(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Humanity’s struggle to locate the easy button permeates all aspects of our existence. In the context of the financial markets, everyone wants to find that expert, newsletter, or secret trading program that if followed will lead to instant, risk-free, and above-average sick GAINZ. Intrinsically, we all know that said button is a fleeting chimera one chases at one’s peril – and yet, I continually get asked “What coins should I buy”, “Is now a good time to buy”, “Does technical analysis work”, and on and on. I don’t offer such opinions even to my closest friends lest they erroneously believe I’m the oracle of the Kampong.

I recently became involved as a sponsor of the Tampines Rovers Football Club in the Singapore Premier League. A few of the footballers are into crypto and asked if they could pick my brain over lunch one afternoon.

The three players had all dabbled in day trading crypto with varying degrees of success. They asked all the standard questions I mentioned above hoping that I could offer the secret to crypto riches over a two-hour lunch. Unfortunately, I disappointed them, and asked them a lot of questions that made them think about why they were investing / trading, how much time they had to dedicate to their endeavor, and what their risk tolerance was. The coup-de-grâce, which served as inspiration for this essay, was when I inquired if any of them had read the Bitcoin whitepaper. None of them answered in the affirmative.

The reason the whitepaper is important isn’t because I’m a Bitcoin maxi, but because nearly all other blockchain and crypto projects borrow concepts from and benchmark themselves against ideas presented in that paper. Some projects may not borrow from Bitcoin’s whitepaper directly, but from another project that had borrowed from Bitcoin’s whitepaper (and so on). As a rule of thumb, almost every blockchain or crypto project takes a set of successful and proven concepts from a previous project, and either imitates them or attempts to build on them.

The scams imitate poorly and at the surface level. Scamcoins have all the buzzwords and a slick looking website — but if you actually take the time to read even a few sentences of their White or Litepaper, you should be able to instantly recognise that it’s a pile of cow dung (often because it’s either a shameless plate of copypasta, or completely unintelligible).

The next 1,000 bagger projects imitate and then improve. Ethereum imitated Bitcoin in many ways, but offered a substantial improvement by creating a virtual decentralised computer that greatly expands the potential use cases for the technology underlying Bitcoin. Don’t you wish you bought some ETH in the pre-sale? I know I do – I publicly called it a shitcoin in a very early edition of this newsletter.

Ultimately, any new project needs to answer these fundamental questions to maximise its chances of success:

- Why are we here at this moment trading this ecosystem of magic internet money?

- What do we hope to achieve?

- What about the current financial system are we trying to improve upon or replace?

If you don’t have a firm understanding of the “why” and the potential “how’s”, you cannot discern fact from fiction. With an ever expanding universe of digital coins to invest in, without a firm understanding of what the ideal outcome is, you will be at the whim of whatever their search algorithm serves up in terms of coin recommendations.

Apart from my last essay ALL ABOARD!, my 2021 missives have been more philosophical in nature and rarely delved into executable ideas. That is because without first understanding “why” digital assets can inflict fatal body blows on our current analogue financial system, you would never have the conviction to ride an asset down 90% in the bear market, to up 10x in the bull market. If you bought Bitcoin at the 2017 high of $20,000, by late 2018 you were down close to 90%. But if you held on until today, that investment is up 3x, which still beats the percentage growth of the Fed’s balance sheet. I will keep reminding everyone that the metric to beat is monetary base expansion. If you lag that, you are losing.

A peer-to-peer system that moves information from point to point without a centralised, trusted gate keeper is the goal of the whole decentralised finance movement. Successful abrogation of trust from an accredited cartel to a network of self-interested, profit-seeking participants has wide-ranging implications. I routinely focus on the financial ramifications of this shit because that is my area of interest and experience. The focus of this essay is to examine at a very high level the tax we pay for blindly trusting various aspects of our financial existence. If we imagine a future where some decentralised digital coin, token, or cryptocurrency can replace a portion of the need for blind trust in a centralised trust cartel, how much upside is there left in the market right now?

Many analysts approach the “value” embedded in our crypto capital markets from a network perspective, such as Metcalfe’s law. I am not a technologist by trade, so I prefer earnings and revenue multiples. I will attempt to fit that paradigm into this essay to render my theory of value more palatable to those of us trained in the more traditional economic canon of our post-WWII era.

