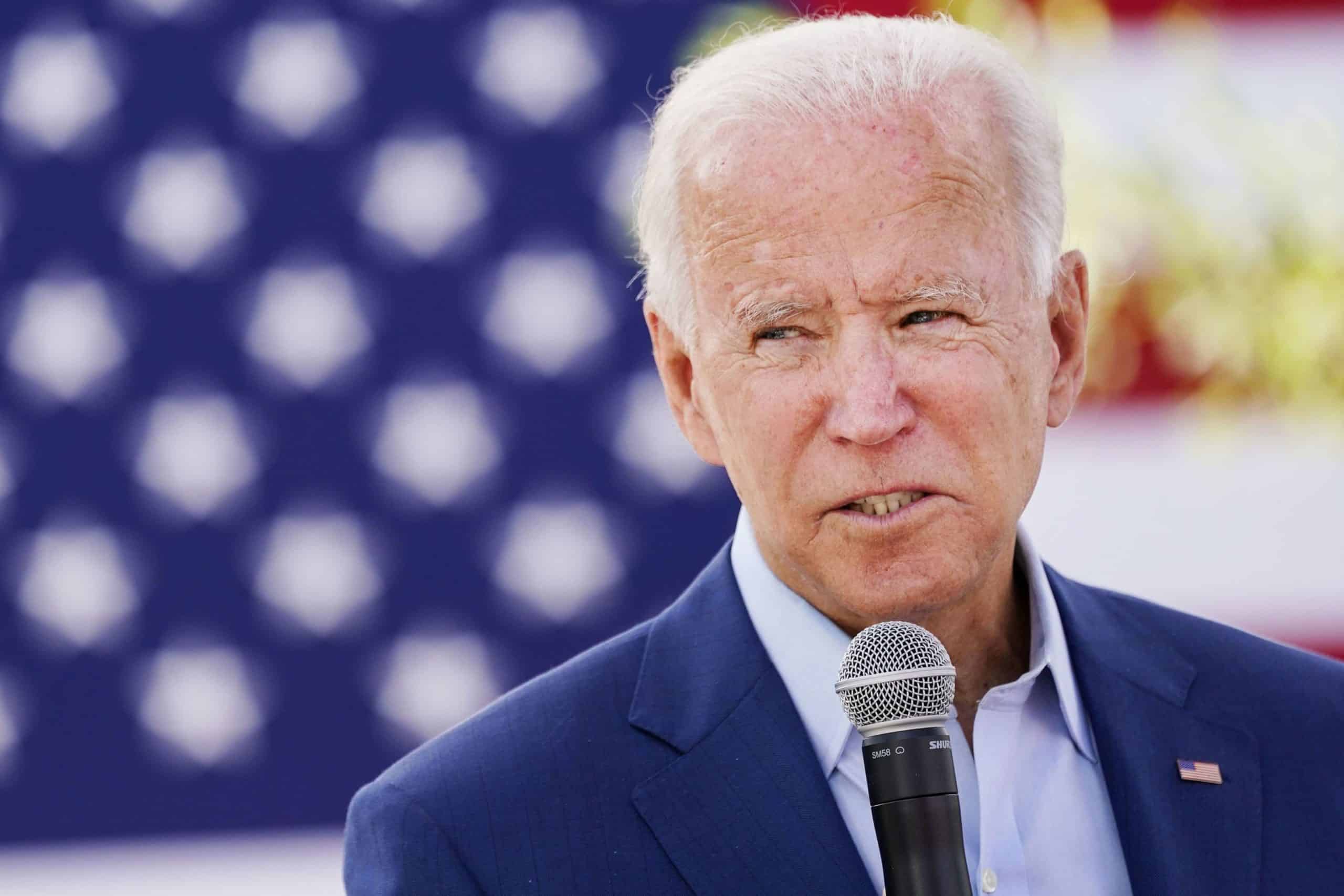

The New York Times claimed that the US economy officially entered a state of recession in February 2020. With that, the question remains if President Trump will join President Coolidge as an exception to the rule or will history repeat itself and Joe Biden will come to power.

