The upcoming Bitcoin Educational Conference organized by Michael Saylor’s MicroStrategy has seen massive interest from CEOs and other executives. Saylor informed that all attendees would benefit from MicroStrategy’s playbook on how to utilize the BTC Monetary Network.

CEOs Interested In MicroStrategy’s BTC Educational Campaign

CryptoPotato reported in mid-January MicroStrategy’s latest pro-Bitcoin initiative, which aims to educate corporations on how they can take advantage of investing in bitcoin or make it their primary treasury reserve asset.

MicroStrategy tapped some of the industry’s most well-known names to present – including Fidelity Digital Asset Services, Binance, Coinbase, Grayscale, Kraken, and more.

With the event scheduled to take place in two parts on February 3rd and 4th, the NASDAQ-listed business intelligence giant offered an update on how the registration process is going.

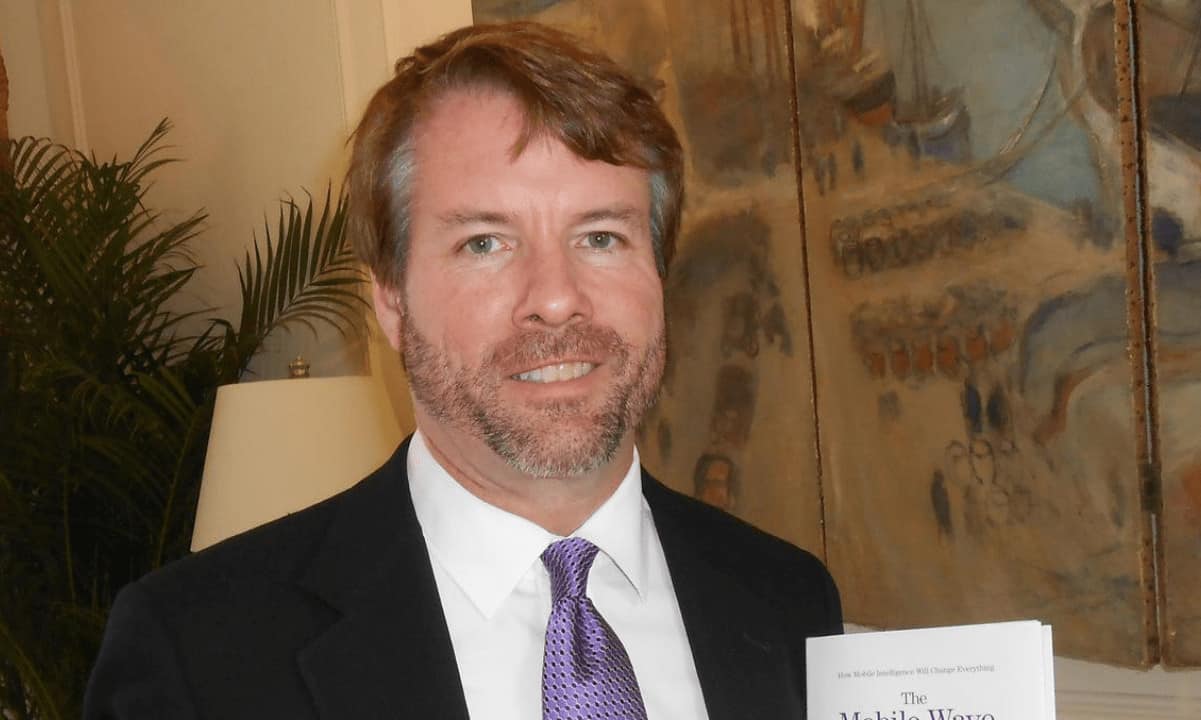

The firm’s founder and CEO, Michael Saylor, emphasized the massive interest from executives, saying that “I have never seen so many CEOs sign up to attend one of our events.”

He urged others to join as “every company can benefit from plugging into the Bitcoin Monetary Network.”

I have never seen so many CEOs sign up to attend one of our events. Send yours, or come join our sessions & report back to your team. Every company can benefit from plugging into the #Bitcoin Monetary Network. https://t.co/17j3OZuswC

— Michael Saylor (@michael_saylor) February 1, 2021

During a recent podcast appearance, Saylor confirmed the growing interest from executives in the crypto industry. He noted that shortly after MicroStrategy announced the purchase of over $1 billion worth of BTC, he was contacted by numerous CEOs for further information.

Although he failed to mention any particular names, Saylor recently interacted with Tesla’s CEO Elon Musk on Twitter regarding the latter’s possible involvement with bitcoin.

MicroStrategy To Buy More BTC

As mentioned above, MicroStrategy has already allocated over $1 billion of its own treasury into bitcoin. The purchases came in several batches, with the first one announced in August 2020 and the last one in January 2021.

Although the business intelligence company is already neck-deep in BTC investments, it doesn’t plan to stop yet. MicroStrategy announced in its Q4 2020 report that it will continue to “hold our bitcoin and invest additional excess cash flows in bitcoin.”

Furthermore, MicroStrategy vowed to explore new approaches “to acquire additional bitcoin as part of our overall corporate strategy.”

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO35 code to get 35% free bonus on any deposit up to 1 BTC.

The post appeared first on CryptoPotato