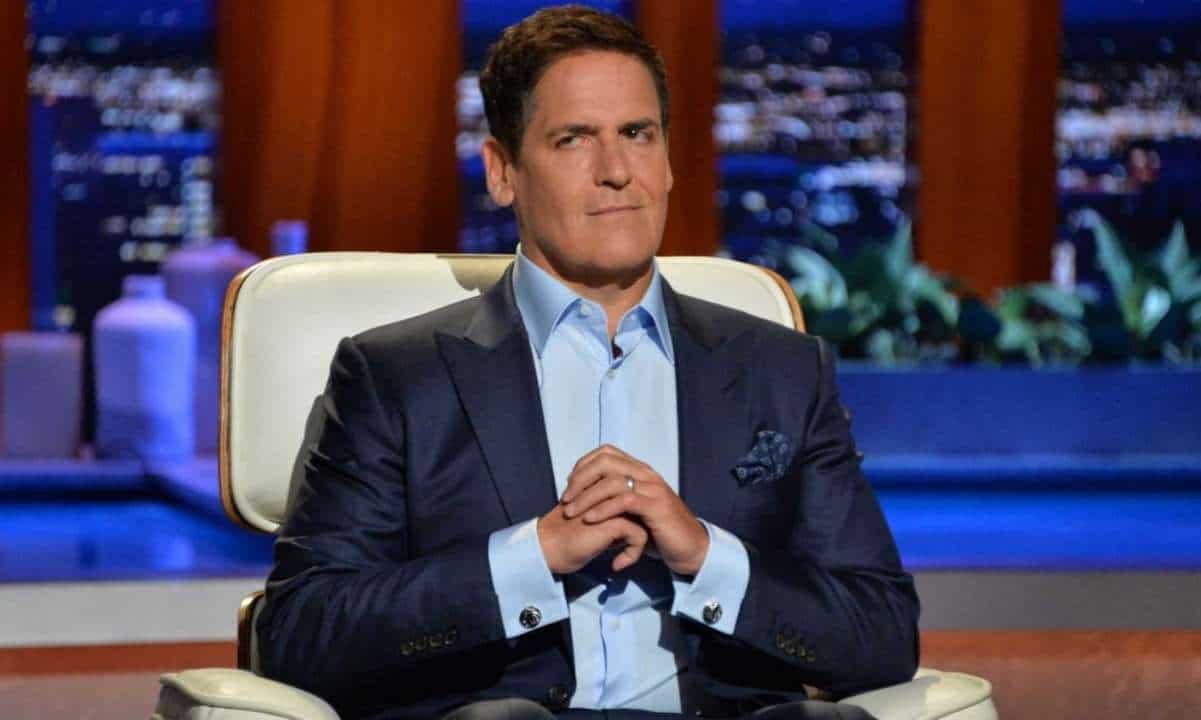

Mark Cuban, a famous venture capitalist, and owner of the Dallas Mavericks, made comments on Twitter regarding the Gamestop stock situation, along with some of the inherent problems that lie within the New York Stock Exchange. In the thread, the billionaire claims that a blockchain system could solve many of the issues that the stock market faces as it enters the 21st century.

“What do you mean by ‘the markets aren’t open?’”

One of the largest differences between trading cryptocurrencies and stocks on the NYSE is that the former can be traded twenty-four hours a day, seven days a week. Compare that to the American stock market, which is open between 9:30 AM and 4:00 PM only on weekdays.

While digital currencies can always tout this as an inherent advantage over traditional financial systems, the recent events in the stock market are showing signs that something needs to change. Mark Cuban pointed out a large flaw in the system on Twitter yesterday and suggested using blockchain as a solution to these problems.

The problem: Brokers trade at the speed of light, but settle trades over 2+ days. This can happen again. Co-ordinated traders can hunt better capitalized platforms and make $gme style buys. Solution? Blockchain. @InjectiveLabs @mirror_protocol othershttps://t.co/F1KF5DduUY

— Mark Cuban (@mcuban) February 18, 2021

A blockchain solution would allow not only more market-hours but also faster finalization of trades. As Cuban notes, the fact that trades are settled over the course of several days leaves a lot to be desired. The Bitcoin blockchain, for example, immutably confirms transactions every ten minutes, on average. Other blockchains confirm transactions in as little as thirty seconds. With that in mind, one could imagine a variety of possibilities for the future of the stock market based on a blockchain protocol.

Transparency is Worth its Weight in Gold

Another facet of the GME saga was the halting of trading of various stocks from retail brokers, something that had not been seen at this scale before. Specific stocks had trading halted.

Meanwhile, other services reacted much more… questionably. Robinhood, for example, did not completely halt trading of the so-called “meme stocks.” They only halted the buying of those stocks while still allowing their users to sell them. Robinhood claimed liquidity problems as the reason they needed to stop buy orders, and Cuban calls them out in the same thread.

We also need to have stress tests and liquidity transparency for all brokers. The customers of RH etc should have known their broker’s liquidity limits were being reached and the consequences of that issue (ending buys).

— Mark Cuban (@mcuban) February 18, 2021

This again highlights blockchain technology as a great solution to address many of the issues with traditional financial industries. Using any transparent blockchain tech, the average retail investors would be able to access much more information about their broker’s liquidity and understand the limits they face. This would give them increased control and understanding of their finances and potentially even displace some of the inherent advantages enjoyed by many Wall Street firms in favor of retail investors at large.

Featured image courtesy of Magazine

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO35 code to get 35% free bonus on any deposit up to 1 BTC.

The post appeared first on CryptoPotato