The Banking System

Let’s start with some charts, which displays how poorly the market thinks of the traditional banking business model.

This is a life-to-date chart of the KBW Bank Index which represents the major commercial banks in America. As you can see, after reaching its peak in 2007, it only recently reclaimed that ATH. The Fed has done whatever it took to save the Too Big To Fail banks, and it still took these banks 14 years to reclaim 2007 highs.

This is a life-to-date chart of the KBW Bank Index which represents the major commercial banks in America. As you can see, after reaching its peak in 2007, it only recently reclaimed that ATH. The Fed has done whatever it took to save the Too Big To Fail banks, and it still took these banks 14 years to reclaim 2007 highs.

This is a life-to-date chart of the EuroStoxx Banks Index, which represents the major European banks. Rut Roh, Max Pain!!! Did they decide to attack Russia in the winter again? This beauty is off 80% from its ATH (reached in 2007).

This is a life-to-date chart of the EuroStoxx Banks Index, which represents the major European banks. Rut Roh, Max Pain!!! Did they decide to attack Russia in the winter again? This beauty is off 80% from its ATH (reached in 2007).

CHOYNA CHOYNA CHOYNA! This is the CSI300 Banking Index chart. China’s major banks are still down 20% from their 2008 highs. State sponsored corporate socialism is THE stated business model in China. However, even with all the help of the authorities, the banks still aren’t punching above their weight. Maybe you should buy some Pu’Er tea instead.

CHOYNA CHOYNA CHOYNA! This is the CSI300 Banking Index chart. China’s major banks are still down 20% from their 2008 highs. State sponsored corporate socialism is THE stated business model in China. However, even with all the help of the authorities, the banks still aren’t punching above their weight. Maybe you should buy some Pu’Er tea instead.

Things aren’t much better next door to China in the land of the rising sun, Japan. The Topix Banking Index is off over 90% from its 1989 ATH. Jiro certainly doesn’t dream of capital appreciation in Japanese mega banks. I’ll stick with investing in bluefin tuna, although after watching Seaspiracy maybe I should opt for the vegan option instead … nah fuck that give me the toro.

Things aren’t much better next door to China in the land of the rising sun, Japan. The Topix Banking Index is off over 90% from its 1989 ATH. Jiro certainly doesn’t dream of capital appreciation in Japanese mega banks. I’ll stick with investing in bluefin tuna, although after watching Seaspiracy maybe I should opt for the vegan option instead … nah fuck that give me the toro.

This is a chart of the Nifty Banking Index from India. I would never have guessed that Indian banks actually performed this well. When demographics are on your side, it is very hard to fuck up your banking system regardless of how hard you try. A+ work for the Indians, hopefully this sort of price performance can continue.

This is a chart of the Nifty Banking Index from India. I would never have guessed that Indian banks actually performed this well. When demographics are on your side, it is very hard to fuck up your banking system regardless of how hard you try. A+ work for the Indians, hopefully this sort of price performance can continue.

On the flip side, even with the blip of the 2000 bubble, technology bellwethers are still exponentially higher today. Given that integrated circuits and semiconductors are the bedrock of the techno utopia we reside in, the chart of Taiwan Semiconductor (TSMC or 2330 TT) represents the march of innovation. Let’s compare that to the performance of the different banking indices shown above.

On the flip side, even with the blip of the 2000 bubble, technology bellwethers are still exponentially higher today. Given that integrated circuits and semiconductors are the bedrock of the techno utopia we reside in, the chart of Taiwan Semiconductor (TSMC or 2330 TT) represents the march of innovation. Let’s compare that to the performance of the different banking indices shown above.

This chart is normalised to a 100-factor starting point. Banks who privatise profits and socialise losses haven’t managed to enrich their shareholders. That is pathetic. If they adopted any of the technological improvements we’ve seen in the past decade at all, then they’d be much better positioned to see the exponential growth similar to TSMC and other technology bellwethers.

The equity market is shouting that the traditional banking business model is broken. The question is what can credibly replace it in the not-too-distant future. Every product and service offered by a bank can be replicated and improved upon by a decentralised service powered by a PUBLIC blockchain. I believe this replication can happen at a lower cost on a macro scale, but that is up for debate — and I expect to see some empirical evidence in the near future.

