The number of open shorts positions on leading cryptocurrency and derivatives exchange BitFinex is at a two-year high as bitcoin price returns to the monthly lows amid $30K.

The current amount of shorts is the highest since June 17, 2019, forcing more traders to wonder whether BTC is set for further dips, which may lead to a first daily close below $30K since January 1st, 2021.

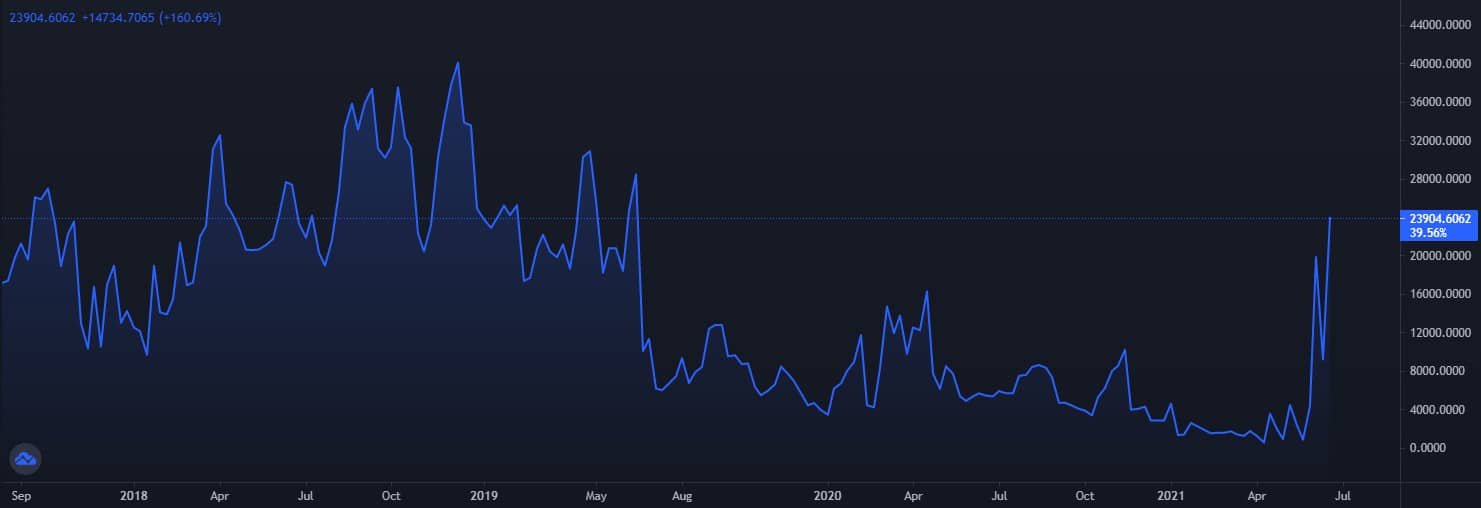

Bitfinex Shorts Hit 2-Year High

According to recent data by TradingView, short positions on Bitfinex saw a sharp increase in the early hours of Friday, just before Bitcoin’s price dropped by $4,000 towards yesterday’s low of $31.2K, according to Bitstamp. Today, the number of open shorts increased even more, setting a new 2-year high.

The same event, of a rapid sharp increase, was witnessed a few days ago, as short positions piled up to reach their peak on June 18, and then decreased significantly until reaching a 2-week low as of yesterday, June 25, before sharply rising once again.

Zooming in the chart can reveal a quick increase followed by a drop on Tuesday, June 22, which marked the lowest price Bitcoin traded for since January – $28,600.

ADVERTISEMENT

As mentioned above, the increase in the number of shorts yesterday and today has pushed shorts positions on Bitfinex to levels not seen in the last two years. There is now 23900 BTC worth of open short positions, valued at almost $700 million as of writing these lines.

The number even reached almost 26500 BTC short positions earlier today, which marked the highest since June 17, 2019.

Bitcoin Whale Behind And Some Bullish Hope

The current spike in shorts on Bitfinex was reportedly due to a whale shorting a significant amount of bitcoins on the platform. Wu Blockchain noted that the whale borrowed 15,157 BTC, and the action broke the long-short ratio, causing the number of short positions to increase significantly.

Meanwhile, the bulls are not relenting as the total number of long positions continues to hold strong and currently at its ATH, perhaps due to the strong fundamentals surrounding bitcoin.

Recently, El Salvador became the first country to adopt bitcoin as a legal tender under a new Bitcoin Law, which will see employees getting paid in bitcoin and several other transactions conducted in the country with the cryptocurrency.

To further boost its chances of implementing the bitcoin law within the country, El Salvador’s president, Nayib Bukele, revealed that the government would give every adult El Salvadoran citizen $30 worth of bitcoin.

The bulls might not lose hope since a high amount of short positions can sometimes lead to a massive short squeeze – where short positions are forced to liquidate due to positions reaching their stop loss and drive more buying power into the market. However,

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 50% free bonus on any deposit up to 1 BTC.

The post appeared first on CryptoPotato