2020’s week 50 is upon us right now, with Week 49 being rather quiet for Bitcoin from a price perspective. Between 2 December and 8 December, Bitcoin’s price movement was restricted between $19,800 and $18,400. While the movement on the 8th remained the most significant, the cryptocurrency’s price did remain above $18,800 for the 6 days preceding that date.

Such price consolidation has the market split between both trends, as reported by Glassnode’s latest report.

Bitcoin: Coin Days Destroyed faces slump

Source: Glassnode

According to the aforementioned data, despite strong confidence by Risk-Reserve (explained below), the inactivity of the price is leading to long-term BTC hodlers selling off some of their assets to realize profits.

As indicated by the chart, Bitcoin‘s Coin Days Destroyed metric has sharply fallen, a metric indicative of old coins moving in the market. Such a situation is keeping Bitcoin’s value at bay under $20,000, with selling pressure sustaining itself at the top.

However, the report was quick to mention that,

“Although long-term holders may be selling at current prices (and creating downward price pressure), historical trends suggest that buy pressure will more than make up for this activity in the longer term.”

Now, here is where the Bitcoin Risk/Reserve Ratio factors in.

R/R Ratio far from being over-bullish

Source: Glassnode

For the optimistic bull, the Reserve Risk Ratio is still comparatively low. For comparison, it is even lower than where it was during the 2019 bull run when Bitcoin climbed to $13,000. The critical fact is that it is still below major levels, an observation that underlined an attractive risk/reward ratio for investment in Bitcoin.

Who is pulling more weight now: Bulls or Bears?

Simply put, it is extremely difficult to decide whether the market will see significant corrections or whether it will go all in for a new all-time high on the charts. There are multiple reasons for the same.

For starters, the market sentiment seemed to be exceedingly greedy, at press time.

In fact, according to Bitcoin’s Fear and Greed Index, the rating over the past week touched an all-time high of 95, a figure that meant that retail investors are more greedy than ever in the industry. While the value may just drop by press time, it is too soon to suggest that this might be the trigger for a radical bearish shift later.

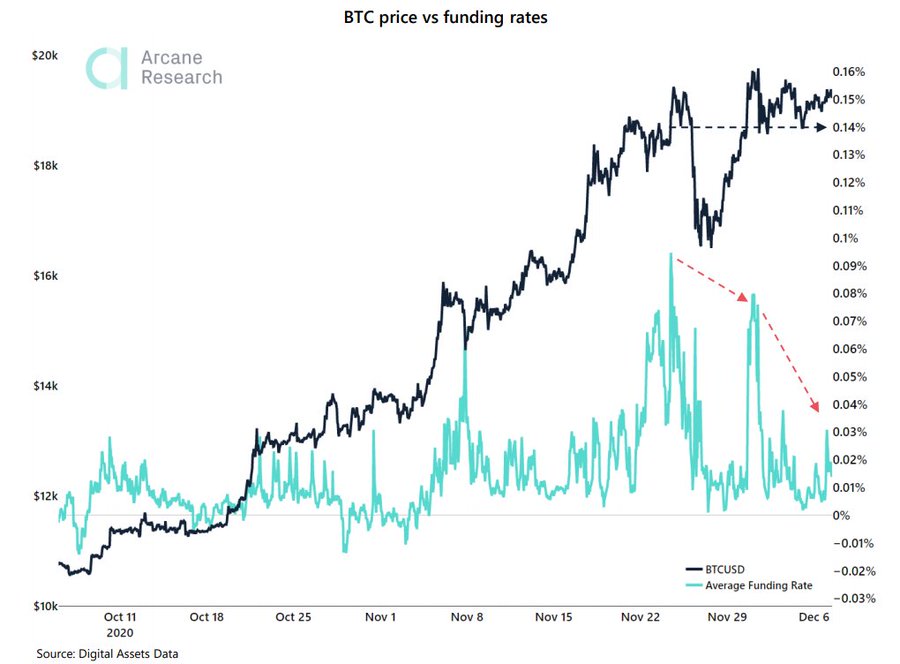

Source: Arcane Research

Combating this scenario is a healthy sign in the derivatives market. According to Arcane’s recent report, future premiums and funding rates slowed down last week, signaling a much healthier state for Bitcoin. A healthy derivatives market means strong Open Interest and an adequate balance between longs and shorts. Hence, Bitcoin’s path is currently laced with arguments in favor of both sides of the trend.

The post appeared first on AMBCrypto