(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

One fine chill day in my senior year of university, one of my besties frantically called me in hopes I could help her pass an upcoming economics exam. I obliged, and we met up that day to go over some material. She provided a practice exam and we attempted to tackle the first question.

To kick things off, I asked her to draw the demand curve. She looked at me like I was speaking Aramaic. I dug a little deeper, and asked if she understood how to represent a demand or supply curve linearly with a given slope. Again, she was silent. She had a few days at most until the exam, and I told her if she couldn’t even draw a line, there was no hope of me being able to teach her enough stuff to pass this exam. She somehow managed to pass, no thanks to my efforts.

Currently, she runs her family’s pizza restaurant. We were chatting recently about the issues she is facing due to the pandemic.

Labour Issues: She employs a lot of university-aged kids. As schools are going back to in-person classes, she is losing a lot of labour. However, she can’t replace lost workers easily because with all the various government checks, her wage rate is not competitive with Netflix and Chill courtesy of the USG.

Food Inflation: She lamented about the spike in the cost of chicken and beef. She raised her delivery charge from $1 to $2. People were pissed— that charge hadn’t changed in 40 years. Hmm… 40 years is about how long it’s been since real wages have grown in the US.

Here are some colourful snippets of our WhatsApp chat:

“Customers crazy”

“Prices of all goods crazy”

“Chicken”

“Pork beef”

“And there’s so many things I don’t even want the customer to order because I’ll lose money lol”

“People already complain”

“They complain I made the delivery charge $2”

“When for 40 years it was only $1”

“Or the fact that we have a $15 minimum for delivery and people want a single sandwich delivered when I tell them they say that they only have $10.”

The conversation drew to a close when she asked on behalf of her brother whether Cardano was a good crypto to buy.

“I don’t know wtf it is”

“I still can’t draw a line”

“Basically he wants to make the most money”

As usual, I disappointed her again by not providing the golden ticket to crypto riches (because I don’t have it). I gave my usual spiel about reading the white-paper, linked her to my blog, and told her to tell her brother there are no shortcuts.

I tell this story to illustrate the gulf between an-on-the ground economic reality, and what our classically trained economic mandarins proclaim their “models” tell them about the health and trajectory of the global economy. All those erudite university grads can certainly draw lines. I can draw an IS / LM model like the best university regurgitator student. But these same people tell us inflation is “transitory”. At some point business owners will have to pay more labour to fill positions, and pass labour and input cost increases onto customers. I promise this essay will not be another diatribe about inflation. This fortnight we talk about the Kwisatz Haderach, LEVERAGE!

Many very intelligent economists pooh pooh the crypto financial markets because there are platforms that offer high leverage. They are scared of leverage because they know the damage it can cause in the traditional financial (TradFi) system they support. However, they fundamentally do not understand the difference between TradFi and the crypto capital markets. This essay will be an intellectual exercise that culminates in a proof that the TradFi system is inherently unstable and the leverage of its participants always leads to constant bailouts by us the taxpayers and users of fiat currencies that must be inflated to pay for banking losses. The crypto capital markets, on the other hand, can suffer 50% drawdowns at most in one trading day, and the underlying blockchain value transfer infrastructure requires no assistance.

Those who should know better – at least, given their supposedly deep understanding of the plumbing of the fractional reserve fiat credit based financial system— have often derided crypto with throw-away comments about highly leveraged traders. I recently read this gem in the 28 May 2021 issue of Grant’s Interest Rate Observer:

“As it is, two Wednesdays ago, at a zero-percent federal funds rate, just $9.4 billion in margin liquidations toppled the combined crypto market cap to $1.4 trillion from $2 trillion, according to Bloomberg, which drew on data from Bybt.com. “Crypto,” Vijay Ayyar, head of Asia Pacific region for crypto exchange Luno Pte., told the news service, “is still a much ‘wilder West’ than any other asset class, where you can trade on some exchanges for up to 50-100x leverage.”

