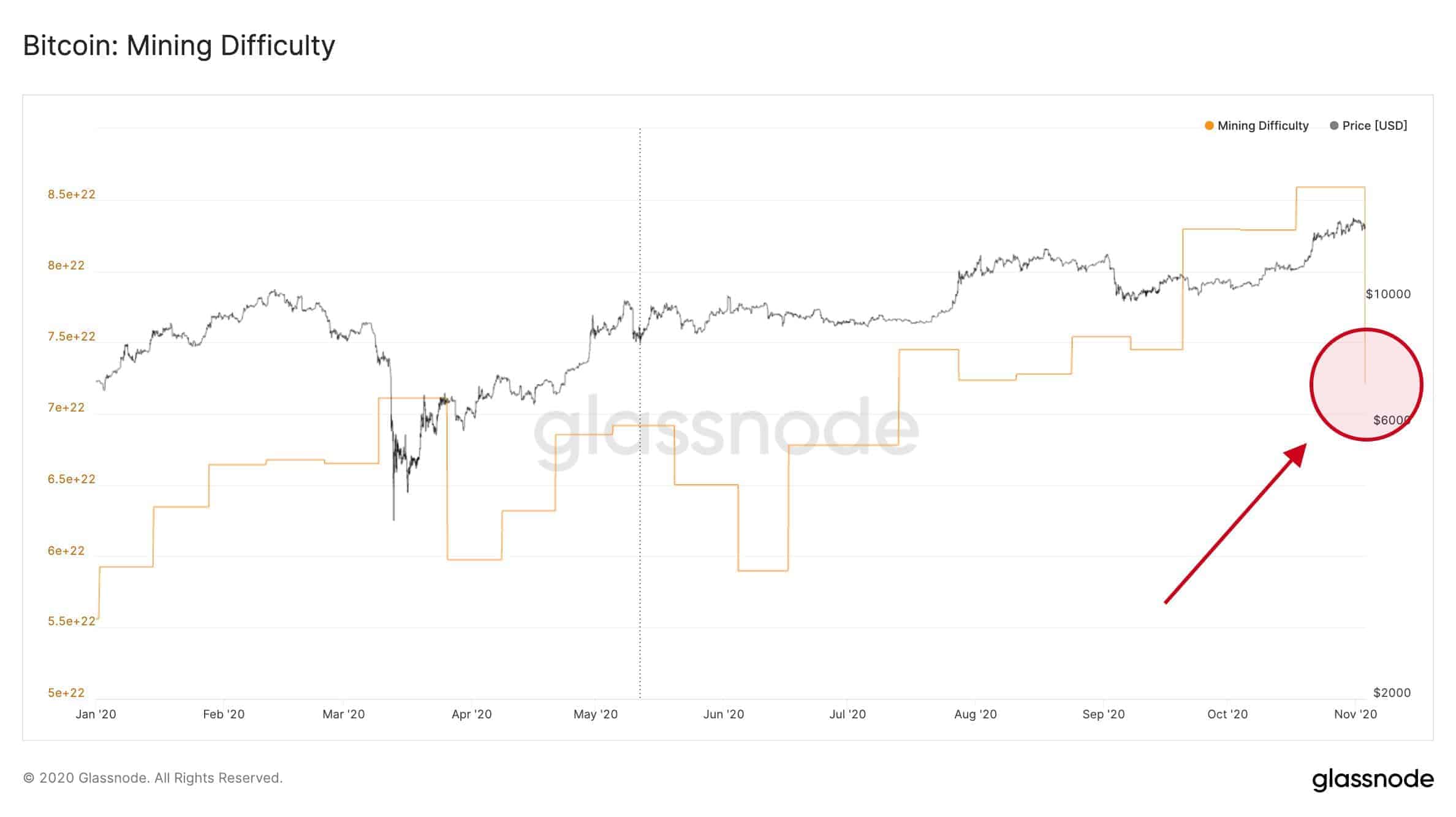

The Bitcoin network just went through the second-largest negative difficulty adjustment and its most significant one since the start of the ASIC era. The 16.05% decline exceeded previous expectations indicating a readjustment of somewhere between 7% and 10%.