Traditional banks are destined to be service companies for a subset of relatively wealthy global Boomers who can’t wrap their heads around digital finance. My mother would rather visit a physical bank branch and risk contracting COVID than learn how to use online banking. She isn’t alone – that is inertia for you. There are still billions of dollars of fee income in that business, but it definitely isn’t a growing slice of the market.

Here is a sample of the common services a bank provides and their decentralised equivalent:

Savings Account – An account where a bank used to pay you interest.

Decentralised Equivalent – A fiat stablecoin that is staked on a DeFi lending platform. E.g. If you hold USDT (Tether) which is purportedly backed 1:1 by USD held in a traditional bank, you can stake them on Compound and earn a positive yield. As a bonus the act of lending your USDT earns you ownership in the Compound network in the form of COMP tokens.

Checking Account – An account where a bank allows you to draw against your balance on-demand to pay for things.

Decentralised Equivalent – Any coin, token, or cryptocurrency held in a digital wallet. You can spend your holdings 24/7 without asking for permission from anyone. The bank, for various reasons, can and will deny you access to your hard-earned money. But the decentralised equivalent is available as long as you are connected to the internet. Don’t worry I know you would rather die than be without your favourite TikTok or Instagram influencer constantly showing off how wonderfully amazing their life is at all times in all circumstances.

Loans – Banks will charge interest to loan you money to buy a variety of things. The rub here is that banks routinely price credit differently depending on non-monetary factors (such as ethnicity), which to this day creates the impression that certain groups are red-lined and must pay a higher cost of credit than others – if they even get a loan at all. Also, in this era of global corporate socialism, large entities borrow essentially for free, while SMEs are in many cases shut out of the commercial credit markets. This creates ire towards banks who are supposed to be the conduits of credit to productive enterprises.

Decentralised Equivalent – Right now, the bulk of lending is at negative leverage and is over-collateralised. Negative leverage means you put down more collateral than you borrow. Also, the only real demand for credit is from speculators and miners. Please read my essay Dreams of a Peasant for a thorough stroll through the crypto fixed-income markets. There are no DeFi mortgage, credit card or personal loan platforms at scale. This is definitely an area where the traditional banking system, even with its shortcomings, does a better job than DeFi.

Trust Services – Banks perform a very vital function to certify certain things about you as a person or business. They can certify that you are of a certain net worth based on your deposit history with the bank, they can certify that you are gainfully employed and the quantum of your salary, and they can also provide a proof of address where your account statements are mailed to. Many of these services come at a price, which you must pay to certify to others your personal details.

Decentralised Equivalent – Assets held on a public blockchain can for the most part be independently verified for free. If you receive your income in the form of digital assets, then it will be very easy to prove how much you are paid. As far as address proof and other PII goes, many projects are working on creating a shared opt-in secure database of PII that can be called by other services in order to authenticate you.