A crucial point I will elaborate on during this essay is that, yes, the crypto capital markets are volatile, and that volatility is driven by leverage that affects the short-term price of various coins. But, I will also share some very simple metrics that demonstrate how leverage flows through the system and how the socialised loss model employed by all leading crypto centralised derivatives platforms actually ensures (1) the platforms are always protected and (2) customers cannot owe more than their initial margin. That is in direct contrast with the unlimited liability customers face when using TradFi intermediaries, as well as the potential for volatile trading days to halt all trading. Can I get a Can’t Stop, Won’t Stop, GameStop shown at your local AMC theatre?!

For all those would be crypto punters sitting in seats at the newly created crypto trading desks of the Tradfi banks, this is a must read so that you understand how leverage snakes through the crypto capital markets. You ain’t in Kansas anymore, and because your yearly bonus is predicated upon predicting short term price movements, failure to understand these concepts will land you right back in Dallas trading equities.

Monetary System Funderrrrmentals

Monetary systems can largely be broken down into three parts.

Monetary Unit – This is the unit of account that is used to store value and pay for goods and services.

Value Transfer Mechanism – This is how monetary units are moved between actors within the monetary system.

Financial Intermediaries – These are the entities that provide financial services to the system. The most important function is amassing monetary units from savers and funneling those savings to entities that wish to pay an interest rate to borrow said funds.

Here is a simple table that depicts the differences between TradFi and Crypto.

|

TradFi |

Crypto |

|

|

Monetary Unit |

Government issued fiat currency, e.g. USD, EUR, CNY etc. |

Native network token, e.g. BTC, ETH etc. |

|

Value Transfer Mechanism |

Physical cash and bank transfers |

Public blockchain |

|

Financial Intermediaries |

Banks |

Centralised and decentralised exchanges, wallet providers, collateralised lending operations |

There are some fundamental differences between TradFi and Crypto that, from a first principles perspective, lead to different outcomes when leverage is used within the system.

Monetary Unit

TradFi

Governments issue the monetary unit. They determine the monetary supply and can change it at will. That is why we call it fiat currency. Central banks are the arm of the government usually responsible for the upkeep and maintenance of the system. Central banks regulate commercial banks that create money via the issuance of loans. Both central and commercial banks can expand the money supply via credit issuance.

The network has a set of rules that all participants agree upon if they choose to run the open source software. A native token is issued and governed by said rules. The total number of tokens in circulation can change, but it requires agreement of at least 51% of the network. In bitcoin’s case, participants agree that only 21 million bitcoin shall ever be in existence. No one person or entity can unilaterally decide to change the quantum of the bitcoin supply.

Takeaway

In TradFi if there is ever a situation where the monetary supply needs to expand or contract, the government can, at will, change the rules of the game without any other participants’ agreement. In crypto, the monetary issuance schedule cannot be changed unless the majority of the network agrees. The more parties that provide resources to the network, the harder it is to form agreement, therefore, changes become more difficult the more successful the crypto network becomes.

Value Transfer Mechanism

TradFi

You can hold physical bank notes or bank demand deposits. Given the complexity and global nature of the TradFi system, unless you are paying locally for goods and services, physical cash is not used. The vast majority of funds are held in banking institutions. Banks obtain a charter from the government, which in essence is a license to print money—despite being private entities— because they are allowed to issue credit.

Without banks, value cannot be transferred between parties. Said another way, if banks go out of business for whatever reason, value will cease to flow between economic participants. We will come back to this potentially dire hypothetical shortly.

Any entity with compute power and an internet connection can validate and publish blocks. For certain consensus algorithms such as Proof-of-Work, at scale, it becomes economically efficient to be as large as possible. In 2021, it is almost impossible for an individual to mine Bitcoin on their home computer. However, should all the massive mining farms go offline, the network will adjust to lower the difficulty of producing a block, which would allow hobbyist miners to again discover and publish blocks.