Record-Setting BTC Mining Difficulty Adjustment

The mining difficulty on the Bitcoin network goes through an automatic adjustment every 2,016 blocks. It’s a feature enabling the system to self-sustain in relation to external events affecting the network.

Depending on the number of miners putting their computing power to work on the BTC blockchain, the adjustment could either make it easier or harder for them to complete their work and get rewarded.

CryptoPotato reported recently that the end of the rainy season in China’s Sichuan province prompted miners to migrate out of the region. This resulted in a sharp decrease in the Bitcoin hash rate. Consequently, the network had to be readjusted so miners would still be incentivized to work on it.

Initial prediction saw the adjustment to decrease the mining difficulty by less than 10%. However, it turned out to be significantly higher. Data from the analytics company Glassnode indicated that this was the “second largest negative Bitcoin mining difficulty adjustment in history: -16%.”

Taking place at block 655,200, today’s adjustment took down the difficulty from its all-time high level of 20.00T to 16.79T. The 16% decrease means that this is now officially the second-largest adjustment in BTC’s history after surpassing the one that occurred after the mid-March madness.

Additionally, it became the most significant percentage decline since BTC mining entered the ASIC era in 2013.

Nevertheless, the all-time record still lies with the October 2011 adjustment, when the mining difficulty dropped by over 18%.

Lack Of Immediate BTC Price Reaction

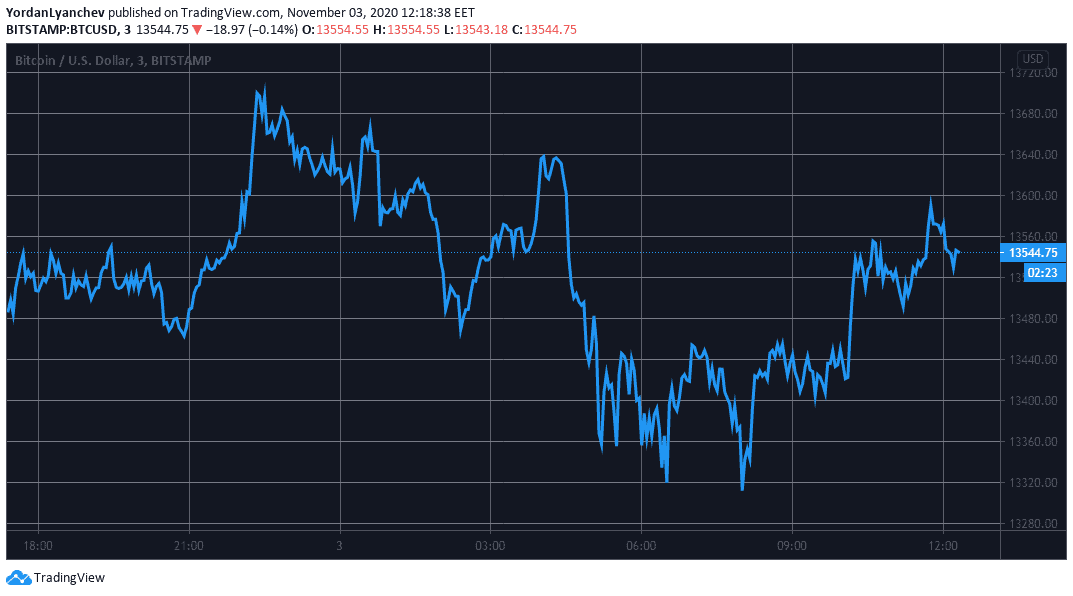

Despite the significance of the difficulty adjustment for the network, the asset price has remained relatively stable and hasn’t displayed any major price movements in the past few hours.

After recovering most of its losses, Bitcoin surged back above $13,500 earlier today. It has maintained its price above that level and even challenged $13,600 minutes ago.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato