(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

A real trader will make a market on anything.

A real trader will make a market on anything.

Story time.

As many long time readers know, I spent the summer of 2007 in the Deutsche Bank Hong Kong internship program. I rotated on the equity derivatives sales desk. 2007 was an era before the trading floor got woke and banned such demeaning activities as interns getting breakfast and lunch for the desk.

As an intern your only worth was your ability to follow orders and get breakfast, lunch, and mid-afternoon snacks for the desk. In return, the professionals would answer your questions about their day jobs. 20 salespeople worked on the desk. Myself, and another intern who I’m still besties with trekked our sorry business casual wearing asses in the humid and hot Hong Kong summer every day to procure sustenance for our masters.

Every week each salesperson would deposit money in the bank of Arthur from which I would debit the cost of their food. I kept a pretty detailed spreadsheet of what each person ordered, the date, and the amount.

That’s all pretty standard, but as an enterprising and broke intern, I endeavored to make a profit from my role as a food sherpa. I charged a pretty hefty spread on every order such that I made a few hundred dollars per week profit. Lest you think I acted out of line, everyone on the desk knew what I was doing, and tacitly approved. Game respects game.

Last fortnight, I opined on the philosophical underpinnings of the NFT craze. This essay focuses on different simple emerging trading strategies. Put aside the question of intrinsic normative value of NFTs, and appreciate that thousands of ETH and BTC change hands every month in the NFT markets. As crypto traders, we must participate lest we leave money on the table. Similar to the story above, are you willing to use any opportunity to your benefit? While this won’t be an exhaustive deep dive into the microstructure of the NFT trading markets, hopefully this serves as a launch pad for more study of alpha generating trading strategies.

The Meatspace Art Markets

Trading analogue art is very expensive due to the massive spreads the various agents take throughout the journey from the creator to the collector. These fees are necessary to pay for the enormous costs to create an environment in which rich people feel comfortable parting with their money for intrinsically useless matter.

The gallerist is the front line of the gravy train. They are trying to discover the next hot thang. A gallery is akin to an exchange. They cultivate a supply of rich patrons, and secure exclusive distribution deals with artists they believe will resonate with their collectors. For this service, galleries take a massive spread in the form of double-digit percentage markups on the artwork. The spread on its face appears egregious but the gallery has real costs to pay. The gallery must pay rent to operate a swanky white walled space in prime rental districts of world financial capitals such as New York, London, Hong Kong, Shanghai, Paris, Tokyo etc. The gallery must put on shows where they supply expensive libations and finger food for free to entice would-be buyers into the space. Finally, the gallery must also cut in their salespeople as well.

It’s not uncommon for a salesperson to receive a commission of 10% to 20%. This is the primary market.

Once in the hands of the “right” collector, the real fun begins. The gallery and collector work together to create the impression that this artist’s work is worth owning. They spend effort to get the works shown at museums and shows globally to create the allure of quality. Collectors who flip works quickly are looked down upon, for obvious reasons. If the artwork changes hands too quickly or too many times it appears too “commercial”. Art is not a mass market item to be bought and sold – it is a priceless piece of matter to be seen by many, but only owned by a select few enlightened and wealthy individuals. Essentially, the expectation is that once you buy something in the primary market, you are carrying it for a while. Quick liquidity is almost impossible to come by, and attempting to create a real market acts as a price dampener.

The auction houses – such as Christie’s and Sotheby’s – take their pound of canvas when collectors trade works between themselves. They usually charge 20% of the auctioned price, but they will sometimes guarantee the seller a price, which introduces market risk into their business models. The auction houses employ specialists who can tell great stories about a piece of artwork, which entices other collectors to bid on said work. They also attempt to assure the market that a particular piece of artwork is not fake (which they often repeatedly fail at).

The point of this short explanation is to illustrate that traditional works of art change hands infrequently, and transaction costs are astronomical due to all the mouths that need to be fed to keep the market functioning. While the art market trades billions of dollars a year, greater transparency and lower fees would create a more vibrant market.

NFT – Same Same but Different

The most popular NFT projects allow anyone to mint the digital artworks they are putting up for sale. Minting requires a small amount of ETH that goes to the project, and additional ETH for network gas fees. The minting process is what creates the unique NFT asset that resides on a public blockchain. Ethereum is by far the most popular chain, but Solana and others have also recently grown in popularity and featured hot projects.

The primary market requires no galleries or exchanges to operate. Using social media skills, projects are able to create demand and hype for their NFT drop, and users go directly to the project’s website to mint. Some projects decide to mint through popular NFT marketplaces such as OpenSea – this may or may not be a better strategy, but it is not necessary. The internet disintermediates the traditional role of an art gallery.

