In this final article of the three-part look at Bitcoin in bearish-2018, we look at which investing period gives you the least loss. The reason for looking at such a pessimistic year while the market is on a bull-run currently is to bring some perspective.

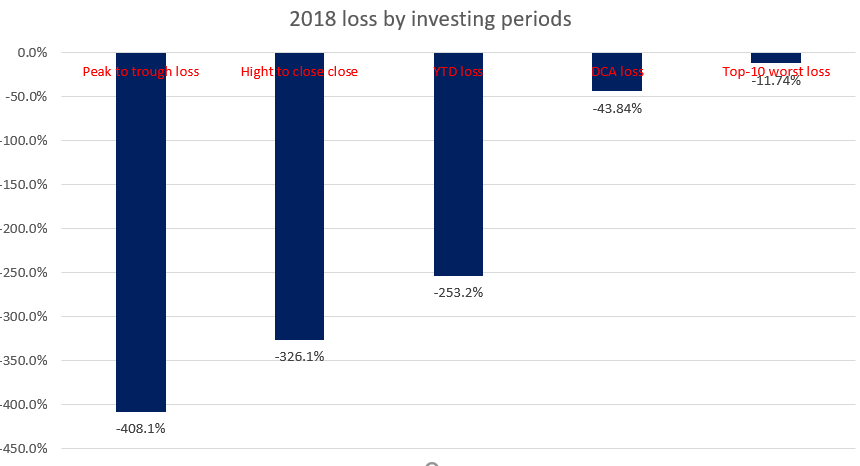

Let’s do a quick recap before the summary. Firstly, we looked at the top-10 worst trading days, and saw that the average loss made was 11.7 percent by buying BTC at the open and selling it at the close. Secondly, we looked at a DCA strategy of $10 for the 261 weekdays of 2018, this gave us a loss of 43.8 percent against our initial investment. While there two are evidently losses, the year was far worse. Looking back, you would call yourself lucky having had a loss of 50 percent, or within the two-digit mark.

Downhill from here

2018 was not a good year, but let’s look at how bad it really was. An open to close investment made a 253 percent loss, the peak to trough loss was 408 percent, high to close loss was 326 percent. Now, the DCA loss of 43.8 percent isn’t looking so bad is it? Here’s how they stack up.

Our baseline of the top-10 worst-performing days did better than even the DCA, why is that? Because, as the price of a depreciating asset dropped, you offloaded it. Despite this ‘offload’ being in a short period of time i.e. 24 hours, it was a good move, because each additional day you held on to Bitcoin, it cost you as the price was dropping. Hence, our baseline did better, because it got rid of a falling asset. This is a lesson in not holding on to falling assets and proves that even a DCA strategy won’t work if the market is bearish and prices are falling fast.

Second, a DCA strategy despite losing out, gave a loss of just 43.8 percent, while every other metric saw a much larger loss, which once again goes on to show why you can limit your losses, even in a bearish year, by investing the same amount throughout the year, irrespective of the price. In fact, as we saw in the previous article, as the price drops the amount of Bitcoin your purchase rises, and if the price reverses, your upside is greater.

What’s the lesson here? Dollar-cost averaging may not work in the worst of times, when the market is tanking, and may result in a loss on your investments, but, it’s not all bad. Since you are buying the same amount of the asset periodically, you buy more when prices are low, and less when prices are high, giving you a lower downside as prices fall, and a higher upside potential if the tide reverses.

The post appeared first on AMBCrypto