There is no third party, like a government, that confers the license to contribute compute power to a public blockchain. It is open to all equally. This is a key tenet of the anti-fragility of a public blockchain; the decimation of the large players does not lead to a complete breakdown of the system. Please watch carefully how the network adapts to the vast amount of hashpower being shut off in China.

Takeaway

If all banks fail en masse the TradFi system ceases to operate effectively. If all large miners fail en masse the Crypto system will experience a hiccup as difficulty adjusts but value can still be transmitted between parties.

Financial Intermediaries

TradFi

The most important and largest intermediaries are banks. They have the government-issued license to accept deposits. Then they can multiply those deposits (printing money) by creating loans to worthy borrowers. The bank places its equity capital and deposits against said loans. The central bank determines the leverage banks can use, but we all know if everyone wants their money back at the same time, the bank will not be able to satisfy all requests. Practically speaking, the government can print as much money as is necessary to make good on all banking system liabilities. Therefore, it becomes a political decision on which constituents experience a haircut on their deposits during a banking crisis.

There is no requirement to use any private entity to interact with the public blockchain. You are your own financial institution. However, there are benefits to centralisation. A variety of private companies offer services such as saving, lending, and trading. These firms can offer a lot of leverage. But because no singular entity can print native tokens into existence, should an intermediary run into trouble, there is no cavalry to return lost funds.

Takeaway

The government can print all the necessary fiat currency to cover all bank liabilities should the bank fail. For any crypto intermediary, if the firm cannot make good on its promises, clients are assured to lose some or all of their capital.

The Problem

The fundamental problem with TradFi is that banks operate the Value Transfer Mechanism and are the largest intermediaries. Governments are concerned about the stability of the broader financial system. Therefore, if the banking system over-leverages itself, and suffers cataclysmic losses, the government must always bail it out. The fact that the government can print the money to cover any and all bank losses with a key stroke means it must use this power every time there is a banking crisis. This is especially true as the global economy has become more complex and interlinked. The only mechanism to stay the decision to bail out the banks is the potential ensuing goods and services inflation which results from the expansion of the money supply.

Banks are private institutions. If you know that the government will always bail you out because it must for the sake of the broader economy, then you will take as much risk as the rules allow. You need not use your common sense to determine if the rules are appropriate, just OBEY! The complexity and size of the global economy also necessitates that to truly be a player, banks must be publicly-funded enterprises via listing on a national stock market.

Bank senior management are paid on an annual bonus cycle for taking risk; they are incentivised to take as much as possible. Risk could be trading stocks, or lending to a particular sector of the economy. If they get it wrong, the public shareholders suffer losses and could get wiped out, but management will most likely keep their jobs as the government needs them in order for the bank to continue transmitting value. If they get it right, they get a big bonus. Matt Levine of Bloomberg Money Stuff always quips that investment banks are socialist paradises operated for the sole benefit of their employees.

This is why leverage is such a dirty word. Everyone knows that leverage can blow up the banking system, and that if it does, the government will swoop in, print money, and possibly create inflation. What they fail to see is that the solution to this problem is to ensure that the value transfer process is not managed by for-profit financial intermediaries.

The advent of Bitcoin, which pioneered distributed ledger technology, now allows Central Bank Digital Currencies (CDBC) to use private permissioned blockchains. The central bank could nationalise the value transfer mechanism by giving all citizens a digital bank account directly with the government. The problem with this is that it would completely alter how the Too Big To Fail commercial banks operate. In essence, the central bank would be competing with the banks that are its shareholders and those it regulates.

If there was a FedCoin that you could hold directly with the US Federal Reserve, why would you hold any USD with a commercial bank? You would only hold money outside the Fed if the rate of interest offered was attractive. The rate of interest would only be attractive if the third party financial intermediary originated loans to solid enterprises that could pay a suitable rate of interest at a modicum of risk appropriate for the general public. That, my friend, is what banking should be about, but because banks have a license to print money and a stranglehold on its movement, they punt dodgy assets and go broke all while picking up a phat Christmas bonus.

Lazy economists and macro pundits hold the misconception that the crypto markets operate similarly to TradFi. They do not. The value transfer mechanism is divorced from the activities of the financial intermediaries. Therefore, financial intermediaries in the crypto markets live and die by their business models and risk management systems. If they blow up, there is no saviour. Unfortunately, customers lose money, but the network continues to work as outlined by the source code.

Leverage in crypto cannot cause a systemic failure of the ecosystem. Any losses would be local and limited to holders of intermediaries’ IOUs and/or individual crypto assets.

Let’s look at how crypto handled Mt Gox and how TradFi handled the 2008 subprime mortgage crisis.

Case Study Mt Gox Bankruptcy vs. 2008 Global Financial Crisis

Mt Gox

At its height in Q4 2013, Mt Gox transacted multiple hundreds of millions of USD worth of bitcoin every day. It was THE dominant exchange at the time. Mt Gox set the global price of bitcoin.

Cracks in the edifice started in Q3 2013. People began complaining about serious delays in USD withdrawals. Slowly the BTC/USD price on Gox crept to a larger and larger premium above the global average. People surmised that Gox had no more dollars, so the only way to retrieve funds was to buy bitcoin and withdraw.

By early 2014, Gox BTC traded at a 10%-20% premium to the rest of the market. Then, one day, they shut all withdrawals and halted trading, citing accounting discrepancies. A few days later they filed for bankruptcy.

Gox lost 750,000 BTC and 100,000 BTC of client and company funds respectively. At the time, that sum represented 7% of the supply of bitcoin outstanding. Imagine if an intermediary “lost” 7% of the supply of USD-what would happen to the global financial system? BOOM!

What happened to bitcoin? Blocks kept coming.

What happened to other intermediaries? They kept matching trades. The big three in China (OkCoin, Huobi, and BTC China) took the mantle of the most liquid exchanges followed by Bitstamp and Bitfinex outside of China.

Did Gox get a bailout? Nope. The bankruptcy process is still ongoing. Customers have recovered nothing so far.

The crypto capital markets kept functioning as per normal. The only change was an exchange no longer existed, and the price of bitcoin dropped roughly 40%.

Is bitcoin higher today than it was in 2013? Does the Pope wear a pointy hat?

The system survived even though a serious player bit the dust. Customers lost funds that have still not been replaced. We will probably never know how much leverage Gox used right before imploding. But it doesn’t matter, because in crypto, the intermediaries do not uphold the payments system and take financial risk.

2008 GFC

In the summer of 2007, two Bear Stearns hedge funds suspended withdrawals, citing losses due to subprime mortgages. Bear Stearns would be forced into the loving arms of Jamie Dimon for the grand total of $2 per share in less than one year. I remember my corporate finance professor telling all the seniors that had Bear Stearns offers not to worry, the system would bounce back and they would find jobs at other banks.

Lehman Brothers succumbed on Monday 15 September 2008. I vividly remember that day as it was my first day on the trading floor at Deutsche Bank in Hong Kong. I sat down and watched the head of trading flit back and forth across the floor announcing which banking counterparties the traders could face. It appeared as if everyone was going DOWN!

Jim Cramer’s epic and prophetic August 2007 clip where he proclaimed the Fed knew nothing captures the zeitgeist.

Remember – subprime mortgages were a small slice of the massive US mortgage market. The vast majority of originated mortgages were conforming, which meant the credit scores met the criteria for the quasi-government agencies to repurchase them. Banks leveraged this small slice of the American mortgage market due to the insatiable appetite of global investors for high yielding paper. Because … housing never goes down!!!

The 2008 GFC wiped almost 6% off global GDP and cost over $3 trillion dollars of economic damage. This is due to the leverage amplification of the global fractional reserve banking system.

