Disclaimer: The findings of the following article are the sole opinion of the writer and should not be taken as investment advice

For Bitcoin SV, the larger bullish trend in the market did not matter at all. Over the past week, its valuation dropped on the back of BTC’s corrections, with the crypto-asset failing to recoup the same sentiment despite Bitcoin bouncing back. BSV, at the time of writing, was facing a massive dilemma on the charts. While it reacts to corrections, bullish rallies have not been identified well in its long-term analysis.

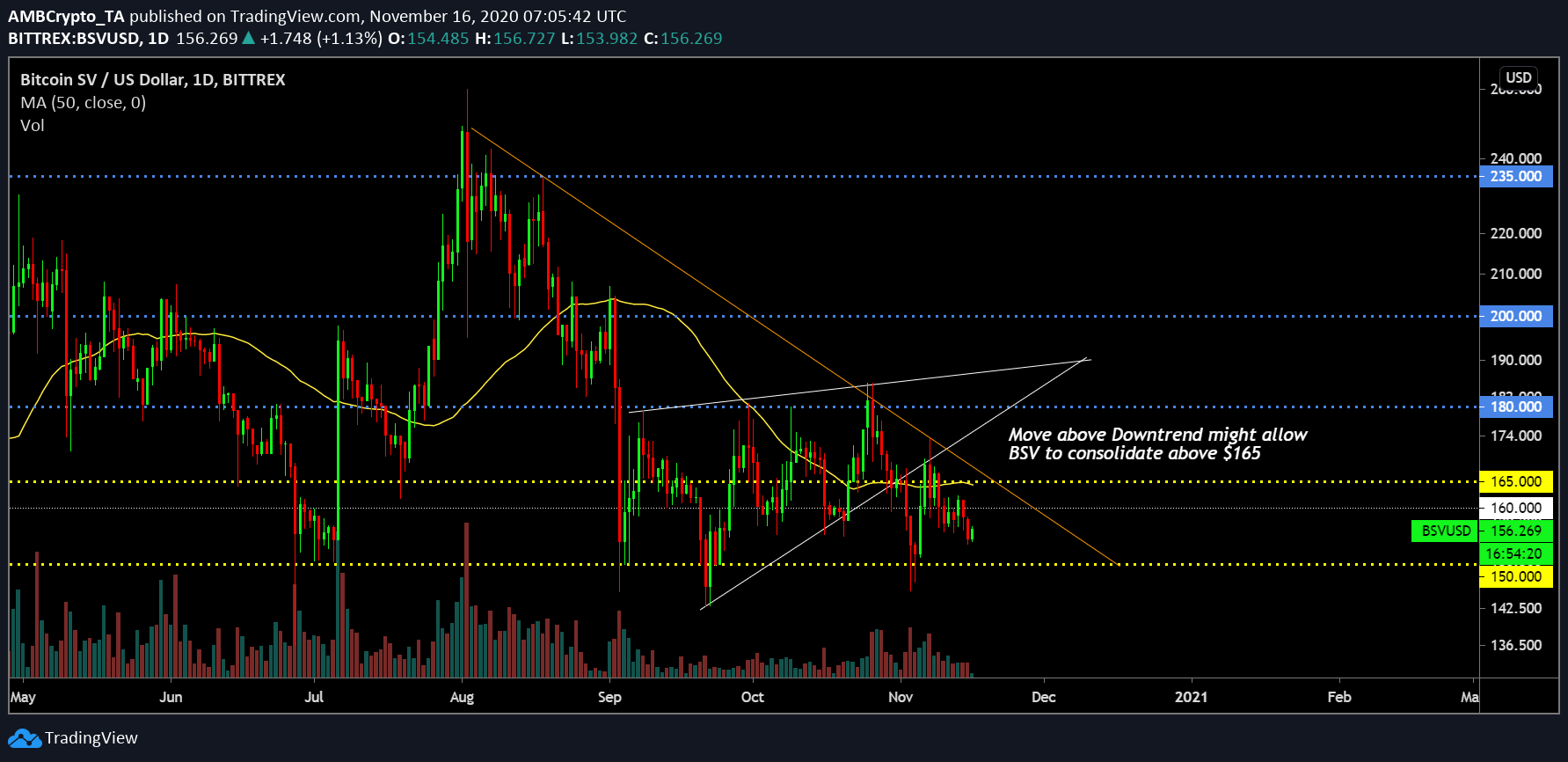

Bitcoin SV 1-day chart

Source: BSV/USD on TradingView

When analyzing Bitcoin SV‘s charts, it can be observed that it recently breached a rising wedge pattern, before continuing to attain a close position to its long-term support at $150. Over the past month, BSV has tested $180 only once, following which, the cryptocurrency’s valuation dropped directly below $170.

At the moment, it is quite clear that Bitcoin’s bullish sentiment is having less impact on Bitcoin SV, with the crypto-asset possibly witnessing a drop in liquidity and volumes. At press time, the 50-Moving Average was continuing to thrust the overhead resistance to the press time price level.