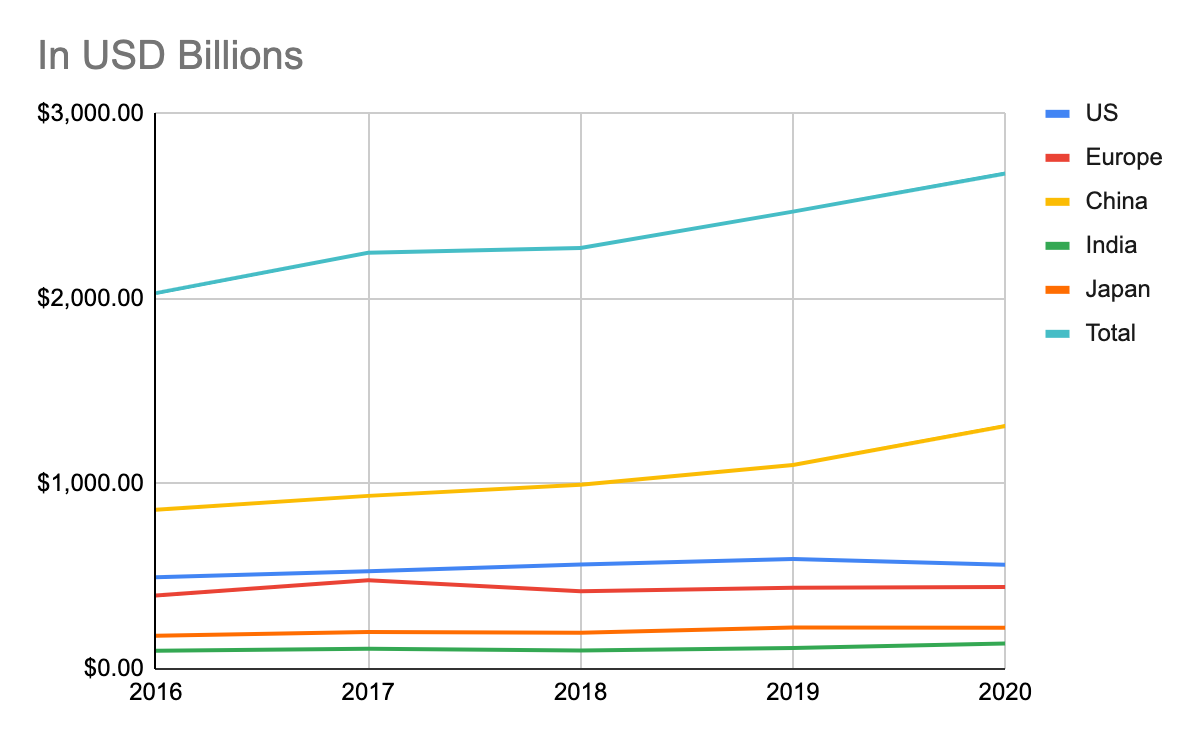

How much in “tax” do we pay each year to the largest financial institutions to perform these services? I analysed topline revenue for the following:

- KBW Banking Index (US focused banks)

- EuroStoxx Banking Index (EU focused banks)

- CSI300 Banking Index (China focused banks)

- Topix Banking Index (Japan focused banks)

- Nifty Banking Index (India focused banks)

The reason I looked at top line revenue is because that is essentially the amount of “tax” we as customers pay for these services.

In 2020 the combined tax paid to these institutions was $2.68 trillion. To put that in context, that is between 2% to 3% of world GDP. That is our collective banking tax. Any ability to reduce this tax while allowing more people and firms access to sound financial services is a net benefit to humanity. And obviously for those speculators who can position themselves in front of the protocols that facilitate these savings, there is a massive opportunity to outperform fiat monetary debasement.

In 2020 the combined tax paid to these institutions was $2.68 trillion. To put that in context, that is between 2% to 3% of world GDP. That is our collective banking tax. Any ability to reduce this tax while allowing more people and firms access to sound financial services is a net benefit to humanity. And obviously for those speculators who can position themselves in front of the protocols that facilitate these savings, there is a massive opportunity to outperform fiat monetary debasement.

Doing Away with Audits

Why do companies need an audit? Anyone interacting with a company from a bank, securities regulator, or even employee wants to know that the books are sound. Therefore, auditing firms charge a fee to verify the veracity of the accounting statements produced by their clients.

In an ideal future, all flows of funds happen on a public blockchain. Imagine you are a Malaysian durian farmer, and you sell your beautiful Mao Shan Wang stinky fruit online. The only payment you accept is USDT, and all of your suppliers for farm materials also can accept payment in USDT. USDT rides on a variety of protocols but let’s just assume you use the ERC-20 version. That means you can verify what was paid and what was earned for every fruit sold.

Your accountant prepares the standard set of income, balance sheet, and cash flow statements. But in addition, the accountant’s ledger can objectively verify by querying the Ethereum blockchain that the payments were made and received in the amounts reflected on the statements. In this case, you do not need an independent third party to charge you a fee in order to verify you are telling the truth. The Ethereum blockchain does that for you free of charge.

Triple-entry bookkeeping, as I have heard some refer to it, renders all professional accounting and auditing firms obsolete. There is no reason for these firms to charge this “trust tax” anymore.