Meanwhile, Mt Gox “lost” 7% of the supply of bitcoin. Bitcoin did not need a bailout to continue functioning – nor could one technically be given. But man, did the global financial system need some serious wampum after the GFC.

The decision on who gets a bailout is always a political decision. In the fiat TradFi system, the government can always print more currency to cover any losses. The US Congress balked at first when the Treasury Secretary proposed the Troubled Asset Relief Plan (TARP) to bail out the banks.

Media reports at the time claim Henry Paulson dropped on one knee before Nancy Pelosi and implored her not to “blow up” the deal.

The market continued puking and forced the government to come up with the dollars to save the system.

The heads of the major banks that effectively were being nationalised called up Don Cornelius and took the Soul Train – aka the Amtrak Acela – down from New York to Washington to bend the knee.

The banking system got their money, paid their bonuses, and moved on. But those who had negative equity mortgages due to the collapse in housing prices had to pay every cent or lost their home. The mortgages were denominated in USD, therefore the government could have made them whole as well. Again, this was a political choice to bail out the mortgage-backed asset holders (banks and other financial institutions) over the debtors (regular citizens).

This illustrates that when the value transfer mechanism’s validity is threatened, the government will and must print the necessary fiat duckets to ensure the wayward financial intermediaries can continue operations.

How Leverage Works in Crypto

What exactly is bitcoin? Is it property, a currency, a commodity, data, a network? It is parts, if not all, of these things at the same time. This makes it hard to legally define what it is, and leads to different legal definitions jurisdiction by jurisdiction.

The foundation of a well-functioning financial system rests with clearly codified contract law. The enforceability of contracts gives participants confidence to engage in arms-length transactions with persons and entities they may never actually meet in meatspace. The output of this is trust.

When bitcoin began there was no concept or definition to fall back on. Therefore, if someone owes you bitcoin, how should you be repaid? It is not a straightforward question, and beyond the scope of this essay. The result of the ambiguity as to the nature of bitcoin means that “not your keys, not your coins” is the only law of the metaverse.

From a centralised crypto platform’s point of view, the only assets you have claim to are those that are in wallets the platform controls. From the customer’s point of view, it means that their financial obligations to the platform are limited. They cannot owe more than their initial margin, regardless of how poorly they trade.

If you deposit 1 bitcoin of margin, leverage the position 100x to a size of 100 bitcoin, and the contract price goes down 10%, the total loss is 10 bitcoin. You only placed 1 bitcoin with the platform, and therefore, the customer only loses their one bitcoin. The other winning side is owed 9 bitcoin. 10 bitcoin loss – 1 bitcoin margin = 9 bitcoin deficit.

To handle trading losses in excess of margin, crypto trading platforms tax profit or close out winning positions early. In the above example, to handle the 9-bitcoin shortfall, the leading crypto derivatives platforms will close out a winning trader’s position using the bankruptcy price of the losing trader. In that way, the total amount of margin that can be won is equal to the total amount of margin that can be lost assuming the limited liability nature of trading. In English, if there is only 1 bitcoin of margin on the long side, and the price falls, the shorts can only earn 1 bitcoin of profit. Each platform tweaks the process of closing out winning traders early slightly, but they all, for the most part, follow the blueprint described above.

The net result is that no matter how significant the liquidation of traders is, the losses will not spread out beyond the shores of individual platforms. No platform could be considered a crypto Systemically Important Financial Institutions (SIFI) because even if all traders were liquidated (a highly unlikely scenario) their losses are contained because of the limited liability nature of trading. It is fortunate that no one was willing to buy seats when the crypto capital market formed. That would have prevented the development of the more resilient antifragile system that exists today.

This is in direct contrast to how a typical margin or leverage agreement is structured and how losses in excess of margin are handled with a TradFi intermediary. With a TradFi intermediary, the customer pledges their entire financial net worth against any debt owed to the intermediary. TradFi intermediaries can and will sue their customers if trades go against them and push the customer into negative equity.