From a long-term perspective, BSV was yet to break above the downtrend (orange line) ranging back from mid-August. It is possible that BSV may consolidate comfortably above the downtrend after the 1st week of December, but a reversal would mean further depreciation and an eventual drop below the support level at $150.

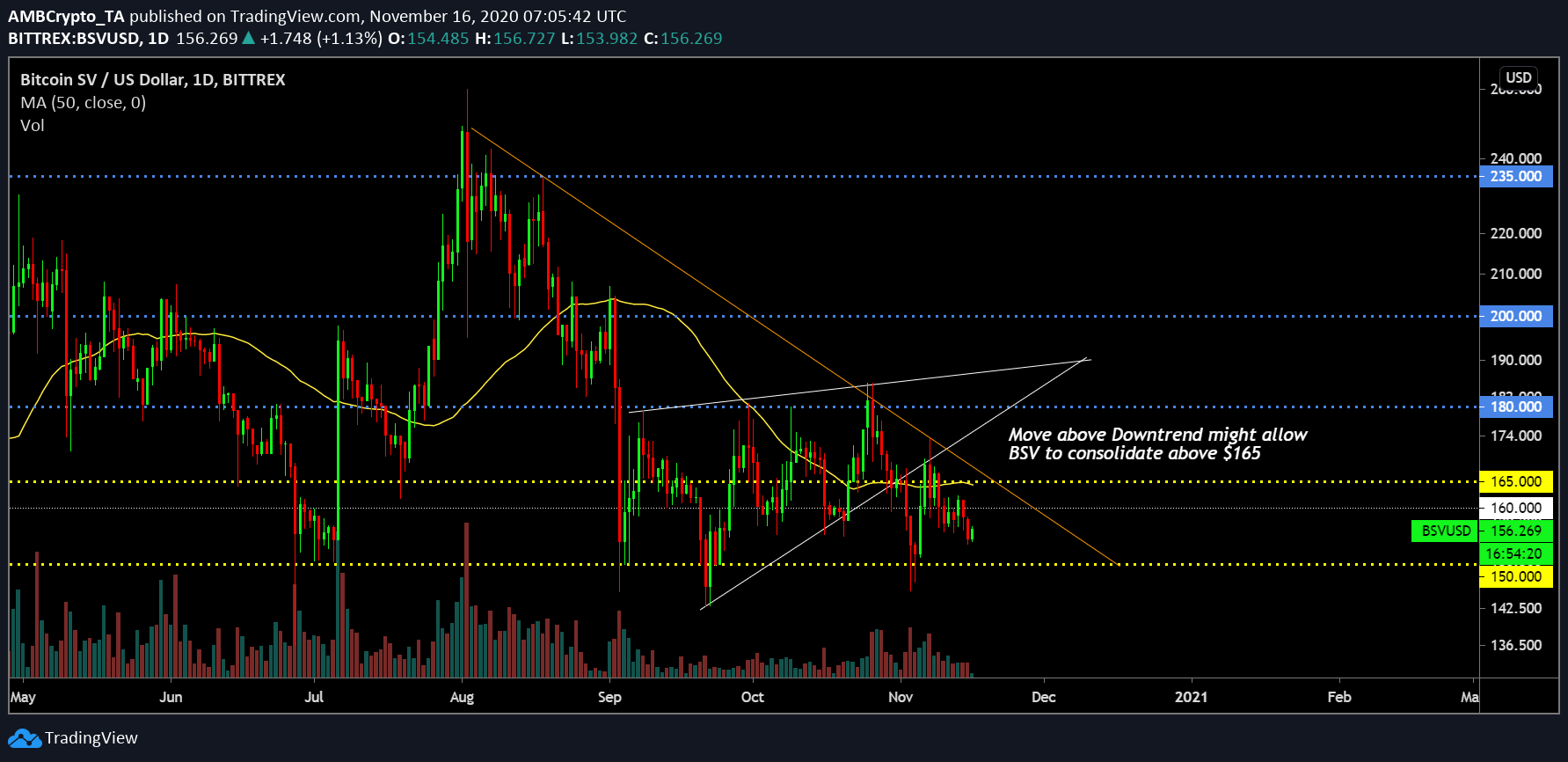

Market Reasoning

Source: BSV/USD on TradingView

Markets Indicators did not demonstrate a sense of confidence either. The Relative Strength Index or RSI pointed to a lack of activity from the buyers, with sellers taking mild control on the charts.

Further, the MACD implied the continuation of a bearish trend since the start of last week, with the Signal line hovering over the blue line.

Finally, the Awesome Oscillator was highly suggestive for increasing bearish momentum. In fact, at press time, the collective trend was shifting towards recovery as well and BSV might mirror a period of decline too.

Conclusion

Bitcoin SV did not have a bullish outlook for the near future. Its consolidation between $165 and $150 has been the story of the 2nd half of 2020. It may finish with an even lower valuation by the end of 2020.

The post appeared first on AMBCrypto