By Lucy Aziz, Product Manager, Coinbase

Crypto taxes can be complicated. Last tax season, many customers told us they didn’t know if they owed taxes on their crypto activity, and those who did know found it manual and difficult to file.

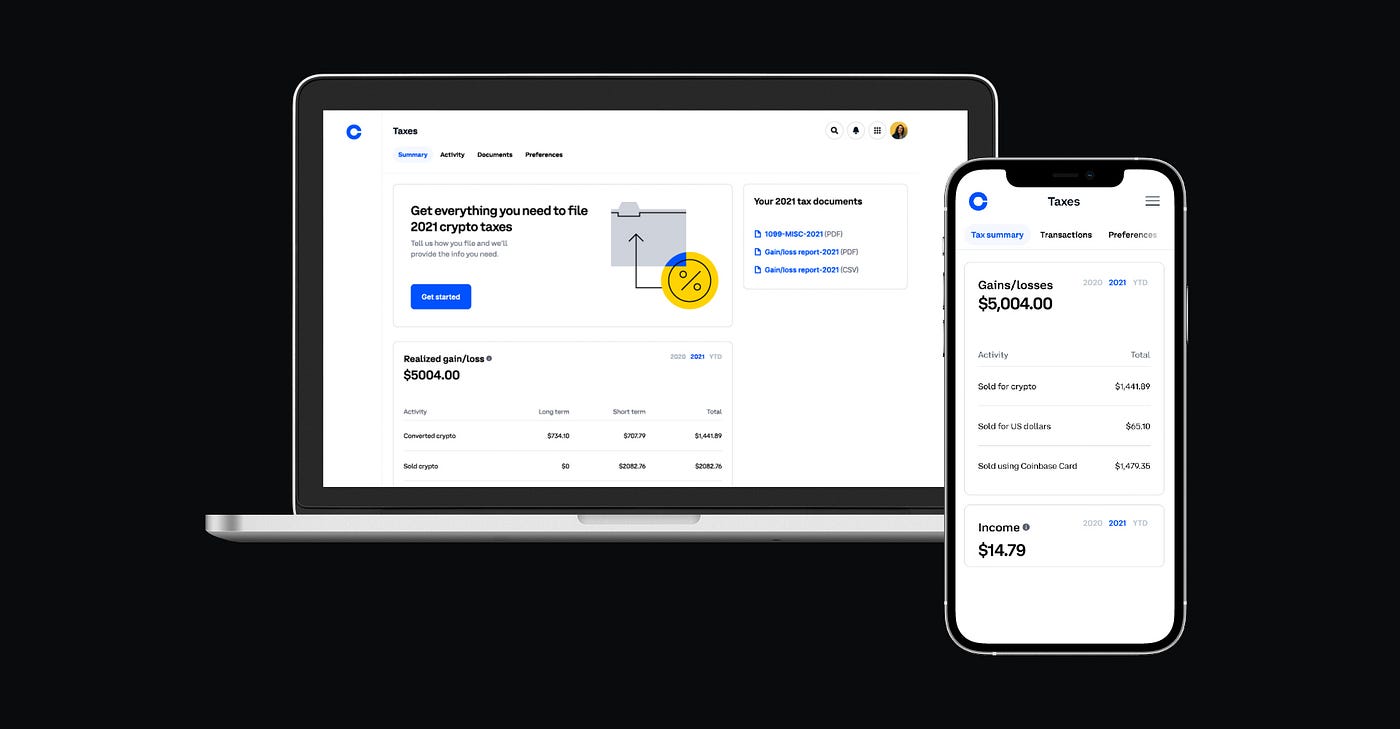

This tax season, we’re introducing a tax center so customers can understand and file their crypto taxes with more ease and confidence. Customers will see all of their taxable activity in one place to determine if they owe taxes, and how much. If they’ve taken more advanced steps like sending or receiving crypto from Coinbase Pro or external wallets, they can receive free tax reports for up to 3,000 transactions from our crypto tax partner CoinTracker. The most complicated time of the year just became more clear.

See a simple summary of taxable amounts

U.S. taxpayers are required to report crypto sales, conversions, payments, and income to the IRS, and these transactions may be taxed as either capital gains/ losses or as regular income. Last year, customers had to research which transactions were considered taxable, and then manually track and sort them to calculate their gains/losses. It was tedious and time-consuming.

Now, we’re simplifying the process by showing each customer a personalized summary of their taxable activity on Coinbase, broken out over time by realized gains/losses and miscellaneous income. Customers can use these amounts to prepare and file their taxes either with their personal accountants or directly with tax prep software like TurboTax®, where all Coinbase customers get up to $20 off TurboTax products.

Get help with all crypto taxes, even transactions off Coinbase

U.S. taxpayers may owe taxes on the amount they gained from crypto, or may be able to use losses against their other income. In order to calculate gains/losses, we need to know the initial value of a customer’s crypto. There are some cases where Coinbase is missing this information (e.g. the customer received it from an external wallet). Customers with these cases can use our crypto tax partner CoinTracker to aggregate their transactions across Coinbase and other exchanges, wallets, and DeFi services. Coinbase and Coinbase Pro customers have free access to tax reports for up to 3,000 transactions made on these platforms and get 10% off CoinTracker plans that support the syncing of any other Wallet or exchange.

Learn about the latest crypto tax tips

To access tax tools on coinbase.com, customers can tap their profile in the upper right hand corner and will see Taxes as a new item in the drop down menu. To access from the mobile app, customers will tap the menu on the upper left hand side, tap Profile & Settings, and will see Taxes. Over the next few weeks, customers will also find written guides on topics like finding the right tax professional and filing taxes on NFTs plus explainer videos on capital gains/losses and income.

Coinbase is committed to making it as easy as possible to understand and file crypto taxes. We’ll continue improving tax tools and creating new content throughout tax season as we all navigate the evolving world of web3.

The post appeared first on The Coinbase Blog