Once a collector mints an NFT, they are free to sell it in a peer-to-peer fashion, or list their NFT on OpenSea or another marketplace immediately (which is what many do). It is not seen as uncouth to attempt to immediately flip what is considered a rare NFT to earn some quick Wei. In fact, many collectors brag about how they quickly turned 0.1 ETH into 10 or 100 ETH in hours or days.

For those collectors / punters who wish to cultivate their collection a bit longer than 24 hours, it is now time to tell the community why this particular NFT is valuable. Collectors announce what they buy on various socials, participate in Discord chat rooms, and endeavour to communicate what attributes make a particular NFT “rare”. In a medium where the artwork can be copied, and pasted infinite times for free, this rarity discussion is of utmost importance.

The ability to join an exclusive community of verified owners of a particular project is a value proposition as well. Look no further than the EtherRock community chat rooms on Discord and Telegram that are restricted to the 100 owners. Many take pride in the fact that they are members of an elite group, but paid less than the current market price for entry. E.g. the floor price for an EtherRock is around 700 ETH, but a month ago it was less than 50 ETH.

For the projects that blow up, the secondary market is extremely liquid relative to the meatspace art markets. Trading a 1,000 ETH NFT is as simple as listing it on a popular platform, or arranging an OTC deal through Discord or Telegram. Selling a multi-million dollar analogue artwork takes a long time, and as I detailed above attracts high transaction fees. Trading NFTs at the low-end costs a few hundred dollars in gas if the network is congested; at the high end 5% to 10% depending on the secondary NFT marketplace.

CryptoPunks is the most traded project. In the last fortnight it traded appx. 135k ETH or $500 million. That is beaucoup liquidity in the art context. Do you blame Christie’s for attempting to enter this market via auctions of so-called “blue chip” NFT artists, and projects such as Beeple and Curio Cards?

Simple Trading Strategies

Mint to Flip

The market convention is for projects to mint individual NFTs at the 0.01 – 0.1 ETH level. If your skill is scanning the socials and chatrooms and discovering the future hot projects, then it is imperative that you mint NFTs quickly.

As a pure punter, your holding period could be hours or a few days. But either way, you’re speculating that the project mints the entirety of the supply in a short period of time. Shortly thereafter, you will list your NFT collection on OpenSea for multiples more than you paid for them. Wham, bham, thank your ma’am for quick, sick, gainz.

As the flipper, you take naked project delta. You are trading the floor price of the NFT project. The floor price is the price of the lowest cost NFT of a series. Depending on the amount of capital you employ, the cost per NFT might be quite inconsequential, making it easy to ape into almost any project that appears promising. If you hit the next CryptoPunks, Bored Ape Yacht Club, or Pudgy Penguin your mint spend will pay off possibly 1,000 times in short order.

Rarity Relative Value

Rarity.tools is an essential tool of any NFT speculator. For popular projects, Rarity ranks how rare a particular NFT is. In a series of 10,000 NFTs how do you know which ones will be more desirable than the others? Yes, one might be aesthetically pleasing to a large number of people, but that is hard to judge. Objective rare value can be determined by the different attributes a particular NFT does or does not possess.

Similar to buying the lowest price stock in a popular industry and playing mean reversion, purchasing an NFT at a discount to its rarity is another strategy. The best part about the internet and the blockchain is that signals can be programmatically discovered and executed upon.

Without a short hedge on the floor price of an NFT project, you are running two types of risk. Firstly you have beta to the NFT project in the form of the floor price. The second is idiosyncratic risk of the particular NFT itself. Maybe for some reason its rarity is not recognised by the broader market and it fails to mean revert. If there is the ability to short the floor of the project, take it. Now you have eliminated project delta, and retain the risk you wish to take vis-a-vis mean reversion.

Wrap It Up Playa

As we know, popular NFTs get expensive quickly. Some owners want to pump their bags further, but to do that requires plebe pricing. When in doubt, form a special purpose vehicle, insert an asset, and then sell shares at a lower nominal price but in a greater aggregate amount to the unwashed masses. Wrap, then fractionalise.

NFT assets can be wrapped into various smart contracts and then fractionalised into a number of units of the owner’s choosing. If you owned an Ether Rock where the floor is 700 ETH, why not create 1,000 units of said rock and sell for 1 ETH each? There are way more punters who can afford a 1 ETH priced NFT.

This strategy requires the astute trader to acquire expensive and sought after NFTs, fractionalise them, and earn the liquidity premium. Fractional.art is the most popular platform that allows you to wrap an NFT, and then split it into smaller units.

