The bitcoin price slid below the $11,000 mark for the first time in more than a week on Tuesday, as the flagship cryptocurrency’s burgeoning inverse correlation with the S&P 500 came back to bite investors.

Bitcoin Price Careens Below $11,000

Bitcoin had entered the day trading sideways in the low $11,000s, where it had more or less languished since the Saturday sell-off that followed BTC’s brief foray above $12,000 last week.

The dam broke around 10 am ET, and the bitcoin price cascaded below $11,000 to breach its lowest level since August 4.

As of 10:35 am ET, BTC/USD had fallen as low as $10,863 on Bitstamp. The leading cryptocurrency last traded at $10,909 for a 24-hour decline of 3.45%.

Notably, the bitcoin price’s steep decline was accompanied by a phenomenal rally on Wall Street. The Dow Jones Industrial Average surged 500 points (nearly 2%), the S&P 500 rose 1.84%, and the Nasdaq cleared the 8,000 level following a 2.32% bounce. The CBOE VIX, which measures implied market volatility, fell 15%.

Trump Admin Delays New China Tariffs, S&P 500 Surges

That incredible divergence shouldn’t be surprising.

As CCN.com reported, bitcoin has developed an inverse correlation with the S&P 500. When the stock market bellwether falls, bitcoin rises – and vice versa.

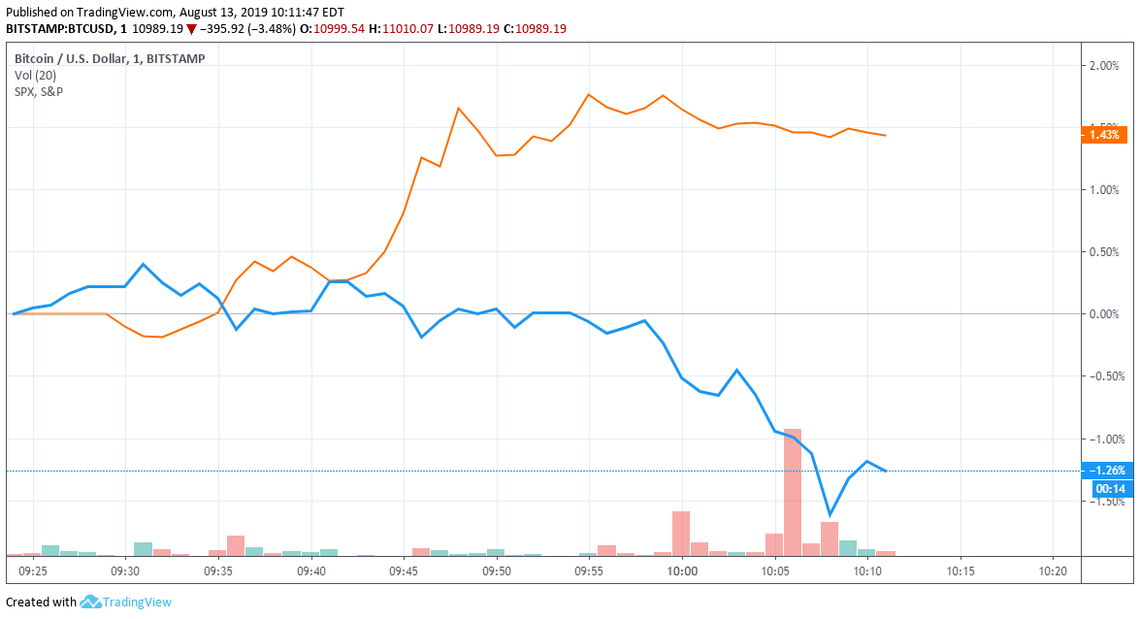

Crypto investors have cheered that inverse correlation as trade war volatility has sent major stock indices into a tailspin, but it was much less welcome this morning. As demonstrated in the chart below, the S&P 500 spiked nearly 1.5% as the bitcoin price endured a loss of equivalent magnitude.

The trigger for both moves was the Trump administration’s stunning revelation that it would delay new tariffs on Chinese specific imports until December 15 and exempt other items from the looming tariff imposition altogether.

“Certain products are being removed from the tariff list based on health, safety, national security and other factors and will not face additional tariffs of 10 percent,” the US Trade Representative’s office wrote in a statement.

President Trump had previously announced that 10% tariffs on $300 billion worth of Chinese goods would kick in on September 1, and analysts warned that the White House might hike those tariffs to 25% in the coming months.

His announcement, which came via tweet, thrust the stock market toward a vicious sell-off – and the bitcoin price toward a spectacular rally – in the days that followed.

Click here for a real-time bitcoin price chart.

The post appeared first on CCN