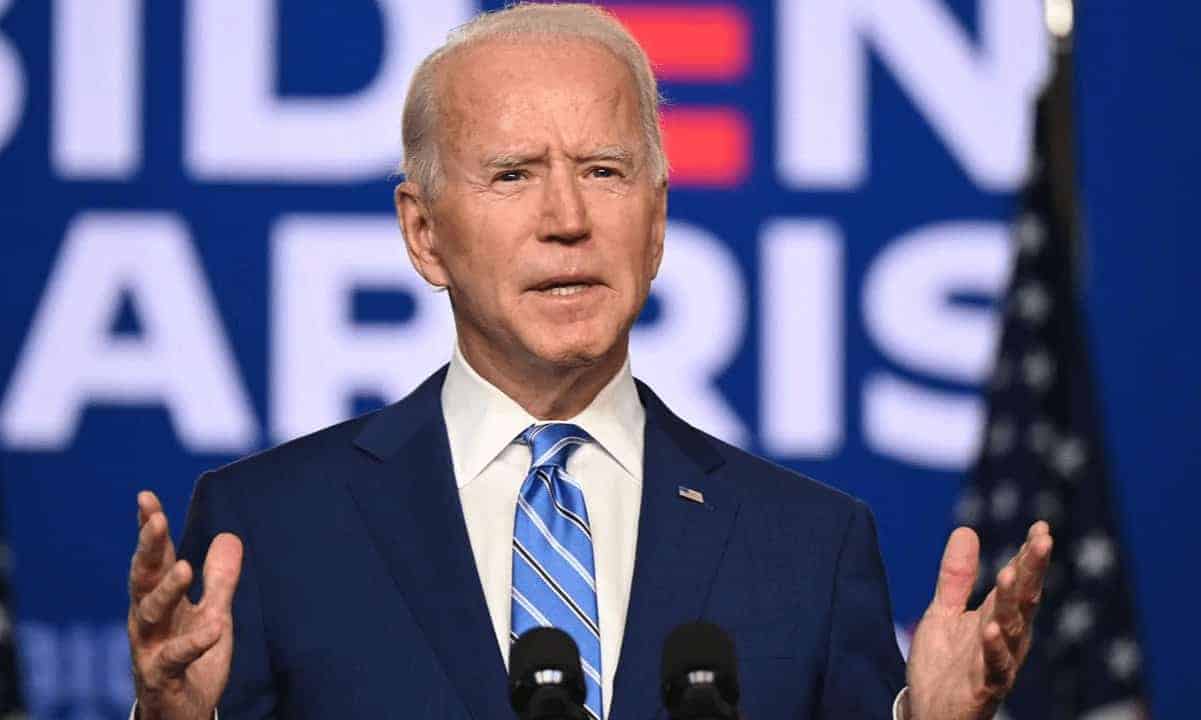

With his approval ratings battered by several failures in the withdrawal from Afghanistan, Joe Biden is turning his attention to massive infrastructure spending and expanding the government’s programs to provide a social safety net for Americans who are struggling.

Biden Proposes Tax Hikes to Boost Washington’s Budget

If passed, Biden’s tax plan would raise the top corporate income tax rate by a further 5.5 percent. It would raise the individual income tax rate by a further 2.6 percentage points.

The bevy of tax increases would also place a 3 percent surcharge on individual income above $5 million, as well as a capital gains tax of 25 percent.

The current capital gains tax rate in the United States is 20 percent in the highest bracket, 15 percent in the middle tier, and 10% in the lowest bracket.

Don’t forget, if you bought $5,000 worth of bitcoin, then sold it for $50,000 to buy a Tesla, the sale of your coins for a profit triggers a taxable event for the IRS, which considers your income to now be $45,000 higher for that tax reporting year.

ADVERTISEMENT

Cryptocurrency still occupies a sort of legal and regulatory limbo, as the technology and how it fits into the economy is so novel and still a very recent development. Legislators and regulators are notorious laggards when it comes to comprehending and regulating new technology. Several contentious proposals are currently in the works to address this.

But at the moment, cryptocurrency tokens like Bitcoin (BTC) are treated as property by the U.S. Internal Revenue Service, and profits made from the sale of bitcoin at a higher price than investors bought it for are taxed as capital gains income.

Here’s How It Will Affect Crypto

So the Democrats’ increase in taxes will affect the wealthiest crypto investors by a tidy sum, and will even affect smaller investors with higher taxes when they go to file. That’s especially true of crypto traders who take profits in the short term on digital assets they’ve held for less than a year.

That’s because the current 10%, 15%, and 20% tax rates on capital gains apply to property held for more than a year. Investors that buy and sell cryptocurrency for a profit in under 12 months have to report the income as ordinary personal income and pay the rate of their tax bracket (10%, 12%, 22%, 24%, 32%, 35% or 37%).

Congress is meanwhile looking to close other “crypto tax loopholes,” like cryptocurrency’s lack of a wash sales rule, like those that apply to stocks and bonds. At the moment, crypto investors can write off on their tax returns crypto sold at a loss only to immediately repurchase it. A proposal in Congress seeks to close the loophole, projecting to raise $16 billion over the next ten years.

Will any of this discourage cryptocurrency investing, or hurt market prices for crypto? Not likely, because the tax proposals don’t apply to crypto specifically, but will affect capital gains tax rates on other asset classes like stocks and bonds as well.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 50% free bonus on any deposit up to 1 BTC.

The post appeared first on CryptoPotato