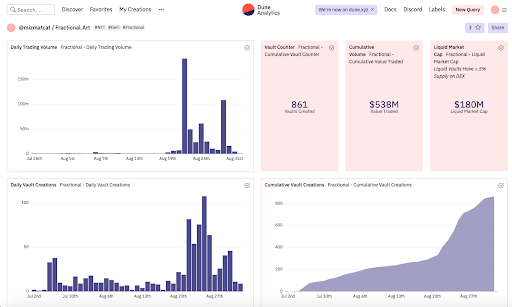

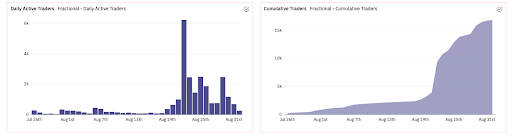

From Dune Analytics:

From my venerable research assistant:

Not directly related but interesting. PartyDAO has developed PartyBid, which allows groups to pool funds to place collective bids for NFTs and receive fractional ownership through Fractional’s contracts.

One to Many

The use of social media to create mindshare around a particular artwork due to the power-law features of social media influencer followings has and will create accounts that can single-handedly make a project pop. These NFT “taste makers” do and will publicly display their collections and talk about why a particular project resonates with them or why they believe it will become popular in the future. This creates a positive reflexive feedback loop which incentivises NFT punters to closely monitor these collectors’ blockchain transactions.

A simple strategy of just buying an NFT priced at the floor of any project held or spoken about by a top ranked NFT influencer is the momentum play in the NFT space. The market is still so nascent and inefficient that employing this strategy doesn’t require lightning-fast execution skills.

Another longer-term strategy is to cultivate a relationship with said influencers such that you can talk your NFT book. If you buy a particular project you believe an influencer would like, and then somehow put it on their radar, and they subsequently acquire or post about said project … BOOM!

More research assistant copypasta:

Kenn Bosak is an NFT Twitter influencer who generates a lot of attention with his coverage of different art pieces/collections.

NFTLive is an NFT focused news show, active on YouTube and Twitter. Their coverage offers a lot of exposure to up and coming projects/artists.

Beeple continues to be an influential figure in the space as well, especially since his big sale earlier this year.

Gary Vaynerchuk runs a popular YouTube channel covering NFT both as art and technology. With 3M subscribers, he is one of the largest NFT focused YouTube channels.

NFT Derivatives

The final frontier will be liquid NFT derivatives for the most popular projects. The creativity of the CeFi and DeFi platform financial engineers will create new and unheard of ways to speculate on and hedge digital art.

An NFT floor-priced derivative is the logical first step. Traders will want to speculate and hedge the floor price of popular and liquid projects.

CEX Floor Derivative

On a centralised exchange a derivative could simply be synthetic like, for example, an ETH margined CryptoPunk floor perpetual swap. The index price is simply the observed floor price for the project obtained by directly interacting with the CryptoPunk contract. The mark price is some measure of the current trading price. Funding is obtained by observing the deviation of the mark from the index price.

To synthetically create the floor NFT in order to hedge a short perp position, a market maker would simply purchase any Punk that is trading at the floor. Unfortunately, the NFT itself cannot be used to magin a short perp position, but I believe a purely synthetic cash settled perp swap would be easy and simple to implement on any CEX. The hairy-ness around physical delivery can be dealt with in the DeFi / DEX space instead.

DEX Floor Derivative

The floor derivative could be split into two parts. First, a protocol is created that allows a user to borrow nETH (NFT-backed ETH) by staking an NFT of a particular project. The user pays some sort of interest rate and overcollateralises the loan. That is, the floor value of the NFT staked will be greater than the nETH borrowed. Should the floor price drop, the borrower must post additional ETH to avoid liquidation.

A second protocol could allow a combination of ETH and nETH to be posted as collateral to trade a decentralised version of a perp swap. The addition of nETH as margin allows market makers who are short perps to fund their position using nETH. Remember, nETH is an NFT of the project that is discounted using the observed floor price of the NFT. Long speculators can just use ETH as margin to go long perp swaps with leverage.

Are You a Trader or a Sucker?

Don’t let the haters distract you from the massive amounts of volume and unique trading opportunities the burgeoning NFT market offers. Put aside the fact that you are trading image files, and relish the ability to trade art in the same way you trade stonks.

NFTs are a market not to be ignored:

They have a price.

They have volume.

The market is new and inefficient.

The market is completely electronic.

The market is completely transparent.

The transaction costs are low.

Just like every other asset class there are humans consensually buying and selling NFT assets between themselves. You can sit in Mayfair and trade meatspace art while getting face–ripped by fees, or sit at home in your Lulu’s, trade Punks, and pay gas. Same same but different. I ask again, are you a trader or a sucker?

Related

The post appeared first on Blog BitMex