A typical TradFi exchange / clearinghouse also has members that put up collateral to cover situations where the deposited margin is insufficient to cover trading losses. Members have a liability to the clearinghouse which daisy chains them to the financial performance of every single contract market offered. Losses in some esoteric corner of the financial market, if big enough, can cause material capital losses to unrelated financial institutions who are members of exchanges / clearinghouses.

The transmissibility of risk due to the underlying structure of the TradFi exchange / clearinghouse model is why many supranational financial regulators consider large TradFi exchanges SIFI. If you are a SIFI it comes with additional oversight, but the upshot is that if you are on the brink of failing you can count on a bail out because for the health of “the system”, you must survive.

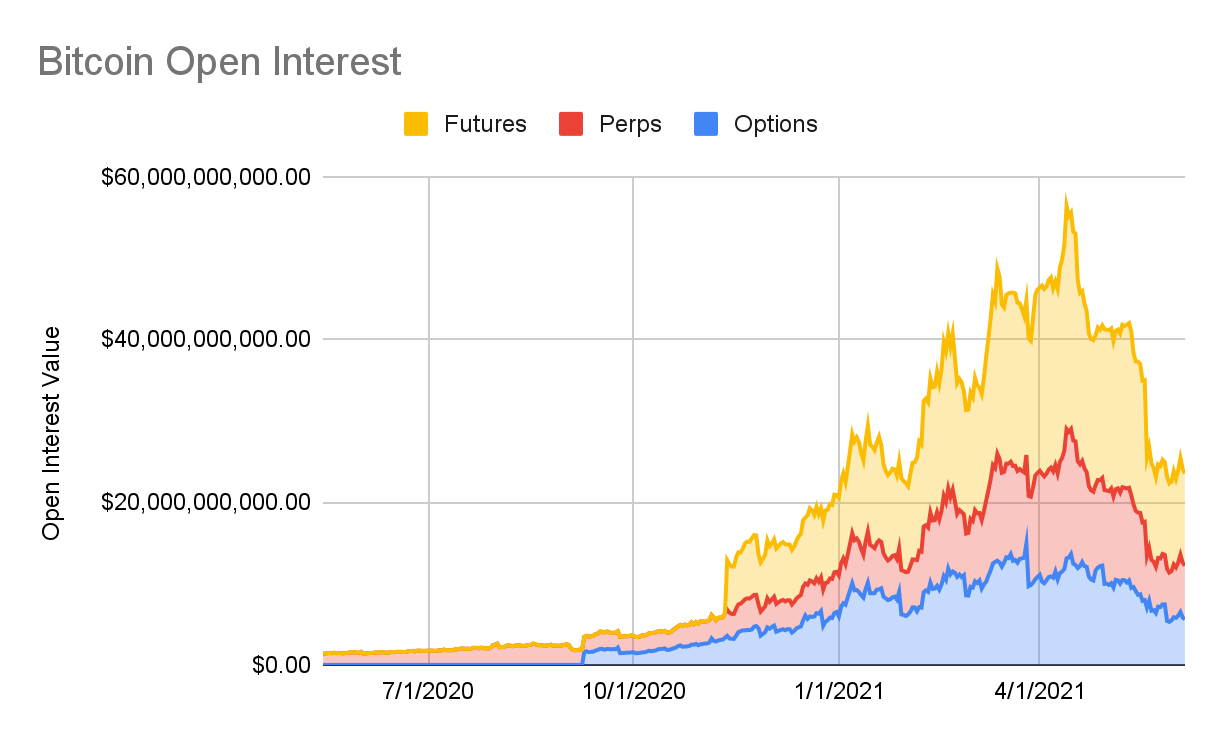

A rough proxy for the amount of leveraged positions on the major centralised derivatives platforms is open interest (OI).

Open Interest Example:

Imagine that there are three traders A, B, and C who all start with a position of 0 contracts.

A buys 1 contract, B sells 1 contract, OI goes from 0 to 1.

