Everyone looks at Bitcoin and Etherum differently. To the ardent followers of one, the other is either too little or too much. To unfamiliar traders, they are just different ways of referring to cryptocurrencies. To crypto-folk, one is a currency, the other a utility. Whichever way you look at them, one thing is certain – They are the world’s largest cryptocurrencies, taking over 75 percent of the entire coin market capitalization.

Bitcoin and Ether have different use-cases and this year has emphasized that difference. With the two cryptocurrencies deviating more than ever, they’ve found their niches and their ideal customers, investors, traders, whatever you want to call their ‘crowd.’ This division of the ‘crypto-customers’ won’t just have an effect on the individual coin’s use-cases, but also on their prices going forward.

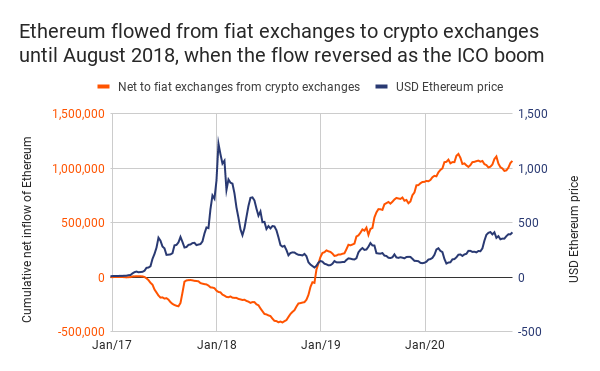

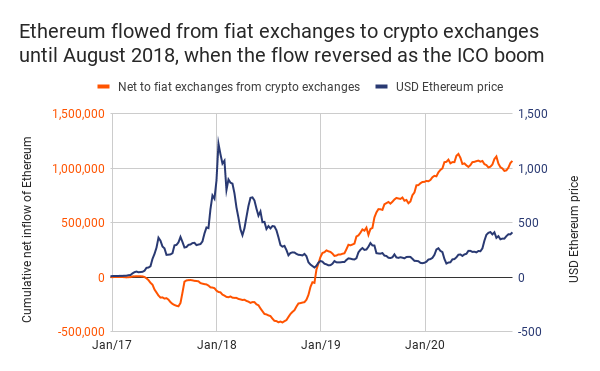

First, let’s look at Ethereum’s native token, Ether. According to a report by blockchain analytics firm Chainalysis, ETH inflows from fiat to crypto-exchanges from 2017 to August 2018 were net positive, meaning more ETH flowed into crypto-exchanges from fiat exchanges than flowed out. This was when ETH was as high as $1,300 and dropped and settled around $275 by August, thanks largely to the ICO boom.

The report stated that ETH exchange flows reversed (earlier from fiat to crypto and later from crypto to fiat exchanges). This continued till April 2020. A key finding post-April of this year is that ETH flows have been balanced, as the price increased, with the report indicating that ETH has flowed more to DeFi, than to centralized exchanges.

ETH flows from fiat to crypto exchanges vs ETH price | Source: Chainalysis

Now, let’s look at Bitcoin. For the king coin, fiat exchanges have net inflows from crypto-exchanges, meaning more flows into the former than out of it. Bitcoin is driven more by fiat to crypto-exchanges, which have fiat currencies as on and off-ramps, and where Bitcoin to altcoin trading is less intense, meaning investors prefer buying their BTC for USD, EUR, GBP, INR, or other fiat currencies, rather than for smaller altcoins.

Based on this finding, for Bitcoin and Ether respectively, the report read,

“This data confirms the observation that bitcoin and Ethereum prices are driven by different use cases and different markets. So while prices for both are currently rising, investors should not expect the correlation to hold as robustly as it has in the past.”

Even as the market enters a bull run, the price rallies of BTC and ETH are not the same. While Bitcoin is trading at record-highs, Ethereum is at a two year high, but still well below its ATH at over $1,300.

Further, over the past two quarters, the two cryptos have been the biggest gainers and losers in terms of market capitalization. For instance, in October, with Bitcoin crossing $15,000, it increased its market share by 4.5 percent, while Ethereum lost 1.3 percent. In the months prior, as ETH was rising and Bitcoin was holding flat, the opposite was true in terms of market cap change.

The post appeared first on AMBCrypto