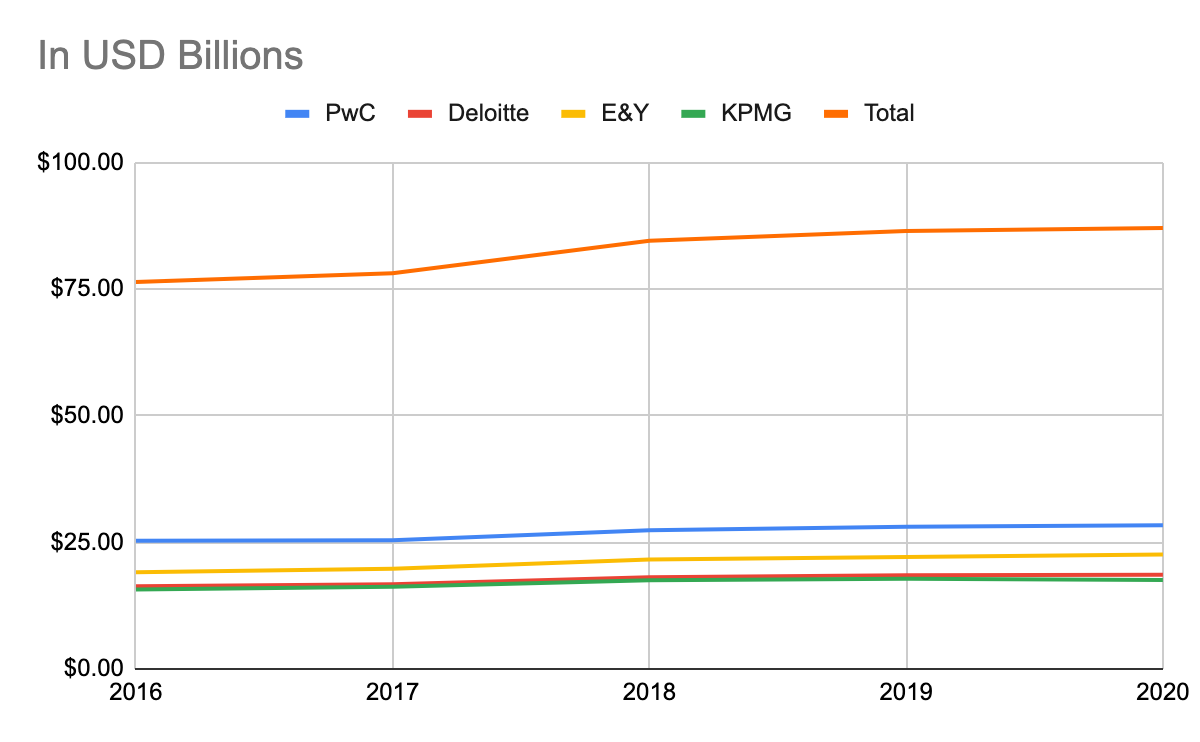

I looked at the fees earned from audit and accountancy services by the big four, E&Y, PwC, KPMG, and Deloitte.

In 2020 we paid a tax of $87.09 billion to these bean counters. This number will go to zero, while accounting statements become perfectly accurate. It’s just that simple.

In 2020 we paid a tax of $87.09 billion to these bean counters. This number will go to zero, while accounting statements become perfectly accurate. It’s just that simple.

The Ratios

Ethereum is the most developed, decentralised smart contract network. Even though the gas fees are currently astronomical, it is a good problem to have. No other public smart contract-enabled blockchain operates at the scale of Ethereum. When they do, I will refresh this analysis.

Nothing in life is free, and this is doubly true in the crypto capital markets. Every action on the Ethereum network incurs a fee. We can think of this as income to those that keep the network up and running, or the tax we as consumers pay to use products and services enabled by ERC-20 Dapps.

I’m using transaction data collected on Glassnode. I have plotted the revenue multiple for the Ethereum network going back four years. The reason I look at this metric is this is what we pay to use these networks. Any of the Dapps that ride on these protocols must pay as well to utilise the network. The fees any Dapp charges over and above the fee to utilise the base layer protocol will be competed away to some natural rate which we won’t be able to observe until the near future. That is why I don’t look at individual fees charged by very successful Dapps that disintermediate various sectors of traditional centralised finance.

A portion of all fees spent using the trust rent-seeking gatekeepers of the traditional financial economy could in the future accrue to these networks. Obviously, DeFi aims to improve service at a lower cost, so we cannot assume that all funds spent in the CeFi world directly translate to earnings to the base protocols and the Dapps they enable. Therefore, let’s just look at a high level to contextualise why this is such an amazing opportunity.

