During a recent interview with Bloomberg, the prominent BTC bull spoke about the adverse short-term effects of China’s recent crackdown on Bitcoin mining. While he acknowledged the hash rate and price declines, Saylor believes this ‘mistake’ from the Asian country will provide an excellent opportunity for others.

- As CryptoPotato reported previously, the world’s most populated nation intensified its crackdown on the cryptocurrency space this year. More specifically, the Asian Superpower went after Bitcoin miners and ordered them to cease operations, citing environmental issues.

- Being the country with the largest share of BTC mining, these actions impacted the network immediately. Not only prices started to tumble, but the hash rate dumped to a multi-month low.

- Some reports indicated that some miners are relocating to other countries like Kazakhstan and the US, but the process will take time, which is why the metric fails to recover while it awaits the subsequent difficulty adjustment.

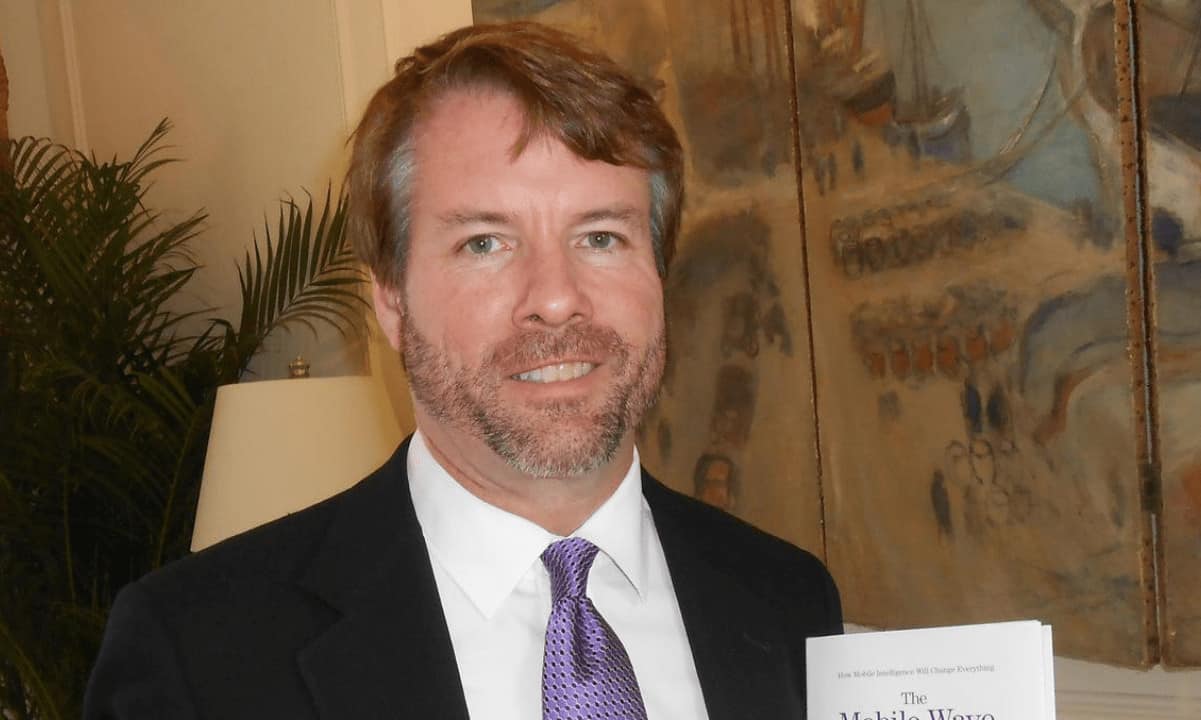

- Michael Saylor touched upon this worrying topic while speaking to Bloomberg and attributed the price drops to Chinese miners being forced to liquidate their positions.

- While talking about China’s decision to oust miners, he called it a “trillion-dollar mistake” for the country, which could actually provide opportunities for others.

-

“China had a 50% market share of Bitcoin, and they were generating $10 billion a year and a business that was growing 100% year over year. And then, the government cracked down on it and squeezed the entire industry out of China. I think that given the growth rate of Bitcoin, this will turn out to be a trillion-dollar mistake for China.”

- Although he admitted that a nation as powerful as China could “afford to make a trillion-dollar mistake,” he still classified the move as a “tragedy.”

- Nevertheless, the low prices are a “great opportunity for Western investors,” including the company he runs, to accumulate more portions of the asset at a discount.

- Saylor believes North American Bitcoin miners will also benefit from this because “their cost is the same, but they are going to generate 50% more revenue or 75% more revenue for quite a while.”

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 50% free bonus on any deposit up to 1 BTC.

The post appeared first on CryptoPotato