A = 1 Long

B = 1 Short

C = No position

A buys 1 contract, C sells 1 contract, OI goes from 1 to 2.

A = 2 Long

B = 1 Short

C = 1 Short

B buys 1 contract, C sells 1 contract, OI does not change, it’s still 2.

A = 2 Long

B = No position

C = 2 Short

A sells 2 contracts, C buys 2 contracts, OI goes from 2 to 0.

A = No position

B = No position

C = No position

OI tells us how many leveraged long and short positions there are on a given platform. While we don’t know the weighted average leverage employed by the average trader, we know some amount of leverage is being used.

I used data from Glassnode to arrive at an approximation for the amount of leveraged notional that exists in the bitcoin market.

The interesting point is that even though the volumes on the derivatives platforms are orders of magnitude larger than the spot platforms, the OI is extremely small when compared to the overall size of the market. I’m sure some gold bugs can find a shocking chart that shows the OI for COMEX gold contracts vastly exceeds the amount of physical gold available to settle. Things that make you go “hmm …”

If all the crypto derivatives platforms imploded this instant, the short-term price impact would be negative, but longer-term the leveraged positions do not represent a meaningful percentage of the market. This ratio will surely grow as the ecosystem matures, but the vast majority of leveraged trading volumes occur on platforms that, by design, can’t spread losses outside of their walled gardens. The interconnectedness of the exchange, clearinghouse, and member in the TradFi system amplifies losses and leads to systemic issues that will always result in a bailout funded by monetary inflation.

The Real Masters of Leverage

Y’all know what time it is. If I start with proclaiming the virtues of crypto, I need to deride some foibles of the TradFi central banking system. As the name implies, a central bank is a bank. Like all banks and private companies in general, a central bank has an equity cushion on the liability side of its balance sheet. This cushion would suffer losses if the assets it holds suffer a decline in value.

Every central bank is funded by different sorts of entities. Many are nominally private institutions that have sold shares to the banks they regulate. It’s immaterial to this discussion who or what purchased equity of a particular central bank, just know that they are operated just like any other company.

As we know from corporate finance (long aaaaaa sound, cause I’m fancy like that), equity holders suffer the first losses. Banks are typically regulated based on their Tier 1 Equity / Total Asset ratios. The higher the ratio, the sounder the bank.

My research assistant compiled public filings for the following central banks to determine their leverage ratios.

In total, these banks represent approx. $36.5 trillion worth of assets. They are leveraged, wait for it, oh yeah the drop is coming, your head is about to explode cause the baseline is so dirty:

96.35x, Can I get a 100x!!!

And a special shout out to the honourable inhabitants of the Marriner Eccles building, who use a respectable 200x leverage. The only major central bank with a larger leverage ratio is the Bank of Canada, who uses 850x leverage.

Usually, the largest category of assets on any central bank’s balance sheet are the bonds of their domestic government. If interest rates rise and bond prices fall, they better be able to hang ten or it’s wipeout city. The situation is not so dire because their profligacy is matched by their ability to print money. Therefore, although they can go bankrupt quite easily, they can just as quickly print the money needed to cover any losses. The issue is that monetary inflation leads to inflation in the real goods and services the plebes care about.

We also looked at the leverage ratios for the ten largest commercial banks globally.

Their total assets clocked in at $31.5 trillion and they collectively were leveraged a modest:

14.04x

I love me some good Whataboutism, and it’s oh-so-juicy to highlight the inherent contradictory claims of the danger of crypto leverage when viewed against the TradFi system we aim to replace. The problem isn’t the leverage, the problem is who pays for the inevitable losses. In crypto, the customer covers their initial margin, and the business is responsible for coming up with the rest– potentially folding in the process. But the wider ecosystem continues unaffected, save for short term price implications. In TradFi, the banks never fail. They can’t because of their role in global payments, but we the global citizenry pay for the losses via inflation.

Related

The post appeared first on Blog BitMex