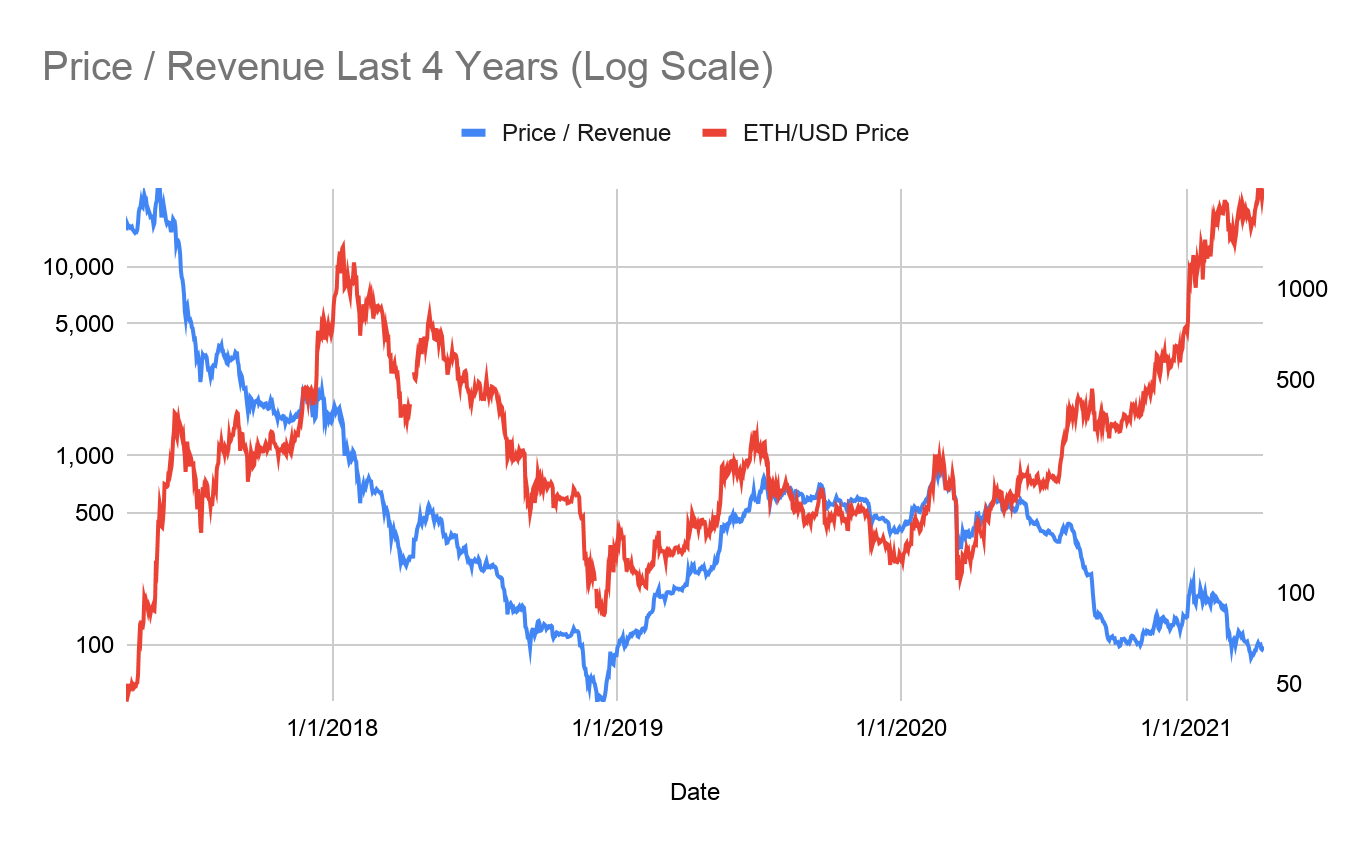

Above are time series of Ether’s price-to-last-12-month’s revenue, where revenue is defined as transaction fees excluding miner block rewards. This chart covers the last 4 years, with the initial spike concurring with the ICO craze in 2017.

Above are time series of Ether’s price-to-last-12-month’s revenue, where revenue is defined as transaction fees excluding miner block rewards. This chart covers the last 4 years, with the initial spike concurring with the ICO craze in 2017.

Both chart Y-axis are in log scale so we can truly appreciate the exponential nature of the time series data. The most interesting thing is currently as ETH hits new highs, it’s Price / Revenue is at the low end of its historical range.

If you are mean reversion acolyte, consider the following:

10 April 2021 Price / Revenue: 98

Mean Price / Revenue: 1,528

Median Price / Revenue: 430

Standard Deviation: 3,939

April 10 2021 ETH/USD Price: 2,071

Price if Median Reverts: 9,054

Price if Mean Reverts: 32,143

These are very optimistic high level guide posts using basic statistics. It doesn’t mean it will happen, but it shows that if data behaves as data does in large sample sets it is not improbable to reach these levels.

Ethereum is a decentralised computer, and compute power costs money. The more useful DeFi applications built on Ethereum become, the more fees will be paid by users escaping the rapacious CeFi platforms. Currently the Price / Revenue ratio stands close to 100, which is at the lower end of its range.

This ratio is a backward-looking measure. From April 2020 till now, here are the Price / Revenue statistics for ETH:

Min: 86

Max: 608

Median: 169

Mean: 255

Standard deviation: 168

Let’s run with the median as a forward looking approximation to value the Ethereum network. Let’s assume that Ethereum can capture some percentage of the 5-year average earnings of banks and the big four audit firms. In addition to the usage fees accrued by Ethereum’s base layer protocol, the Dapp that sits on top will also charge some fee to use its service. Therefore, we must err on the side of assuming that the amount that actually accrues to Ethereum vs. the Dapp is smaller.

Below is a table depicting a hypothetical scenario where for the next 12 months a certain percentage of revenue is diverted from a centralised to a decentralised service.

|

Price / Rev Multiple |

169 |

||

|

% Captured by DeFi |

F12M Revenue |

ETH Marketcap |

ETH Price |

|

100% |

$2,764,828,661,977 |

$467,232,454,281,093 |

$4,059,669 |

|

50% |

$1,382,414,330,988 |

$233,616,227,140,547 |

$2,029,834 |

|

25% |

$691,207,165,494 |

$116,808,113,570,273 |

$1,014,917 |

|

20% |

$552,965,732,395 |

$93,446,490,856,219 |

$811,934 |

|

10% |

$276,482,866,198 |

$46,723,245,428,109 |

$405,967 |

|

5% |

$138,241,433,099 |

$23,361,622,714,055 |

$202,983 |

|

1% |

$27,648,286,620 |

$4,672,324,542,811 |

$40,597 |

|

0.50% |

$13,824,143,310 |

$2,336,162,271,405 |

$20,298 |

|

0.10% |

$2,764,828,662 |

$467,232,454,281 |

$4,060 |

The numbers are quite extraordinary, but as this is a very rough, high-level contextualisation of a very uncertain future, it’s unlikely to be totally accurate. At 0.50%, the price of ETH, assuming that amount of activity is diverted to its ecosystem, implies a 10x price appreciation from current levels; at 0.10%, the exercise implies a doubling of the ETH price. I am very certain that DeFi can take away at least 0.50% of activity from CeFi. Can DeFi exhibit an even higher degree of success? Absolutely. If I’m happy with 0.50%, imagine if we blow the doors off and get 10x that or 5% of revenue.

When you take a high-level approximation that shows you will make money even when you are assuming the worst-case scenario, get long whatever the fuck you are valuing.

The problem is simple: the current financial architecture has not adopted technology at the rate it should. The market clearly shows a sclerotic financial services system evident in the equity valuations of its major players. The solution may be DeFi. DeFi is powered by public blockchains which feature smart contracts. While Ethereum is the best of the lot right now, there are others out there attempting to capitalise on its foibles and become the top dog – including Polkadot, Solana, Cosmos, Cardano (when Godot arrives and smart contracts are finally available), etc.

At 0.50% of the revenue earned by the CeFi companies researched, that is still $14 billion of revenue on which a multiple will be applied. As you can see from ETH, the market attached a very high multiple vs. the transaction fees generated to an immature ecosystem. Therefore, even a spray and pray attitude to smart contract base layer chains that have a shot plundering some CeFi booty could, at the portfolio level, generate a high return.

The danger is that if you are intellectually lazy, you will invest in any project that says the right things on the surface. Take a word cloud of the most read Medium posts about DeFi, stuff that onto a slick looking website, and I bet you would attract large sums into your wallet from punters looking for the next Ethereum. That is why I implore the footballers I lunched with to read the Bitcoin whitepaper and research what they don’t understand. Only when you witness and appreciate beauty can you protect your capital from ugliness.

Related

The post appeared first on Blog BitMex