Some More History

Speaking of history, Forbes recently noted that the stock markets have “performed better during a year when an incumbent president is elected compared to a new administration.” The data is conclusive – the elections have a direct impact on the stock markets.

With that in mind, the cryptocurrency community has raised the question of if or how the elections will impact a currency operating outside the traditional financial infrastructure – a currency existing in the digital world going by the name Bitcoin.

During its relatively short existence, Bitcoin has gone through two US elections – in 2012 and in 2016. Although they weren’t so long ago, most community members agree that the asset was too small to feel the consequences. However, that’s not the case in 2020.

So, what could happen if President Trump, who has openly criticized the whole cryptocurrency industry, remains in office? Or, what could transpire if the former Vice President Joe Biden takes charge?

The community’s opinions slide in either direction but not Max Keiser. The popular TV host believes that Bitcoin is not correlated to any political parties or outcomes because it’s backed by “insatiable hunger.” As such, he recently told CryptoPotato that Bitcoin wins either way, but with different styles.

Trump Wins: How Could That Possibly Be Good For BTC?

Trump’s presidency has been filled with somewhat controversial actions and statements, to say the least. Those range from planning to build a physical wall with Mexico to keep migrants away to threatening his 2020 opponent Joe Biden with physical assault.

However, his views on Bitcoin have been consistent and unfavorable. In July 2019, he said that he’s “not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air.”

An unpublished book written by Trump’s former national security advisor John Bolton claimed that the President urged Treasury Secretary Steve Mnuchin to “go after Bitcoin” a year prior to his assertions mentioned above.

With that being said, it’s hard to imagine that President Trump will suddenly have a change of heart and start supporting the first-ever (or any other) cryptocurrency. So, if he wins the elections, the effects on Bitcoin could be rather adverse, right?

Well, that’s not what Max Keiser believes. He told us that “with Trump, who at least understands something about capitalism, the ascent of Bitcoin would be slower as I believe he would calm markets by having the US enter the global hash war that Iran now leads in a Sputnik-like call to enter the Hash Race moment.”

Keiser added that the US needs to strive for a “big slice of Bitcoin’s global hash rate before our competitors do. I know of several countries that will soon announce major sovereign underwritings of BTC hash rate to try and oust Iran’s position.”

What Will Happen To Bitcoin if Biden Wins?

The democratic party’s presidential candidate was involved in the infamous Twitter hack earlier this year. Shortly after, he said that he doesn’t own any bitcoins but hasn’t made any decisive comments about the cryptocurrency. As such, it would be more difficult to argue whether or not his presidency would be ultimately good for Bitcoin.

Keiser’s views see BTC sharply explode in value in case Biden emerges the winner come Sunday.

“As I’ve said, a Biden win would accelerate Bitcoin’s advance as panic-buying from those looking to escape the socialists, money printers, and MMT’ers goes into hyperdrive.”

“It will be like the 1938’s Kristallnacht (also known as the Night of Broken Glass or the November Pogrom), jack-booted armed thugs will go door-to-door stealing property in the name of social justice.”

Max Keiser: Bitcoin Wins No Matter What

Bitcoin is bigger than the elections, asserted Keiser. It’s an asset that has no real “correlation with anything – stocks, bonds, currencies, gold, commodities, or property – and certainly no political parties or political outcomes, here in the US or anywhere in the world.” Bitcoin is correlated only to Bitcoin.

Despite the outcome of the upcoming elections, Bitcoin will still be backed “by an insatiable hunger.” It’s a cosmic scale hunger because “Bitcoin is the Big Bang of money.”

“To be clear, I don’t mean BTC is backed by energy. What I’m saying is, it’s backed by code that’s unstoppably programmed to consume all available energy on Earth and beyond, to create absolute monetary scarcity to elevate humanity to a more pure spiritual state of existence. Transcendence on this scale takes synchronization and massive amounts of energy.”

Keiser also said that no matter who’s the US president, Bitcoin is on its way to take out gold as the ultimate monetary store of value and doubled-down on his 40x-80x price prediction.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato