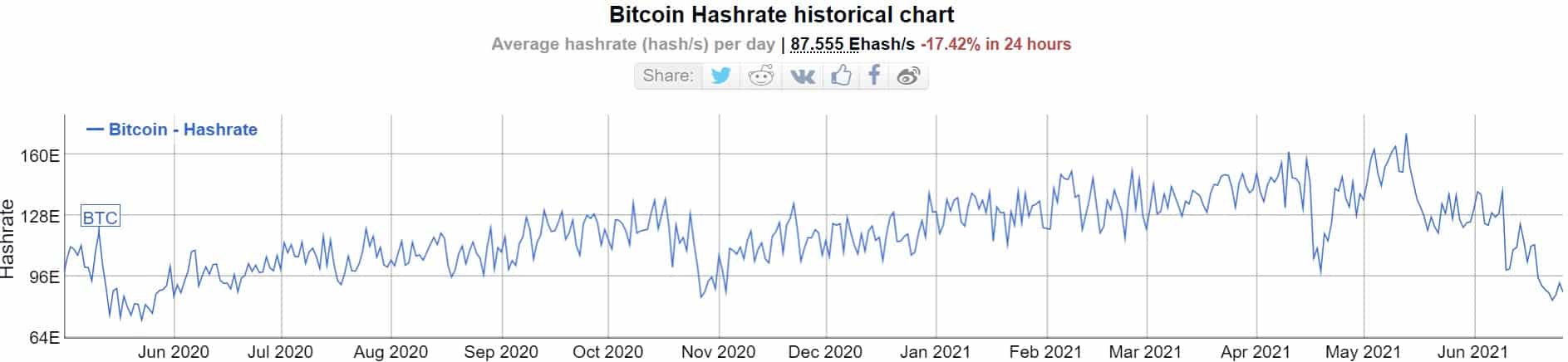

The effects of the Chinese crackdown on Bitcoin mining continue to harm the network as the hash rate has dumped to its yearly low of below 90 Ehash/sec. This comes just days before the next difficulty adjustment, which is expected to be one of the largest in BTC’s history.

Bitcoin Hash Rate Drops to Yearly Lows

The world’s most populated nation decided to intensify its hostile actions against the cryptocurrency industry in May this year when it went after Bitcoin mining. Being the country responsible for over 60% of the mining at that point, it was inevitable that the network will suffer, especially after the Chinese authorities ordered several regions to halt all such procedures.

In a matter of weeks, the hash rate – the metric exemplifying the total computational power miners put into the largest blockchain – started to decline vigorously. Some reports even suggested that the creation of new bitcoins had slowed down because of it.

The situation has only worsened since CryptoPotato’s most recent coverage less than a week ago. The hash rate had decreased to around 100 Ehash/sec back then, which was an eight-month low, but it’s now down below 90 Ehash/sec, according to Bitinfocharts.

ADVERTISEMENT

The metric even dumped to 83 Ehash/sec this weekend, which became the lowest level since mid-June 2020. Thus, the hash rate had plummeted by more than 50% since its all-time high about a month ago when it peaked at over 170 Ehash/sec.

Difficulty Adjustment to the Rescue?

Upon the creation of the network, the unknown person or a group going by the name of Satoshi Nakamoto may have predicted such a rapid decline of the hash rate. To protect the system, though, the anonymous creator(s) implemented a procedure that could ultimately help called the difficulty adjustment.

Essentially, it’s a feature that occurs at every 2,016 blocks (roughly two weeks) and makes it either harder or easier for miners to do their job. In extreme cases like now, the mining becomes easier, which would mean that the network’s hash rate will recover shortly even if the number of miners doesn’t increase soon.

Back in May – when the Chinese government started its crackdown on mining – the difficulty dropped from 25T to 21T. It went through another negative adjustment two weeks later, and estimations show that there’s more coming.

On-chain data shows that the next one should take place in about four days and should decrease the difficulty by more than 23% to 15T. Should it happen as such, this would be the largest negative difficulty adjustment in BTC’s history.

On a more positive side, recent reports asserted that quite a few Chinese miners have prepared to relocate to countries like Kazakhstan and the US. Consequently, they could be back putting their computational devices to work on the BTC blockchain soon. But, until then, the network will readjust itself to become more robust.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 50% free bonus on any deposit up to 1 BTC.

The post appeared first on CryptoPotato